- Joined

- Jun 9, 2011

- Messages

- 3,503

- Reaction score

- 2,202

- Location

- Planet Earth

- Gender

- Undisclosed

- Political Leaning

- Very Conservative

It is always fun to play shell game with uniformed and simple people...but instead of looking under the cup, lets look at what is in the sleevesTrump and Ursula having a presser right now. They are both very pleased.

| Category | Trump 2025 Deal | Earlier U.S.–EU Approaches |

|---|---|---|

| Tariff Strategy | 15% flat tariff; high steel tariffs | Obama: near zero via TTIP Biden: tariff suspension |

| Energy Trade | $750B EU energy purchases (oil, LNG, nuclear) | Biden pushed for renewables; EU resisted U.S. oil under Obama |

| Negotiation Tactic | Ultimatum-style pressure + short deadline | Obama: multilateral, diplomatic Biden: cooperative forums |

| Investment | $600B EU corporate commitment | Previous deals emphasized regulatory reform more than cash inflow |

| Tone | “Transactional & coercive” | Obama/Biden: “Rules-based & multilate |

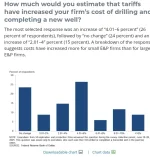

Tariffs:

This essentially means the cost of everything imported from Europe will go up by 15%. Hooray for us—we get to pay more for the same stuff! What a win.

Energy Trade:

Let’s be clear—this shift began under Obama, when Europe wanted to reduce its dependence on Russian energy after Crimea. But sure, let’s give credit to the guy least deserving of it. I believe MAGA folks call that “DEI” when others do it.

Negotiation Tactic:

Anyone who understands even basic game theory (and I highly recommend learning about it) can see this approach is shortsighted and self-defeating. This will backfire—if not now, then soon.

Investment:

This part is... curious. I don’t know the exact mechanics, but given Trump’s well-documented tendency to seek personal gain in every deal, I wouldn't be surprised if he ends up the biggest beneficiary of the bribes—I mean “investments.”

Tone:

Once again, this is all a shell game. As soon as the U.S. loses its leverage—or the political winds shift—the entire framework collapses. See game theory. Again.

Diving Mullah