- Joined

- Sep 23, 2006

- Messages

- 19,295

- Reaction score

- 8,601

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

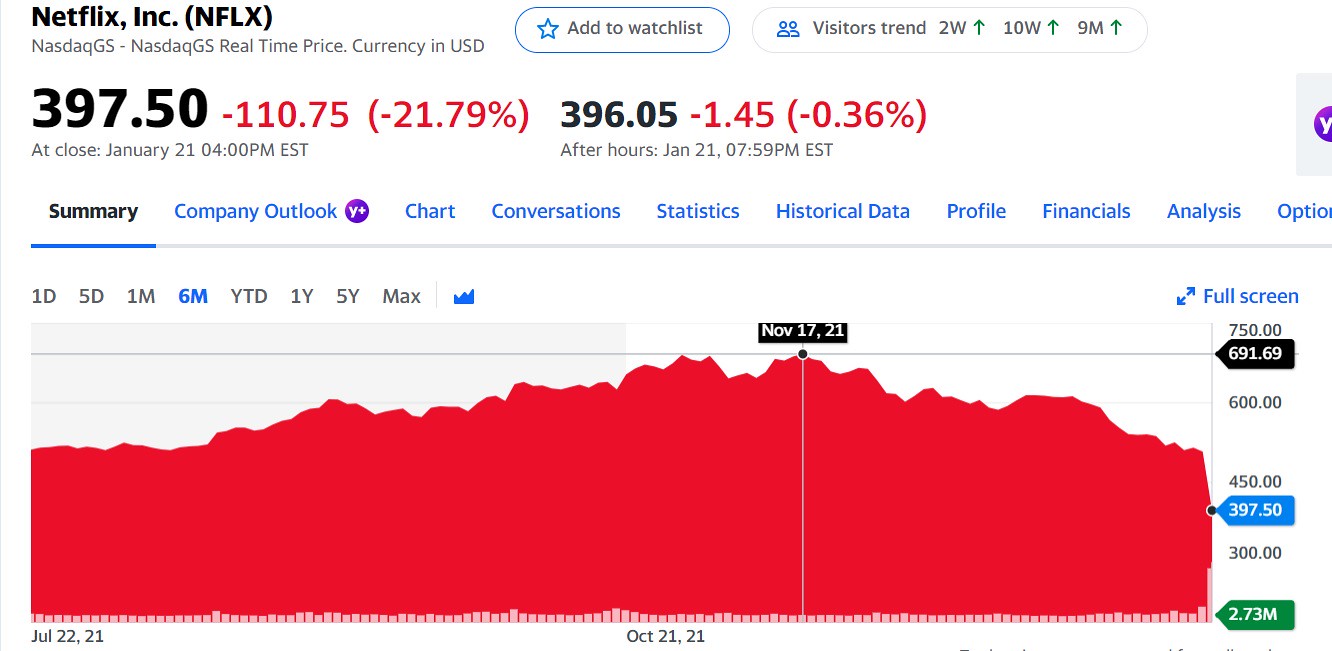

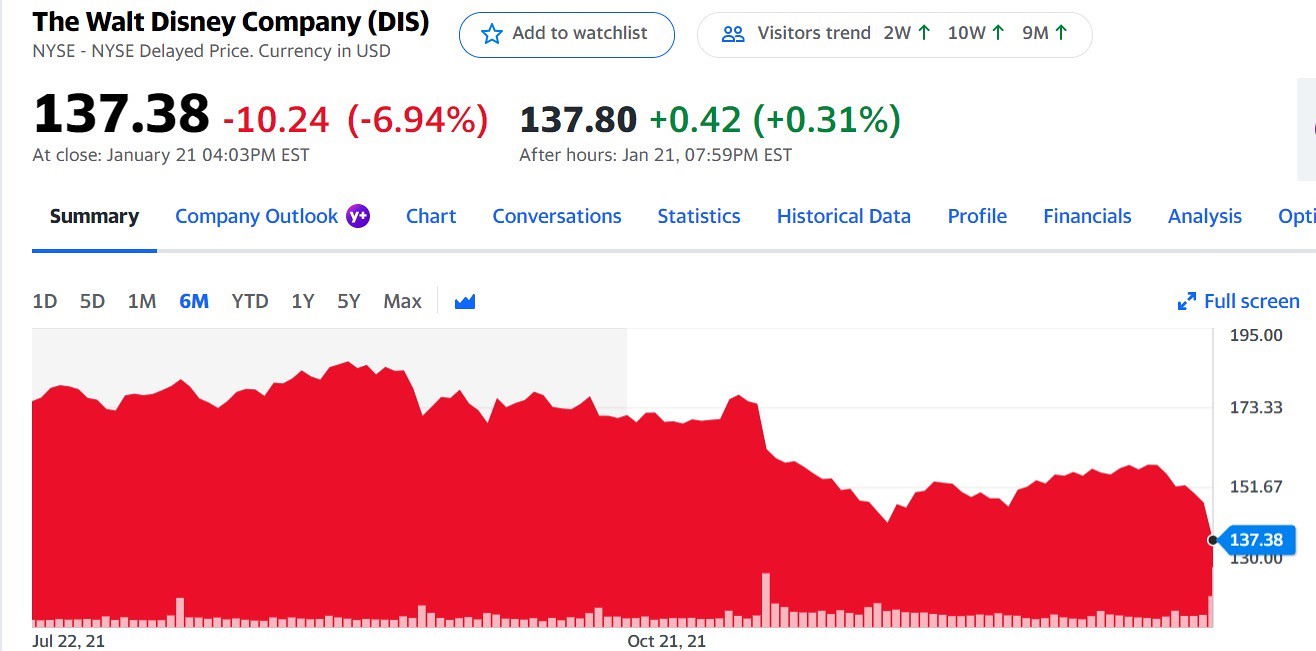

I've been trading stocks online on my own account for 24 years. I've never seen a decline with the characteristics of this one that became much broader only since Wednesday, January 4, but began in some former high flying "growth" stocks as long ago as September, but still has not appreciably affected DOW Index's 26 of 30 stocks under Price to Earnings ratio (P/E) of 30, except INTC (Intel) with a noticeable price decline despite a P/E of only 10!

I want opinions of whether recent movements in stock prices signal that it's more likely stocks that haven't declined much, soon will, or that stocks that have declined seem attractive buy candidates, even if just for a quick bounce in price and a quick exit of an immediate new long buy position.

Do you have heightened recent concerns, as I now do, that these price declines cannot possibly be in reaction to the Federal Reserve signaling a one percent interest rate increase and the Fed ending its purchases of U.S. gov. bonds and moving to begin to sell off the bonds it is holding, in competition with the U.S. Treasury's own anticipated auctioning of new bond debt, permitting market demand to set the rate of interest the government pays on new debt issuance.

This forum restricts images to 3 per post, so I'm going to post 3 times with three stock chart images in each. These first three have all experienced dramatic price declines. The first, UPST, sells an alternative credit scoring program to lenders it claims is more accurate than Fair Isaac's FICO credit risk scoring but qualifies a more diverse and larger number of potential borrowers with result of less payment defaults. The next two stocks, MRNA and NVAX, both manufacture FDA approved, effective Covid-19 vaccines and are forecast to sell as much vaccine as they are able to produce and distribute. All three stocks are high P/E, exceptionally high projected growth.

