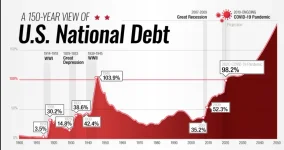

A long history of low inflation? For much of our history, the value of the dollar actually held steady. Yes, there were times of inflation, but there were also times of deflation, with the result that 120 years after the founding of the United States (1789), the dollar's value was only 3.3% lower--and a decade earlier, it was actually 6%

higher. By 1919 the dollar had lost 49.1% of its value, true, but we'd just finished fighting a war, and wars do that. A decade later, on the eve of the Great Depression, the dollar had actually regained a smidgeon of value, to 51.5%, so no inflation there. The Great Depression hit, and the dollar's value actually recovered substantially, up to 63.3% of its value. Throughout that total period, the average inflation rate had been only 0.31%.

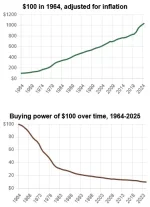

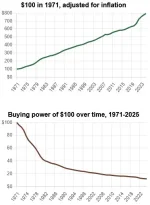

Then we got WWII, and the devaluation of the dollar began to pick up steam, dropping to 37% in 1949, 30.2% in 1959, 24% in 1969. Over that time, the average yearly inflation rate was 0.72%. And then it took off like a rocket, so that over the course of my lifetime (1964 to 2024), the dollar has lost 90.1% of its value, with an average yearly inflation rate of 3.93%. That is

not a "long history of low inflation."

View attachment 67575135

View attachment 67575136