When President Trump and the Republican Congress cut taxes multiple employers responded with bonuses for employees. It also set off a wave of hiring, real low unemployment without skyrocketing inflation. Of course all you offer is childish villification of employers.

lol, no, that's all self-serving partisan nonsense. Only a handful of companies gave employees bonuses; wages barely budged. Most corporations bought back stock.

Companies have jumped to buy back their own stock as a primary means to spend their tax savings.

www.investopedia.com

US companies got about $54 billion.

www.vox.com

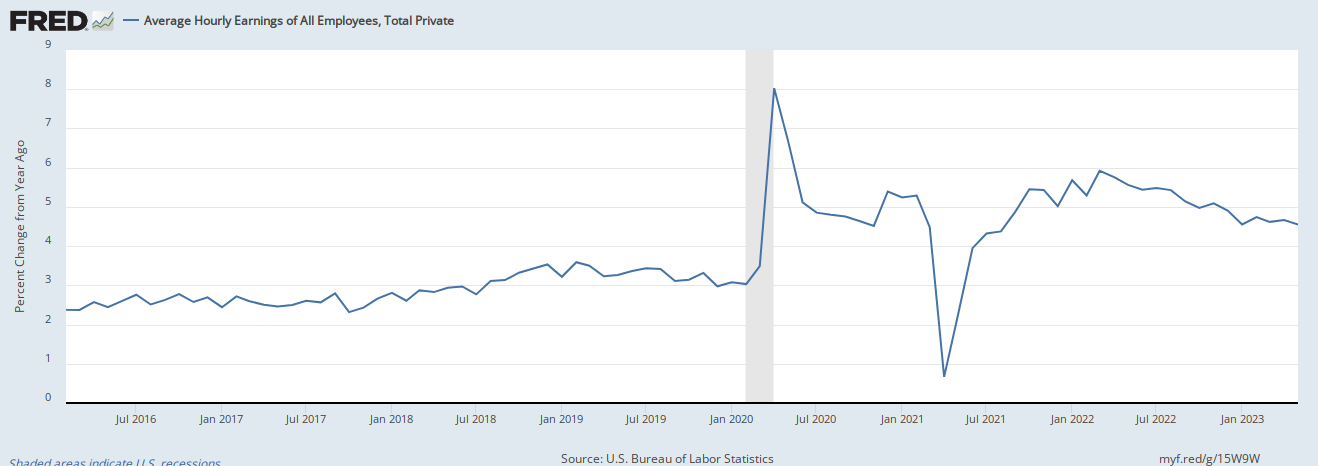

YoY change to private wages, no big jump due to the tax cut:

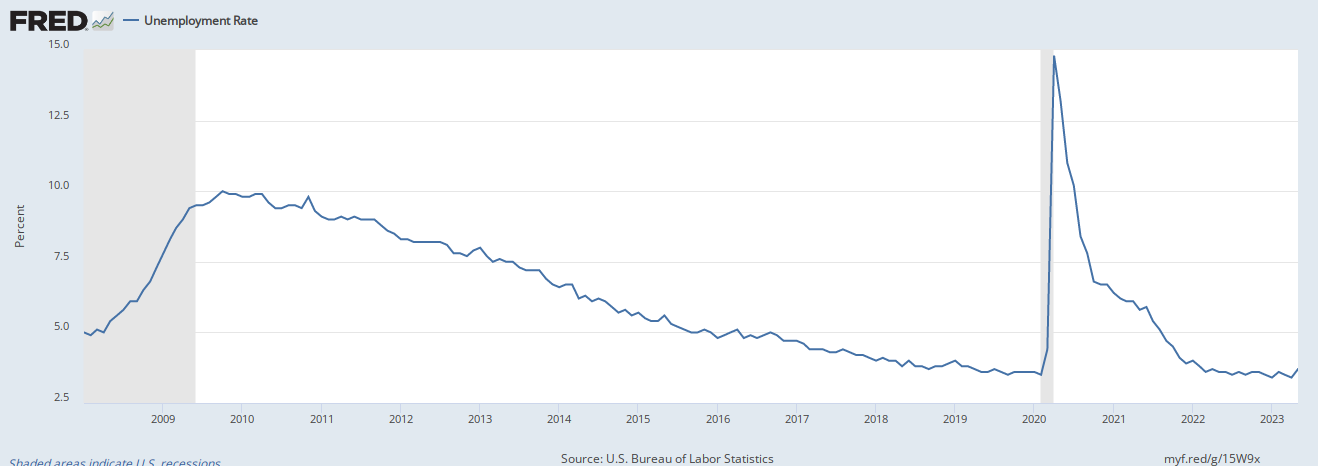

And no, there was no "wave of hiring" because of the tax cut. U3 unemployment started improving in 2010, and continued to improve at the same rate until COVID hit:

