jonny5

DP Veteran

- Joined

- Mar 4, 2012

- Messages

- 27,581

- Reaction score

- 4,664

- Location

- Republic of Florida

- Gender

- Male

- Political Leaning

- Libertarian

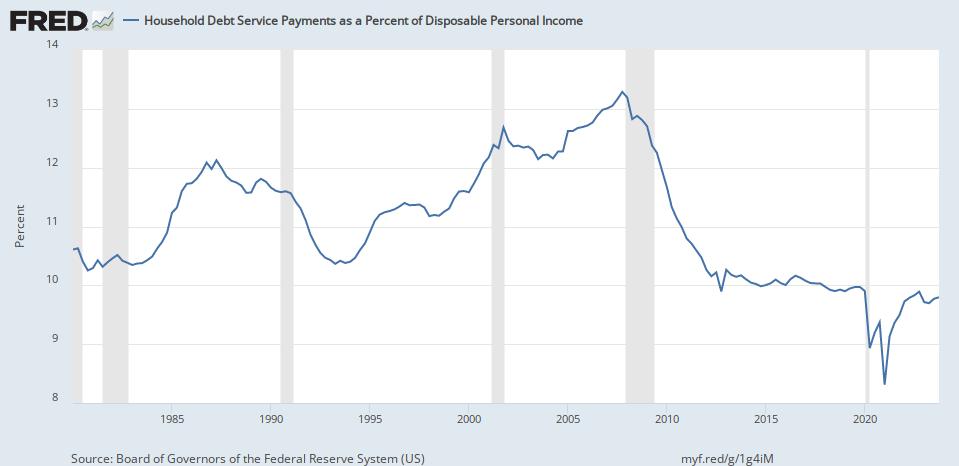

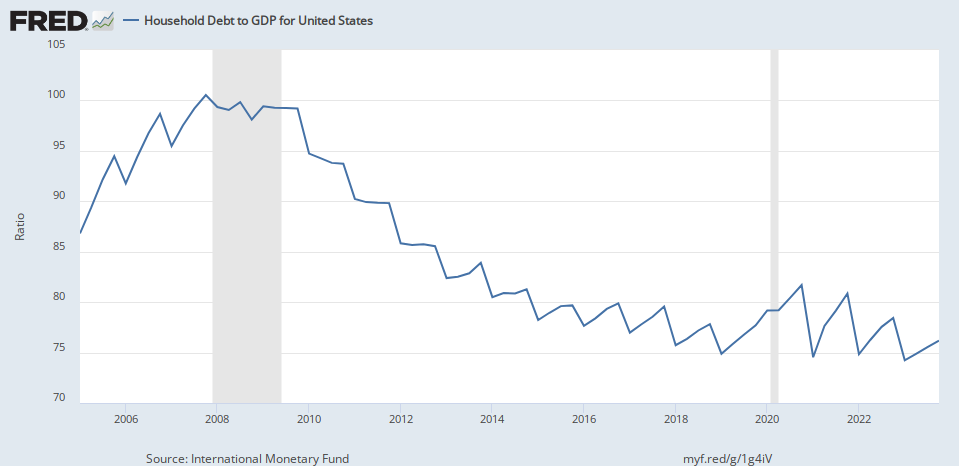

There's where your economic boom is coming from.

Current‑dollar GDP increased 4.8 percent at an annual rate, or $328.7 billion

Total household debt rose by $212 billion to reach $17.5 trillion in the fourth quarter of 2023

The federal budget deficit totaled $509 billion in the first quarter of fiscal year 2024

At the end of FY 2021, the latest year reported by the Census Bureau, the state government debt was $1.21 trillion At the end of FY 2023 the state government debt was “ ” to be $1.25 trillion

What are going to do about it? Right now the govt is trying to pass another 100bn in spending while we're broke, and has done nothing to reduce the deficit. People are spending like drunken congressman, on their credit cards.

www.newyorkfed.org

www.newyorkfed.org

Current‑dollar GDP increased 4.8 percent at an annual rate, or $328.7 billion

Total household debt rose by $212 billion to reach $17.5 trillion in the fourth quarter of 2023

The federal budget deficit totaled $509 billion in the first quarter of fiscal year 2024

At the end of FY 2021, the latest year reported by the Census Bureau, the state government debt was $1.21 trillion At the end of FY 2023 the state government debt was “ ” to be $1.25 trillion

What are going to do about it? Right now the govt is trying to pass another 100bn in spending while we're broke, and has done nothing to reduce the deficit. People are spending like drunken congressman, on their credit cards.

Household Debt and Credit Report

Unique data and insight into the credit conditions and activity of U.S. households

Household Debt Reaches $17.5 Trillion in Fourth Quarter; Delinquency Rates Rise

Total household debt rose by $212 billion to reach $17.5 trillion in the fourth quarter of 2023, according to the latest Quarterly Report on Household Debt and Credit. Credit card balances increased by $50 billion to $1.13 trillion over the quarter, while mortgage balances rose by $112 billion to $12.25 trillion. Auto loan balances rose by $12 billion to $1.61 trillion, continuing an upward trajectory seen since 2011. Delinquency transition rates increased for all debt types except for student loans.