I don't mind folks engaging in off-topic banter in my thread, provided they've "earned the right to do so" by simply providing a clear, direct and on-topic answer (not just a response, an actual direct answer to the question(s) asked) to explicit non-rhetorical questions posted in my OP.

Alternatively acceptable is one's posting one's off-topic remarks such that one explicitly notes one is doing so. That's no different than what folks do in in-person casual conversations.

- "I know this isn't what we're talking about but...."

- "We covered this about this before, but..."

- "I'm sorry, and I know this isn't exactly what we're discussing, but..."

People at least have the decency to acknowledge that they're upcoming remarks aren't really on topic but they feel compelled to share them. One may or may not like that someone does that, but few folks refuse to indulge someone who shows the discursive courtesy of at least prefacing their off-topic remarks with some sort of "mea culpa." Most importantly, they don't pretending that what they're about to say is germane/timely to the topic or conversation.

Red:

I didn't purely arbitrarily choose that sum. I chose it because it's high enough that

in about 65% of the country, that's enough to make one a "one-percenter," and in the places where it's not enough to do that, it's nonetheless enough to ensure one is at least comfortable. Also, I made that "judgement call" for the purpose of keeping things simple for the thread. The "keeping things simple" aspect comprises the peremptory component of that sum being chosen as the last amount prior to $1M/year.

Blue:

Currently it doesn't, yet by the same token people like even less that which does: political contributions. In any case, it's clear you and I have markedly different normative stances on what the RGI should/shouldn't accord payers of it.

Pink:

I'm sure your relative has done what he was and is expected to do. If he has and he enjoys a decent lifestyle, there's nothing to say. He's doing what everyone should do. If he's earning less than $400k/year, I wouldn't see him be subject to the RGI I suggested in my OP.

Tan:

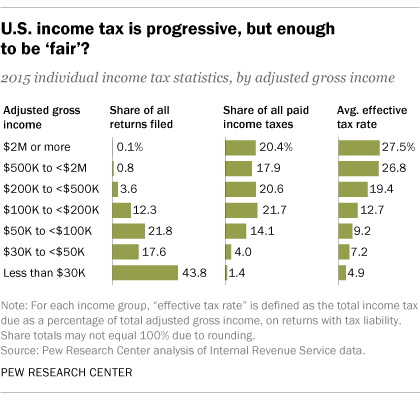

I suppose one can think of it that way. I don't think of it that way; I think of it as a matter of getting unique something in return for paying a unique tax, the RGI, that nobody but high earners would have to pay. As implied before, insofar as medium-high and high earners pay about 57% of the federal income tax dollars the government collects, yet they comprise about 5% of the population, that they'd have to further pay the RGI I proposed, thus increasing the percentage of tax dollars they contribute to the nation's coffers, I think it's apropos that they receive the right to designate how the RGI share of their tax be used.

Teal:

Well, as a "bootstrapper," I buy into it. There are some people for whom I don't think the "Horatio Alger" model is viable, but for most folks, I think it is a viable model as goes assessing whether one's done what one's supposed to do to thrive in the US. The US is a nation designed by and for entrepreneurs, and I'm not of a mind to change the design so much that it doesn't continue to be overwhelmingly thus designed/structured. Neither do I object to there being many ways to thrive in the US without being an entrepreneur.