- Joined

- Dec 20, 2009

- Messages

- 81,991

- Reaction score

- 45,055

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

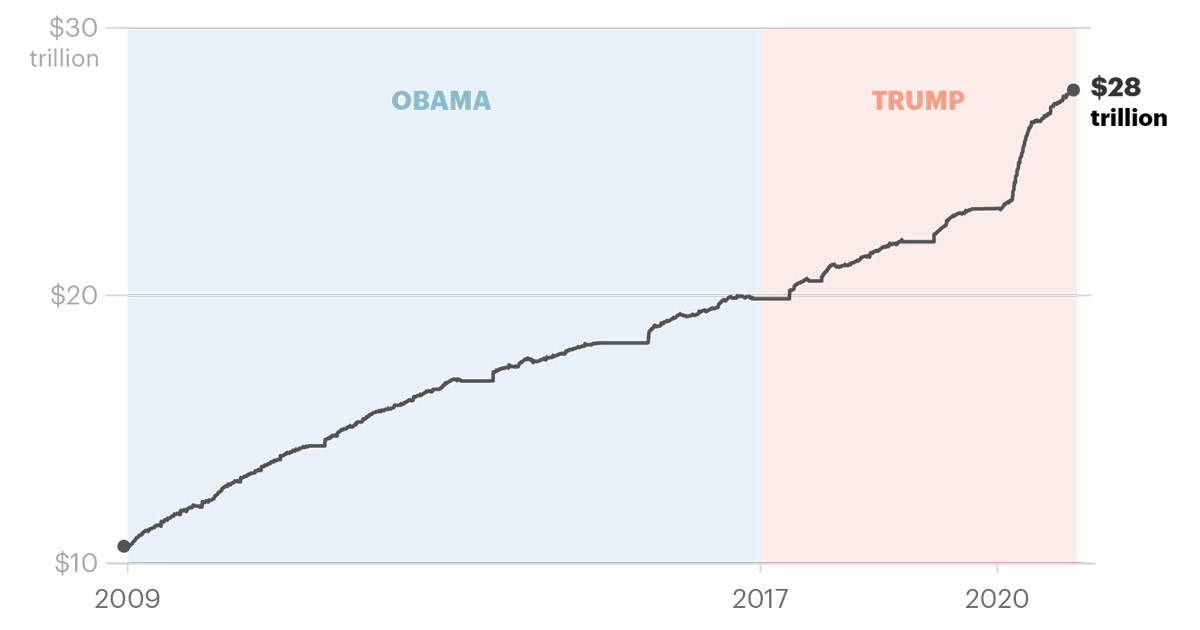

Hooray, Fun New Roadmark

Back in 2021, when we were noting that Interest on the debt had risen from $325 Billion in 2018 to half a trillion, I asked:

Current rate on a 10 year Treasury is 4.08%.

Back in 2021, when we were noting that Interest on the debt had risen from $325 Billion in 2018 to half a trillion, I asked:

Hey out of curiosity, what happens when our interest rates return to historic norms?

Current rate on a 10 year Treasury is 4.08%.

The Biden administration rang up a budget deficit topping $1.8 trillion in fiscal 2024, up more than 8% from the previous year and the third highest on record, the Treasury Department said Friday...

One aggravating factor for the debt and deficit picture has been high interest rates from the Federal Reserve's series of hikes to fight inflation.

Interest expense for the year totaled $1.16 trillion, the first time that figure has topped the trillion-dollar level. Net of interest earned on the government's investments, the total was a record $882 billion, the third-largest outlay in the budget, outstripping all other items except Social Security and health care...

As a share of the total U.S. economy, the deficit is running above 6%, unusual historically during an expansion and well above the 3.7% historical average over the past 50 years, according to the Congressional Budget Office....

One aggravating factor for the debt and deficit picture has been high interest rates from the Federal Reserve's series of hikes to fight inflation.

Interest expense for the year totaled $1.16 trillion, the first time that figure has topped the trillion-dollar level. Net of interest earned on the government's investments, the total was a record $882 billion, the third-largest outlay in the budget, outstripping all other items except Social Security and health care...

As a share of the total U.S. economy, the deficit is running above 6%, unusual historically during an expansion and well above the 3.7% historical average over the past 50 years, according to the Congressional Budget Office....

:max_bytes(150000):strip_icc()/GettyImages-591478749-fb686ce4aa5c4dc1b2ef76949bb8ea81.jpg)