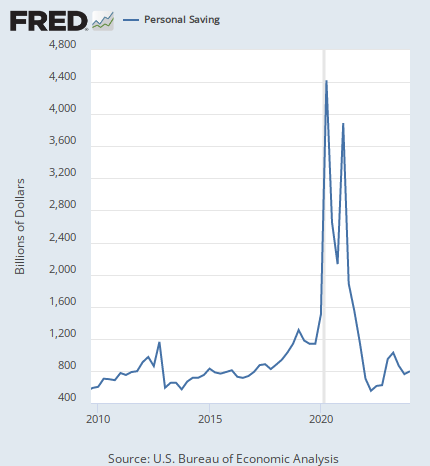

Yes. They are. The personal savings rate soared once the pandemic hit.

View attachment 67340687

You can't determine savings rates or debts paid off by looking at your lawn.

In fact, the evidence makes it clear that a lot of people are saving money, because despite slightly higher than normal unemployment rates, people aren't desperate for work. That's mostly because they have enough savings to hold off for better jobs.

Incorrect.

Savings rate data is from the BEA. Three month old reports aren't "outdated."

Because of the coronavirus crisis, consumers are paying down debt and saving more than they have in decades.

www.cnbc.com

lol

Yes, we are "lurching out of a pandemic." That's why some prices have gone up -- and are starting to fall. However, total debt grew much slower than inflation in recent quarters; credit card debt fell by $49 billion according to the Fed.

Housing prices have gone up -- but the number of sales have also gone down, because people generally didn't want to sell during the pandemic, so inventory shrank. Most mortgage activity recently is people refinancing.

Seriously?

That is your proof that people aren't saving?

Oh, good grief. Lots of things

aren't increasing in price, too, but you just ignore them. We've been over this ad nauseum.

OMG NOOOO!!!!

sigh

Yet again... Almost all of this is temporary. Gas prices rise and fall

all the time; when adjusted for inflation, gas was more expensive in 2010 and 2011 than it is today (and... prices fell shortly thereafter... what a shock) Hay prices too. And guess what? Yup, beef prices too. In fact, adjusted for inflation, beef was more expensive in 2014. And yet, when prices fell in 2015, no one screamed bloody murder about deflation.

View attachment 67340703

View attachment 67340703

With wage increases.

That's how it works. When consumer prices increase, people demand higher wages. We're already seeing that happening in the lower end of the labor market.

Or, they will buy less. And we're seeing evidence of that too, both in savings and consumer expenditure rates. But, of course, knowing that requires actually looking at data, instead of freaking out because someone charged you extra for hay.