- Joined

- Jan 13, 2021

- Messages

- 19,904

- Reaction score

- 4,475

- Location

- Dripping Springs, Texas

- Gender

- Male

- Political Leaning

- Centrist

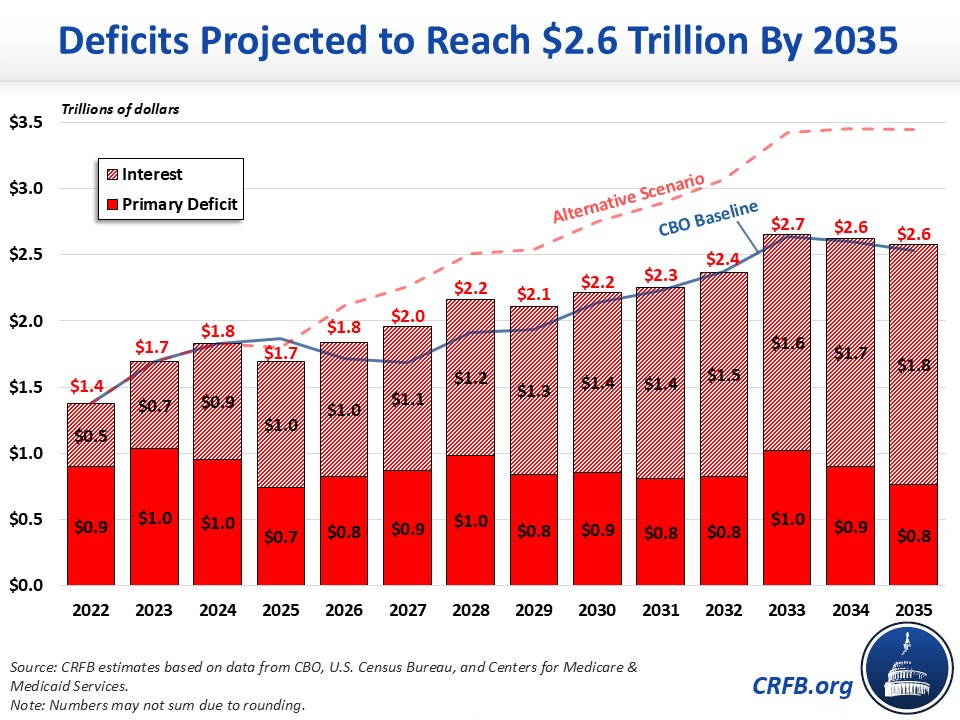

Is the CBO lying to us?I put the chance of that happening slightly above zero.

Have they lied to us before?

That is really a rhetorical question i suppose because we all know they have (not intentionally of course) but simply because of what they are asked to use/and how to score things result in misleading the people.