Income inequality is nothing but a socialist/progressive/commie/pinko talking point.

Or, it's a natural consequence of a capitalist system, which is fine most of the time as long as it's within reasonable bounds.

When it gets out of control, like it has lately, it causes a wide variety of issues -- not the least of which is how it damages the economy and society as a whole.

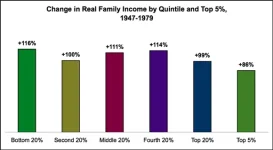

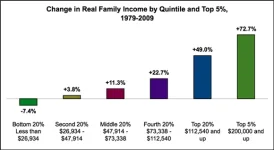

It has nothing to do with the poor being worse off and everything to do with the fact that those who are the movers and shakers can move and shake faster and more profitably than ever before thanks to ever-improving technological advances, greater global wealth, easier international trade, better automation and constantly improving business practices among other things.

Actually, it's a result of the problems facing the poor, as well as the advantages of the wealthy.

Prior to 1980, the CEO-to-worker pay ratio was below 50:1. Since then, it shot up to as much as 300:1, before falling to 200:1 after the recession. Technology has not made CEOs 4 to 5 times more effective than rank-and-file employees -- in fact, it's the opposite. Worker productivity has gone through the roof, while wages have stagnated. CEOs simultaneously say they need to cut wages in order to cut costs, while increasing their own pay -- often regardless of the actual performance of the company.

In addition, most of the top earners are not actually doing things to improve the economy. Most of them are mere speculators, such as hedge funds or investment bankers. At best, they make a slight improvement to the liquidity of the market. But most of the time, they are happy to fleece trusting investors and/or destabilize economies to get their way.

Or, they "invest" in distorting public policy in their favor, either to nab government-funded windfalls for their corporations, or to lower taxes for the top earners. Which in turn gives them yet more money to use to buy influence, and deepen their ability to influence the system.

Meanwhile: Productivity advances, automation and offshoring result in companies requiring fewer employees than in the past. Rather than invest our resources in making our citizens more productive, the executives and speculators are taking a greater share and hoarding it.

There are great opportunities today than ever but low education and low skill and low risk jobs aren't going to pay much different than they ever did and people who go after that kind of work can't expect that the increases in their pay are going to run parallel to the pay of entertainers, sports stars, business tycoons, CEO's, etc.

No one is suggesting that a typical employee should be paid millions. But thanks for the straw man argument....

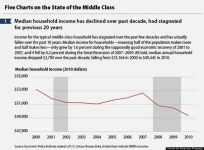

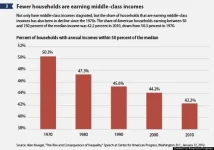

It is certainly not the case that there are more opportunities now than in the past, especially for anyone hoping for a middle-class income. 20-30 years ago, you could earn a decent wage with a union job in a factory environment; today, most of those jobs are gone. What is left are service sector jobs, which are fine -- if there are enough people to afford those services. But if people aren't getting paid enough to afford those services, then where exactly are the opportunities?

We are still in a relatively brief period where technological innovations create opportunities where none existed previously, and in some cases these can be volatile. E.g. social networking didn't exist as we currently understand it in 2000, and in the early days an established player (MySpace) was bought by a major media conglomerate, and got disrupted by a bunch of young turks. In turn, Facebook today is a powerhouse, but could be a ghost town in 5 years.

However, suggesting that "anyone" can be a high-tech mogul is not reality. The vast majority of the Top Guns attended elite colleges and universities, and the tech world is notoriously discriminatory against women. A 35 year old high school graduate is unlikely to found a Facebook-killer.

Oh, and let's not forget that the cost of higher education has been outpacing inflation for decades. Getting the education you need to land a good job can put you in debt for decades.

So... Where exactly are all these great opportunities? In what fields? How much do you need to borrow to be in a position to take advantage of them?