- Joined

- Jul 6, 2022

- Messages

- 1,095

- Reaction score

- 544

- Gender

- Male

- Political Leaning

- Moderate

The U.S. Treasury says.The recession was not caused by the tax cuts. That is the only thing you got right in these 2 sentences.

It is binary lol. Something either works as intended, or it doesn't.

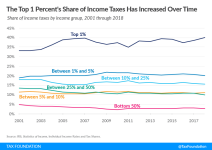

Nope. Tax cuts have nothing to do with growth, employment etc. Increased employment is entirely fueled by increased demand for production. Tax rates are meaningless. We know empirically, because we have decades upon decades of data, that tax cuts do not magically increase economic output. All they do, every...............single.....................time..............................is reduce revenue and explode deficits.

Why does the United States owe so much debt?

Continued decreases in the amount of taxes paid by corporations and the wealthiest Americans have resulted in less money coming in. At the same time, spending continues to increase.