- Joined

- Jun 14, 2019

- Messages

- 1,333

- Reaction score

- 732

- Gender

- Female

- Political Leaning

- Very Liberal

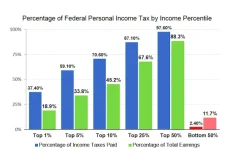

Republicans tend to like flat taxes, since the GOP effectively works for the rich and a flat tax would shift tax burden from the rich to the poor and middle class. But I think some people haven't really thought through just how much it would do so. Here's some slightly dated information to illustrate that:

www.taxpolicycenter.org

www.taxpolicycenter.org

Right now, the average effective individual income tax rate is 9.4%. So that means that to collect the same revenues, you'd need to set a flat tax at least at 9.4% (probably a bit higher, to account for inevitable loopholes and dodges that even flat taxes wind up having, but we'll go with 9.4%).

So, what would that mean for people? Well, if you're in the top 1% of earners, it would mean a truly MASSIVE windfall, from 23.5%. Of course they love the idea. There's a reason it's long been Steve Forbes types talking the idea up.

However, this would constitute a tax hike for those in the 0-20% group, and those in the 21-40% group, and the 41-60% group, and the 61%-80% group, and even the 81-90% percentile. In other words, it would hammer the working class and middle class and even half the upper class.

Only that last 10% of earners would see their effective tax rates fall with a flat tax. And even there, it would be a very modest improvement for the 91-95% level earners (just a two-point drop in tax rates). Very nearly all the benefit of the change would flow just to the top 5% of earners.

As a practical matter, if your household earns less than $200,000, a flat tax would wind up being a tax hike for you. The farther you are below that threshold, the bigger the tax hike it would be. From $200k-$300k of household income, it would be a small tax cut (around two points). From $300k to $500k it would be a sizable tax cut (6.1 points or so). And above $500k it would be a truly massive tax cut (over 14 points).

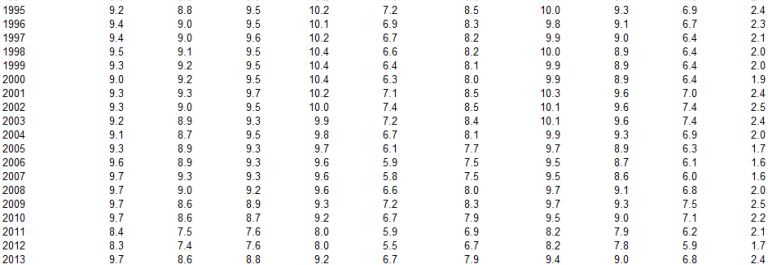

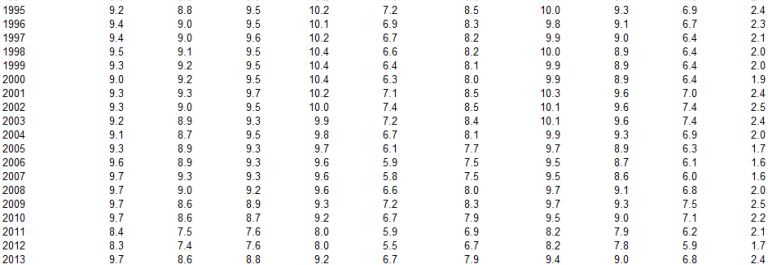

Historical Average Federal Tax Rates for All Households

Average federal tax rates for all households, by comprehensive household income quintile.

Right now, the average effective individual income tax rate is 9.4%. So that means that to collect the same revenues, you'd need to set a flat tax at least at 9.4% (probably a bit higher, to account for inevitable loopholes and dodges that even flat taxes wind up having, but we'll go with 9.4%).

So, what would that mean for people? Well, if you're in the top 1% of earners, it would mean a truly MASSIVE windfall, from 23.5%. Of course they love the idea. There's a reason it's long been Steve Forbes types talking the idea up.

However, this would constitute a tax hike for those in the 0-20% group, and those in the 21-40% group, and the 41-60% group, and the 61%-80% group, and even the 81-90% percentile. In other words, it would hammer the working class and middle class and even half the upper class.

Only that last 10% of earners would see their effective tax rates fall with a flat tax. And even there, it would be a very modest improvement for the 91-95% level earners (just a two-point drop in tax rates). Very nearly all the benefit of the change would flow just to the top 5% of earners.

As a practical matter, if your household earns less than $200,000, a flat tax would wind up being a tax hike for you. The farther you are below that threshold, the bigger the tax hike it would be. From $200k-$300k of household income, it would be a small tax cut (around two points). From $300k to $500k it would be a sizable tax cut (6.1 points or so). And above $500k it would be a truly massive tax cut (over 14 points).