- Joined

- Apr 18, 2013

- Messages

- 110,719

- Reaction score

- 100,991

- Location

- Barsoom

- Gender

- Male

- Political Leaning

- Independent

Trump rate hopes burned as new inflation data comes in hot

The PPI reading "is a most unwelcome surprise," said one investment analyst.

8.14.25

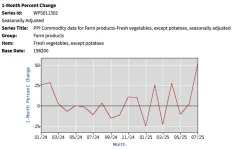

Producer prices rose sharply in July, federal data shows, dashing President Donald Trump's hopes that the Federal Reserve would cut rates in September as he has been demanding. The Producer Price Index (PPI) rose by 0.9 percent on the month in July, the U.S. Bureau of Labor Statistics (BLS) said on Thursday, and by 3.3 percent on the year. Both were much higher readings than the markets were expecting. The monthly rise was the biggest since June 2022, and the annual increase the highest since February this year. Core PPI, which strips out volatile data points, rose by 3.7 percent over the year, its highest annual rise since April 2021. The PPI measures the output prices for domestic producers of goods and services before they reach consumers. he PPI data suggests that the much-anticipated feedthrough of Trump's tariffs into consumer prices is coming down the line, a fear that has so far deterred the Fed from cutting rates. Chris Zaccarelli, chief investment officer for Northlight Asset Management, said the "large spike" in PPI "shows inflation is coursing through the economy, even if it hasn't been felt by consumers yet. Given how benign the CPI numbers were on Tuesday, this is a most unwelcome surprise to the upside and is likely to unwind some of the optimism of a 'guaranteed' rate cut next month." Christopher Rupkey, chief economist at fwdbonds, said: "It will only be a matter of time before producers pass their higher tariff-related costs onto the backs of inflation-weary consumers."

Increased costs for Trump's tariffs are coursing through production/transportation pipelines. This is reflected in the latest PPI data. Buckle-up folks.