- Joined

- Nov 20, 2013

- Messages

- 78,184

- Reaction score

- 59,972

- Gender

- Male

- Political Leaning

- Other

The infrastructure bill and the reconciliation bill are two different bills.

The infrastructure bill was passed by the Senate and the House and is headed to Biden's desk for signing.

Rather odd, in that the CBO hasn't done their estimations so neither legislative body knows how much the cost for what they voted for. You'd think that this piece of information might be important in critical thinking and decision making . . .

The reconciliation bill is the one that's far more packed with all the leftist radical progressive's social engineering and manipulation, at least far more so than the infrastructure bill.

So, yes, it's still 'a thing', but one who's lights are dimming rather rapidly, much to the consternation of the leftist radical progressives .

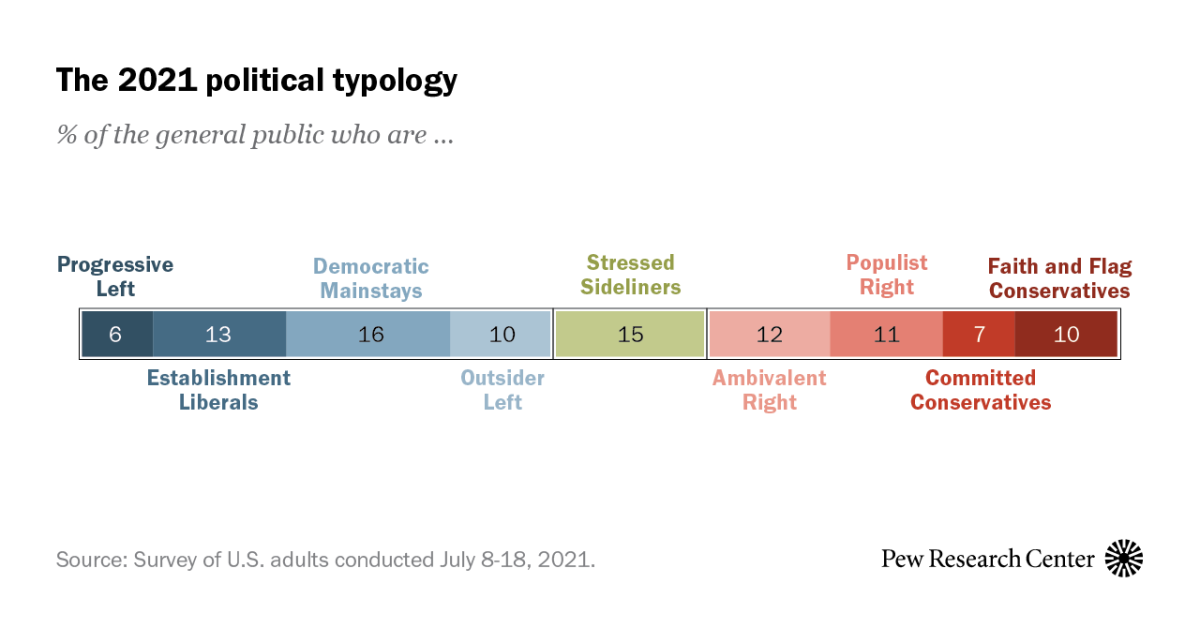

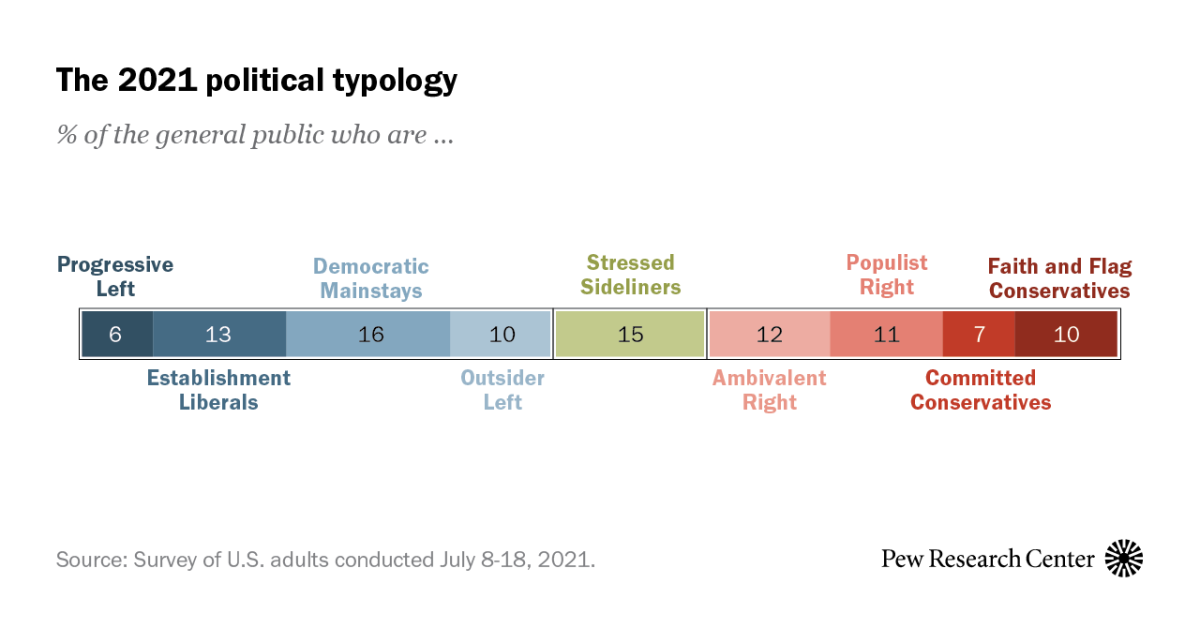

Rather odd that such a small fraction of the over all electorate and even such a small fraction of the Democrat party have such control as to drive the Democrat party bus (off the rails and over the cliff).

www.pewresearch.org

Only 6% of the over all electorate and only 12% of the Democrat party, yet the leftist 'news' (political propaganda) media always gives them the ever larger megaphone.

www.pewresearch.org

Only 6% of the over all electorate and only 12% of the Democrat party, yet the leftist 'news' (political propaganda) media always gives them the ever larger megaphone.

Well, 'With friends like these . . .'

The infrastructure bill was passed by the Senate and the House and is headed to Biden's desk for signing.

Rather odd, in that the CBO hasn't done their estimations so neither legislative body knows how much the cost for what they voted for. You'd think that this piece of information might be important in critical thinking and decision making . . .

The reconciliation bill is the one that's far more packed with all the leftist radical progressive's social engineering and manipulation, at least far more so than the infrastructure bill.

So, yes, it's still 'a thing', but one who's lights are dimming rather rapidly, much to the consternation of the leftist radical progressives .

Rather odd that such a small fraction of the over all electorate and even such a small fraction of the Democrat party have such control as to drive the Democrat party bus (off the rails and over the cliff).

The Political Typology: In polarized era, deep divisions persist within coalitions of both Democrats and Republicans

Pew Research Center’s political typology provides a roadmap to today’s fractured political landscape. It segments the public into nine distinct groups, based on an analysis of their attitudes and values.

Well, 'With friends like these . . .'

:max_bytes(150000):strip_icc()/money-social-share-default-5ac795adc0647100374ba7e7.png)