- Joined

- Aug 10, 2013

- Messages

- 20,231

- Reaction score

- 21,629

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

The debate in Colorado (halted last year due to the pandemic) over whether to become the second state to launch a state-level public option is heating up again. The opponents started their opening volley earlier this month:

Nonprofit launches $1 million TV ad buy against Colorado Democrats’ public health insurance option proposal

One local think tank is keying-in on the somewhat underwhelming returns from the first year of Washington state's experiment with a public option to argue that Colorado's current approach to keeping down premiums (reinsurance, which takes some medical expenses out of premiums and reimburses for them separately) is better:

Recent Trends in Health Insurance Costs: Early Results of Public Option in Washington State Compared to Colorado

Reinsurance is indeed good and more state marketplaces should be using it. Every state that has implemented it under the ACA saw double digit premium decreases as they reset premiums downward--Colorado effectively erased the 2017-18 Trump Bump when it implemented reinsurance in 2020. But prior to that, Colorado's marketplace premiums closely tracked the national numbers, whereas Washington (which doesn't have reinsurance) has tended to have lower premiums than the national average almost from the start.

And reinsurance removes some costs from premiums but doesn't eliminate them, meaning Colorado's premiums (by design) don't reflect the full cost of care. Reinsurance is good for the functioning of the insurance market in that it doesn't allow the expenses of the highest cost enrollees to price out healthier shoppers, but it doesn't tackle the underlying prices of the care being purchased.

For example, the prices paid to hospitals by employer-sponsored health plans in Colorado appear to be 15-20% higher, using local Medicare prices as a measuring stick, than prices in Washington. And indeed the high margins enjoyed by Colorado's hospitals are a key impetus for the public option push there: Colorado hospitals’ profit margins are nation’s highest as state lawmakers move to cap health care costs.

Just pursuing reinsurance won't tackle that. Given that reinsurance and a public option aren't mutually exclusive (in fact, they might be great complements), this whole line of argument seems like a bit of a red herring. That said, it's hard to imagine that Washington's public option experiment, three months in, won't become a talking point going forward. This one will be interesting to watch!

Nonprofit launches $1 million TV ad buy against Colorado Democrats’ public health insurance option proposal

A deep-pocketed nonprofit backed by private insurance companies has launched a barrage of advertising aimed at building public opposition to Colorado Democrats’ attempt to create a public health insurance option.

Partnership for America’s Health Care Future launched a TV ad buy at a cost of nearly $1 million on Monday that will run through early April. The ads are airing in the Denver, Grand Junction and Colorado Springs television markets.

And that’s just the beginning of the group’s full-court press against a bill that still hasn’t been introduced.

One local think tank is keying-in on the somewhat underwhelming returns from the first year of Washington state's experiment with a public option to argue that Colorado's current approach to keeping down premiums (reinsurance, which takes some medical expenses out of premiums and reimburses for them separately) is better:

Recent Trends in Health Insurance Costs: Early Results of Public Option in Washington State Compared to Colorado

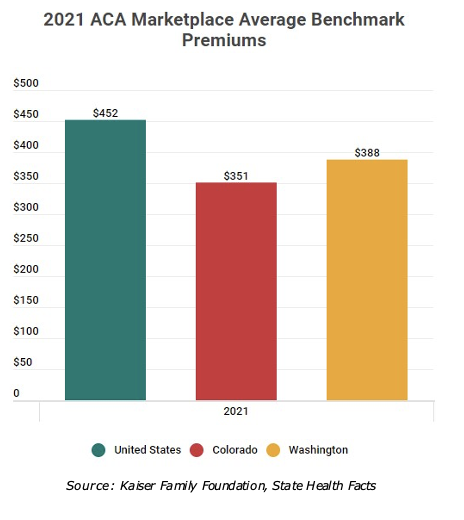

For the 2021 plan year, while both Colorado and Washington State have more affordable premiums than the country as a whole, average benchmark premiums in the ACA marketplace are 9.5% lower in Colorado than Washington State.

Over a longer time-period, Colorado has also seen larger reductions on a percentage basis in ACA average benchmark premiums. Since 2018, Colorado benchmark premiums have fallen by 25.3%, compared to 15.5% increase in Washington State. Across the nation, ACA average benchmark premiums have fallen by 6.0%.

In most of the counties where a public option was offered in Washington State, public option premiums were more costly than other plans.

Reinsurance is indeed good and more state marketplaces should be using it. Every state that has implemented it under the ACA saw double digit premium decreases as they reset premiums downward--Colorado effectively erased the 2017-18 Trump Bump when it implemented reinsurance in 2020. But prior to that, Colorado's marketplace premiums closely tracked the national numbers, whereas Washington (which doesn't have reinsurance) has tended to have lower premiums than the national average almost from the start.

And reinsurance removes some costs from premiums but doesn't eliminate them, meaning Colorado's premiums (by design) don't reflect the full cost of care. Reinsurance is good for the functioning of the insurance market in that it doesn't allow the expenses of the highest cost enrollees to price out healthier shoppers, but it doesn't tackle the underlying prices of the care being purchased.

For example, the prices paid to hospitals by employer-sponsored health plans in Colorado appear to be 15-20% higher, using local Medicare prices as a measuring stick, than prices in Washington. And indeed the high margins enjoyed by Colorado's hospitals are a key impetus for the public option push there: Colorado hospitals’ profit margins are nation’s highest as state lawmakers move to cap health care costs.

Just pursuing reinsurance won't tackle that. Given that reinsurance and a public option aren't mutually exclusive (in fact, they might be great complements), this whole line of argument seems like a bit of a red herring. That said, it's hard to imagine that Washington's public option experiment, three months in, won't become a talking point going forward. This one will be interesting to watch!