-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stocks surge after Powell signals rate cuts ahead

- Thread starter VySky

- Start date

- Joined

- Sep 23, 2011

- Messages

- 12,947

- Reaction score

- 8,866

- Location

- On a Gravy Train with Biscuit Wheels

- Gender

- Male

- Political Leaning

- Very Liberal

Shocker, Wall Street likes ez money and loosened fiscal policy.

- Joined

- Jul 18, 2024

- Messages

- 261

- Reaction score

- 334

- Gender

- Male

- Political Leaning

- Other

I don't know what the prescription for stagflation is. We'll find out how this works.

- Joined

- Jun 19, 2025

- Messages

- 8,686

- Reaction score

- 8,732

- Location

- Cali

- Gender

- Male

- Political Leaning

- Independent

Thank God we have an adult in charge of the fed ignoring the child rapist crashing our economy.Good news

SNORT

Stocks surge after Powell signals rate cuts ahead

- Joined

- Nov 9, 2020

- Messages

- 52,502

- Reaction score

- 71,766

- Gender

- Female

- Political Leaning

- Slightly Liberal

He was fairly noncommittal but more positive than prior. Will be interesting to see what Trump does with job numbers now that he needs to keep them low if he wants that cut! HOOT!

- Joined

- Sep 12, 2019

- Messages

- 50,172

- Reaction score

- 19,848

- Gender

- Male

- Political Leaning

- Moderate

Thank God we have an adult in charge of the fed ignoring the child rapist crashing our economy.

- Joined

- Aug 19, 2014

- Messages

- 52,946

- Reaction score

- 45,650

- Location

- Tennessee, USA

- Gender

- Male

- Political Leaning

- Conservative

Good news

SNORT

Stocks surge after Powell signals rate cuts ahead

That'll piss Trump off. He won't have as much to bitch about Powell on now.

- Joined

- Nov 9, 2020

- Messages

- 52,502

- Reaction score

- 71,766

- Gender

- Female

- Political Leaning

- Slightly Liberal

Yeah. So noncommittal

I didn't say the markets were noncommittal just that Powell was though, as I said, he was far more positive than up until now. I think those job numbers, you know the fake ones, were alarming to him. The markets are loving the change in tone and so is my portfolio.

- Joined

- Jun 15, 2021

- Messages

- 7,714

- Reaction score

- 10,788

- Gender

- Male

- Political Leaning

- Independent

Not exactly what he said.

Federal Reserve Chair Jerome Powell on Friday opened the door ever so slightly to lowering a key interest rate in the coming months but gave no hint on the timing of a move and suggested the central bank will proceed cautiously as it continues to evaluate the impact of tariffs and other policies on the economy.

Federal Reserve Chair Jerome Powell on Friday opened the door ever so slightly to lowering a key interest rate in the coming months but gave no hint on the timing of a move and suggested the central bank will proceed cautiously as it continues to evaluate the impact of tariffs and other policies on the economy.

- Joined

- Aug 21, 2009

- Messages

- 19,509

- Reaction score

- 7,076

- Location

- Pindostan

- Gender

- Male

- Political Leaning

- Other

Mo money, mo problems.........I hope we're not heading into bubble territory.

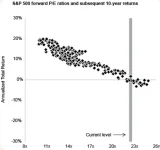

It’s definitely more risk than I’m willing to assume. JP Morgan published a dot-plot chart of the FPE (the forward price-to-earnings ratio, or the ratio of the price of a stock to its predicted 12-month earnings) of the S&P 500 to the subsequent expected 10-year return for that index. At a time when the FPE was 23, the expected 10-year return was between -2% and 0%:

For what it’s worth, that ratio currently sits at about 27.

If we look at the Shiller CAPE ratio, which looks at historical trailing earnings going back ten years to even the results out over an entire business cycle, that ratio is also at or near historic highs and indicating poor returns going forward. Bonds actually look like a better bet.