One problem: Federal revenue didn’t fall after the big Trump administration tax cuts, much less by $2 trillion. Instead, total revenue rose. In fact, after trimming the rates for five of the seven brackets and nearly doubling the standard deduction, the government collected nearly $100 billion more in personal income tax revenue for the year ended Sept. 30, 2018. That was the biggest jump in three years.

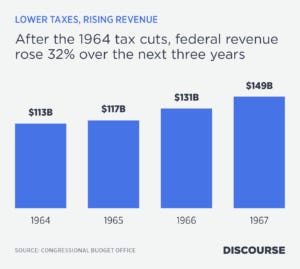

The conventional wisdom in media, political and policymaking circles is that tax cuts cost the government so much revenue that they drive the country’s enormous budget deficits, but this isn’t true. After President George W. Bush’s 2003 tax cuts, revenue rose for the next four years, with the deficit shrinking to as little as $161 billion in fiscal 2007. After the 1986 Reagan tax reform, which cut the top personal income tax rate from 50% to 28% and lowered the rates for other brackets, the deficit plummeted 32% the next year and stayed at that low level for another two years while revenue rose dramatically for three straight years.