Again, that has nothing to do with what we are talking about. When the

government buys assets, they use new money, and they go through private banks.

[\QUOTE]

They don't by people bank accounts you don't know what you are talking about you should stop.

I'm not trying to get myself out of anything. I would like you to eventually get this right, so I don't have to keep on correcting you.

Sure you are you knowingly made and continue to double and triple down in the fact that you were wrong.

So far the only person wrong here is you as I have already proven.

Private lenders have nothing to do with the fed. QE only involved banked owned assets nothing to do with private lenders.

THIS PROVES THAT YOU STILL HAVE NO CLUE HOW BANKING WORKS. (Nor does the guy that wrote that Investopedia article.)

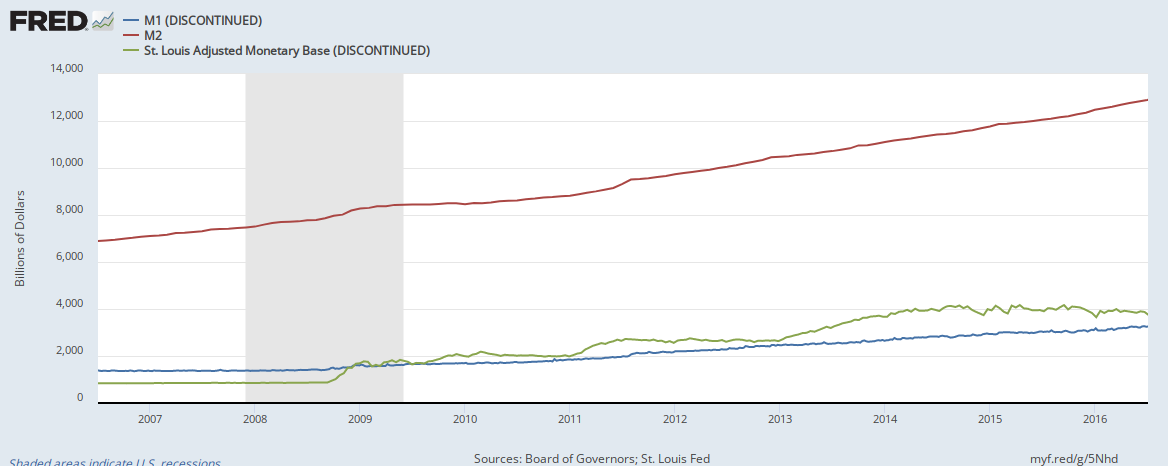

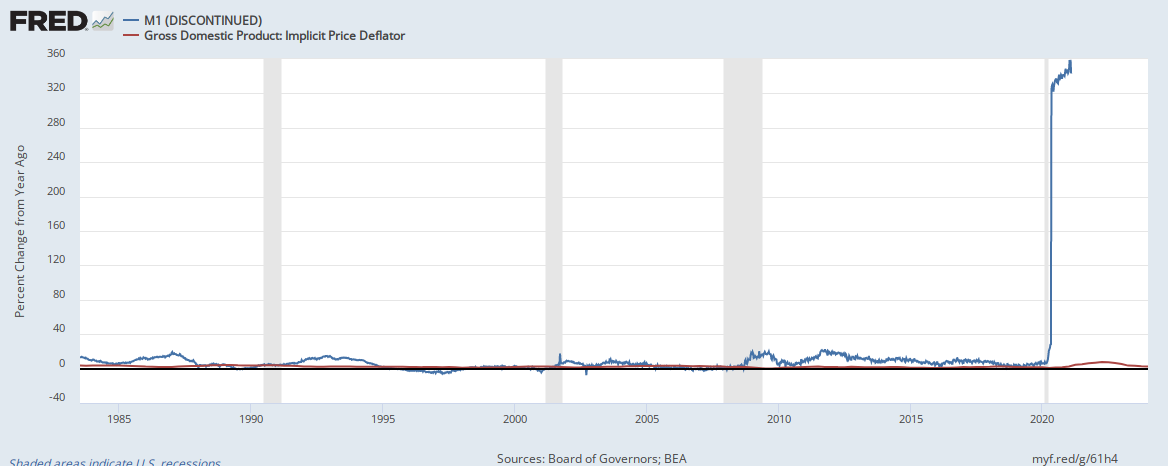

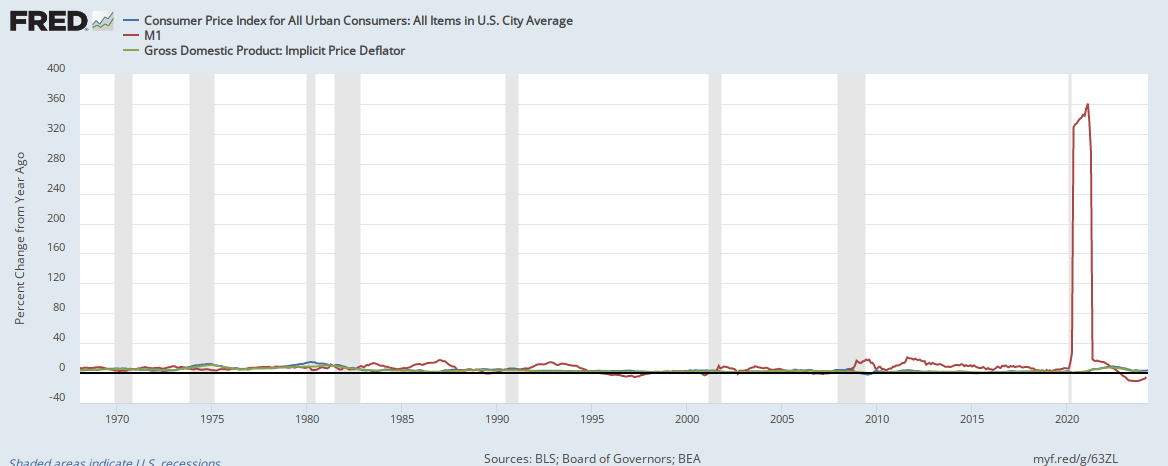

Banks do not "distribute" MB. Aside from the normal demand for cash (which remains pretty stable), MB stays in reserve accounts at the Fed, whether banks create loans or not. And when banks create loans, that doesn't change the level of MB.

Anyway, when the govt. buys assets from a bank, they do it by adding to that bank's reserve account, and the bank makes the necessary changes to its own books (no net change, though). But when the govt. buys assets from a non-bank entity, they do it by adding reserves to the NBE's bank's reserve account, and then the bank increases the NBE's account balance, thereby increasing M1. And that's why QE did add some dollars to the economy. When the govt. writes you a check for $1000, MB goes up by $1000 (increased total reserves), AND M1 goes up by $1000 (your increased bank balance).

Yes we know you don't understand how banking works which is why we constantly wonder why you ignore actual professionals that tell you that you are wrong.

The fed doesn't deal with no banking entities. You still don't seem to understand that.

Ignoring the article I posted only shows how dishonest you really are.