David_N

DP Veteran

- Joined

- Sep 26, 2015

- Messages

- 6,562

- Reaction score

- 2,769

- Location

- The United States

- Gender

- Male

- Political Leaning

- Liberal

We all know what the bad ideas are..

http://krugman.blogs.nytimes.com/20...Opinion&action=Click&pgtype=Blogs®ion=Body

Summarized: We suffered from a "Post modern recession" brought on by private sector overreach, and the usual methods to handle a recession were ineffective due to interest rates not being high to begin with and the severity of the housing bust/banking crisis. Fiscal Stimulus was the only tool we had left, if sustained, but we got a pathetic small/short lived stimulus. One side lost the debate, and that is the side that predict runaway inflation and soaring interest rates. Now is the time for a larger deficit, with spending aimed at the poor, in my opinion, especially when looking at this:

Why Did US GDP Growth Slow Down in 1Q16? - Yahoo Finance

http://krugman.blogs.nytimes.com/20...Opinion&action=Click&pgtype=Blogs®ion=Body

Many years ago a long-time policy wonk gave me a very useful metaphor. Bad ideas, he explained, are like cockroaches: no matter how many times you flush them down the toilet, they just keep coming back.

Still, economic debate since the 2008 crisis has seemed unusually cockroach-infested: bad arguments just keep coming back, no matter how totally they have been refuted by evidence.

Jonathan Chait finds Kevin Williamson of National Review reviving, for the umpteenth time, the claim that Obama is an economic failure — despite a record of job creation much better than that of his predecessor, or of any other major advanced country — because we didn’t have a rapid, V-shaped recovery from the 2007-2009 slump.

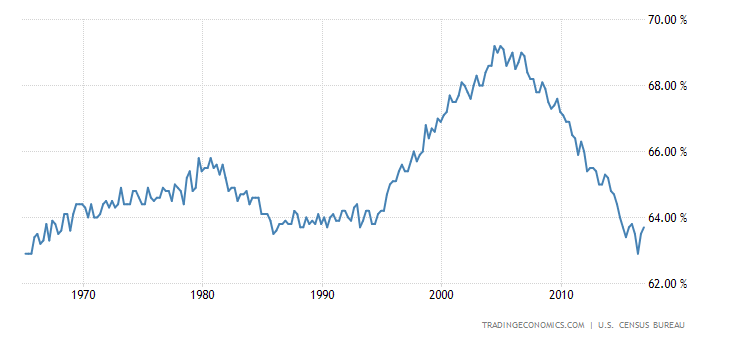

The key point was that we had suffered from a postmodern recession. Unlike, say, the double-dip recession of 1979-1982, brought on by interest rate hikes to fight inflation, 2007-9 was brought on by private sector overreach: interest rates weren’t very high to begin with, and even cutting them to zero wasn’t enough to offset the downdraft from the housing bust and the banking crisis. So the normal recession-fighting weapons ran out of ammunition. Sustained fiscal stimulus could have led to a better recovery, but it didn’t happen: the Recovery Act was both too small and too short-lived, again something many of us predicted in advance.

The debate over the causes of sluggish recovery is part of the broader debate about economic models — in which one side predicted runaway inflation and soaring interest rates, while the other, using the same general approach that predicted sluggish recovery, predicted quiescent inflation and rates. Rarely in the history of economics has one side of a debate been so completely vindicated, and the other so completely discredited by events.

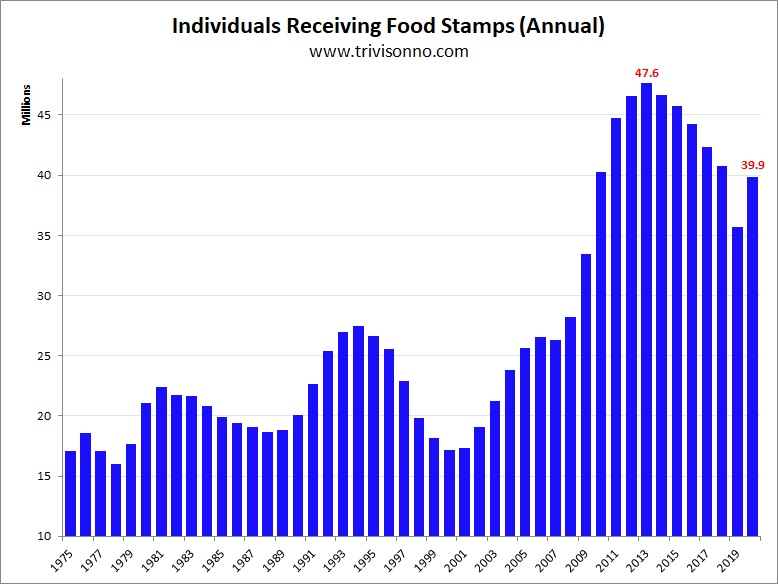

Summarized: We suffered from a "Post modern recession" brought on by private sector overreach, and the usual methods to handle a recession were ineffective due to interest rates not being high to begin with and the severity of the housing bust/banking crisis. Fiscal Stimulus was the only tool we had left, if sustained, but we got a pathetic small/short lived stimulus. One side lost the debate, and that is the side that predict runaway inflation and soaring interest rates. Now is the time for a larger deficit, with spending aimed at the poor, in my opinion, especially when looking at this:

Why Did US GDP Growth Slow Down in 1Q16? - Yahoo Finance

The US economy (QQQ) (SPY) (VOO) (IWM) saw GDP (or gross domestic product) growth of 0.5% in the first quarter of 2016 as compared to the 1.4% expansion in the fourth quarter of 2015, according to data provided by the US Bureau of Economic Analysis. However, this was below the market expectations of 0.7% growth. It was the weakest performance in the last two years. In the first quarter of 2014, the US economy contracted 0.9%.

The weaker movement of the US GDP growth indicates that American consumers controlled their spending and demand also slowed down in the first quarter.