- Joined

- Oct 15, 2020

- Messages

- 52,944

- Reaction score

- 27,522

- Location

- Greater Boston Area

- Gender

- Male

- Political Leaning

- Conservative

No, I understand that when a loan is written off, in full or in part, that it impacts someone's balance sheet, and that impact is a loss.Then you understand why your question is stupid.

No, what's stupid is the assertion no one takes the loss. And when I say "stupid" in this case, I mean really stupid."Let's do some math:

Let's say I take out a $50,000 loan at 8% interest and, under my IDR plan, I pay $250 a month on that loan. At that rate, I will NEVER pay off the loan, the interest will accrue faster than I can pay down principle. But, after 25 years of $250 a month, I would have paid back $75,000 on a $50,000 loan.

These are the kinds of plans which are receiving forgiveness."

To directly answer your question, no one takes a loss in the above scenario. Which, again, is why your question is stupid.

Loans, both from the principal and future cash flow standpoint, have value. In the extreme scenario you described, that's loan value is assessed based on both the principal and the payments that can be feasibly made, i.e. $250 a month, even though that $250 a month will never catch up to the accumulating 8% interest, those payments will accumulate to something.

So yes, let's do some math though this time do it properly. For simplicity's sake, let's suppose the following is true:

- $100,000 student loan at 8%

- Borrower begins paying at age 25

- Borrower will only ever be able to pay $250 a month ($3k a year)

- Actuarial tables peg the borrower's life expectancy at 85, so they'll be making 60 years worth of payments or $180,000.

Another way to look at this, play with a loan calculator and you'll find that by agreeing to the $250 monthly payment and an 85 year life expectancy, the loan terms effectively change and become $100k at 6.2% interest, paid out over 60 years.

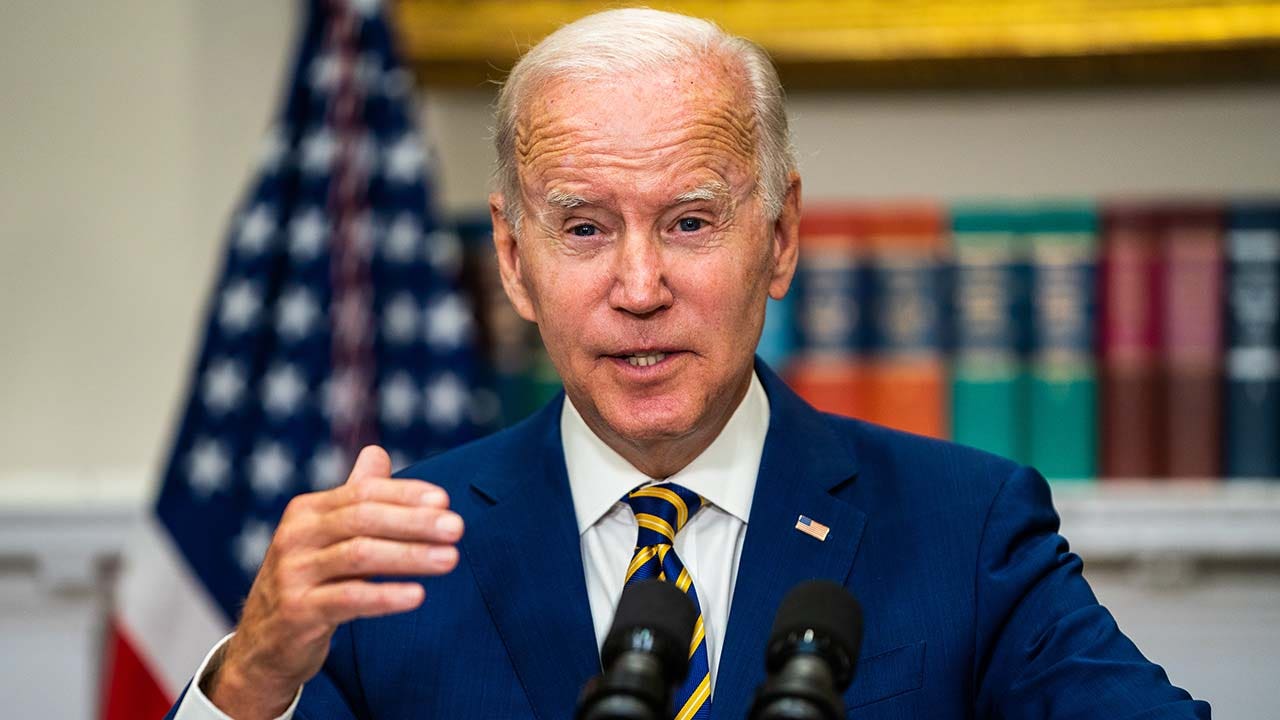

But here's what happens. Shortly after someone buys this loan at $200k, Joe Biden proclaims "Borrower, your loan is forgiven!" Now, If you think the holder of that loan doesn't suffer a $200k loss, then you're only fooling yourself. If the originator held the loan, they've suffered the loss. If the loan was purchased or underwritten, the buyer or underwriter has suffered the loss.

Which brings us back to the original point; the federal government has underwritten these loans, therefore it's federal taxpayers who have suffered the loss.

There's no free lunch, and there's no free loan forgiveness.

Here endeth the lesson.