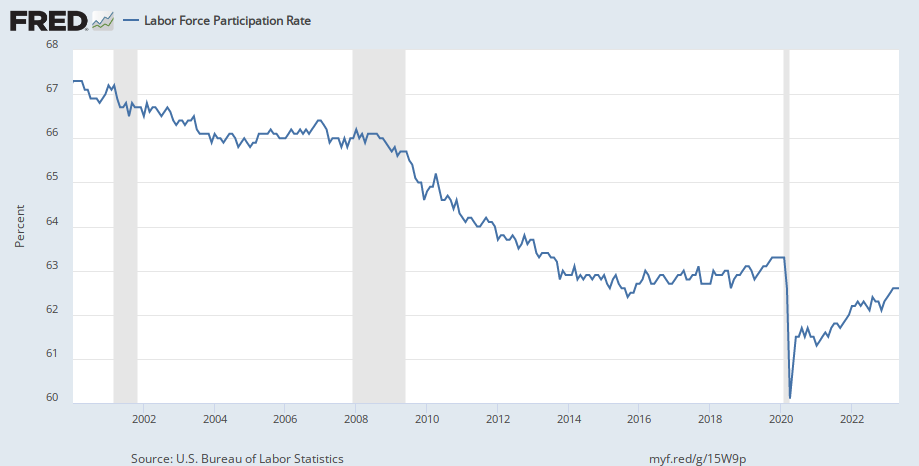

LFPR started falling in 2000, flattened out in 2014, and barely changed until COVID.

Over the decades the SS taxes provided a nice backdoor revenue source for politicians to spend on buying votes. As an added bonus next to nothing gets paid out when an old age pensioner dies.

In the original SS act, refunds were provided to the families of workers who died before they were 65. SS now includes early retirement options and survivor benefits. Meanwhile, thanks to Medicaid, most people get far more benefits than what they paid in taxes. Even the Cato Institute admitted that.

Earlier this week, we published a story and several charts showing that average government spending on each elderly pers

www.politifact.com

I'd love to see some verifiable statistics proving your claim that people were unwilling and unable to provide for their retirement in the roaring 20's.

lol... How about the fact that they didn't? The whole reason to create SS was because the vast majority of seniors were in abject poverty. 30 states had already set up pension plans.

Capitalism has lifted more people out of poverty on the way to prosperity than any other economic system in history.

It has... But that

certainly doesn't mean it is flawless. There is no question that capitalism also creates enormous inequality, and that government is the only way to correct that particular problem.

Work ethic has been replaced by claiming benefits. Programs like SS encourage reliance and dependence on government.

Yes, we definitely need to put those 75 year olds to work!!!

And no, SS has not in any way, shape or form reduced incentives to work. You don't get SS if you don't work, remember...?

None of the measures you mention are fixes, they are bandaids. SS is systemically corrupt. All they do is kick the can down the road.

It is only "corrupt" if you repeatedly get your knickers in a twist because you refuse to understand that it's a welfare program for seniors and the disabled, and has pulled tens of millions above the poverty line.

(By the way, SS's administrative costs fall almost every year, and are now down to 0.5% of expenditures. Woah so corrupt!!!

)

Privatized SS will not reduce dependency either -- as government is still needed to mandate, manage, and regulate the whole program AND provide safety nets for those who burn through their savings. Or do you want 90 year olds to starve?

After all these posts you still remain stubbornly ignorant of how SS works refuse to acknowledge basic financial planning concepts and continue to retreat into stawman fantasies. Rhetoric replaces reality with you.

After all these posts, you still remain stubbornly ignorant of how SS works; how the policy you seem to advocate would be enormously expensive and just cause a whole bunch of other problems; how looking at the policies of other nations shows us exactly what those problems are; fail to understand the myriad cognitive biases and failures of capitalism that result in so few people sufficiently preparing for retirement on their own; and instead retreat into incorrect and irrelevant fantasies. Rhetoric replaces reality for you.

:max_bytes(150000):strip_icc()/wells_fargo_shutterstock_161195846-5bfc324746e0fb00265d29cc.jpg)