TOTAL "NET WORTH" TAXATION

Why is a flat-tax unacceptable? Here's one explanation: "Some drawbacks of a flat tax rate system include

lack of wealth redistribution, the added burden on middle and lower-income families, and tax rate wars with neighboring countries."

Why should we redistribute wealth? That question is dead easy. Because without redistribution very large discrepancies between the lowest income-levels and highest become apparent. And, there appears an "Us vs Them" attitude by many. (Which I suggest could one day bring about tragic means to lower upper-income taxation in a revolutionary manner.)

There are two excesses that must be avoided in any country:

Far too much redistribution of Income and far to little. From a point-of-view of social-functioning it is best to have a graduated system of taxation (from very-low to rather-high) in order for a taxation to seem "fair and equitable".

And this latter ersion we-do-not-have ever since JFK decided to reduce upper-income taxation (in order to "please daddy"). The result has been disastrous. Replicant presidents have continued the downward "bite" of marginal income-taxation to where it is today.

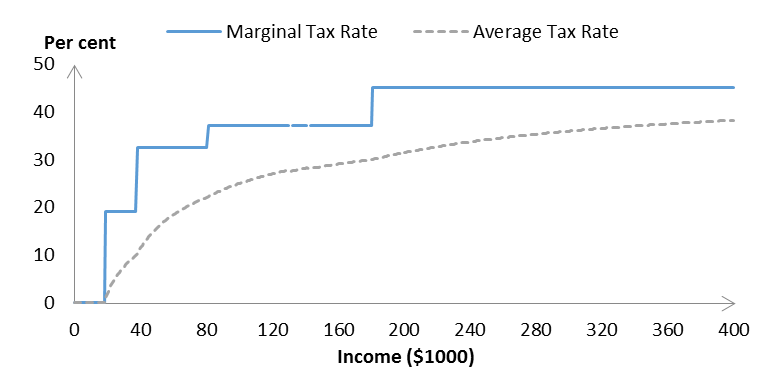

A higher taxation would seem appropriate and it should look like this below -

except the higher limit must reach at least 85/90% taxation of the very excessive incomes!

Nobody needs to be making billions of dollars a year, so Truly Upper-income Taxation should be around 90%. For all incomes beyond, say, 5/10 megabucks of "worth" and not just "income".

Iow, total

Net Worth Taxation ... !