- Joined

- Sep 28, 2011

- Messages

- 17,571

- Reaction score

- 14,340

- Location

- SF Bay Area

- Gender

- Male

- Political Leaning

- Conservative

Obviously you have fallen for the MSM lie that tax cuts are only for the rich. The top 1% federal tax rate increased from 22.2% to 26.3% . The top 50% of all federal tax payers paid 97.7% of all federal taxes while the bottom 50% paid 2.3%.

This the truth:

Summary of the Latest Federal Income Tax Data, 2025 Update

New IRS data shows the US federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates. Average tax rates for all income groups remain lower after the Tax Cuts and Jobs Act (TCJA).taxfoundation.org

The reason you don't see a reduction in the deficit is because when congress (both parties) when they see extra money they spend it. But you been duped by your own party and the MSM big lie tax cuts are only for the wealthy.

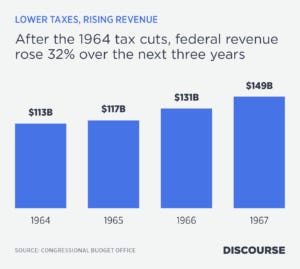

In Actual Dollars, Tax Cuts Boost Revenue Time After Time

From the Kennedy legislation in 1964 to the Trump package in 2017, the naysayers are proven wrong again and againwww.discoursemagazine.com

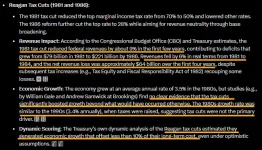

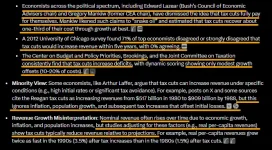

With all due respect to the author of the tax foundation organization, and a writer at discourse magazine, the economics profession as a whole says this is snake oil nonsense.

This trope began in the first Reagan term when they picked up on "the Laffer Curve", a hypothetical curve that showed after crossing a certain marginal tax rate, the incentives created by reducing that rate would pay for itself, as well as produce a surplus.

This was a pivotal moment in evolution of American conservative views - the notion that balanced budgets were very important was now old fashioned conservatism. Reagan loved the new idea because it no longer required drastic cuts in sensitive programs that would cause public outrage, NOR tax increases that would alienate his voters. It was the start of fiscal magical thinking on the right, and the birth of a myth based on an idea...not on empirical proof.

Mind you no one disputes that at extremely high marginal rates, such as the 80 percent average rate once imposed in Sweden, in theory could disincentivize the economy such that a cut might create a net gain in tax revenue. But NO ONE had evidence that the US was on that side of the Laffer curve. And the experience and studies since then by economists, liberal and conservative, have only confirmed the view that this is "snake oil" (Greg Mankiw, prior Republican Chair of Economic Advisors).

As Mankiw has suggested, a tax cut most likely does pay for "part" of itself in increased GDP, but it is still a serious net loss.

To be clear, tax cuts especially on high income earners, can stimulate growth - a useful strategy if one uses a tax cut early enough in a recession. However, whatever benefits that are derived (eg softening the bottom) isn't cost free, and will add to the deficit.

By the way, folks should note we are entering a second phase economic snake oil for "conservatives" who desire magical thinking, that of tariffs. Second wave revisionist conservatism is even more absurd than the first under Reagan; Laffer, is an ardent free traders; as such, these views are well within the mainstream of modern economics. Since Adam Smith most economists have come to believe that international trade is win-win. Unlike Trump, they reject the idea that a trade imbalance means that one nation must be the winner and the other the loser, and they supported the North American Free Trade Agreement (nafta), and international organizations, such as the World Trade Organization, that reduce trade barriers around the world.

Sadly, conservative fiscal policy informed by economics is no longer a part of MAGA conservatism. Populist magical thinking is now following two false gods: tax cuts and tariffs. And like all magical thinking (eg William Jennings Bryans) is yet another step backwards into ignorances long thought dead.