finance.yahoo.com

finance.yahoo.com

finance.yahoo.com

finance.yahoo.com

finance.yahoo.com

finance.yahoo.com

I want opinions of whether recent movements in stock prices signal that it's more likely stocks that haven't declined much, soon will, or that stocks that have declined seem attractive buy candidates, even if just for a quick bounce in price and a quick exit of an immediate new long buy position.

Do you have heightened recent concerns, as I now do, that these price declines cannot possibly be in reaction to the Federal Reserve signaling a one percent interest rate increase and the Fed ending its purchases of U.S. gov. bonds and moving to begin to sell off the bonds it is holding, in competition with the U.S. Treasury's own anticipated auctioning of new bond debt, permitting market demand to set the rate of interest the government pays on new debt issuance.

This forum restricts images to 3 per post, so I'm going to post 3 times with three stock chart images in each. These first three have all experienced dramatic price declines. The first, UPST, sells an alternative credit scoring program to lenders it claims is more accurate than Fair Isaac's FICO credit risk scoring but qualifies a more diverse and larger number of potential borrowers with result of less payment defaults. The next two stocks, MRNA and NVAX, both manufacture FDA approved, effective Covid-19 vaccines and are forecast to sell as much vaccine as they are able to produce and distribute. All three stocks are high P/E, exceptionally high projected growth.

Upstart Holdings, Inc. (UPST) Stock Price, News, Quote & History - Yahoo Finance

Find the latest Upstart Holdings, Inc. (UPST) stock quote, history, news and other vital information to help you with your stock trading and investing.

Moderna, Inc. (MRNA) Stock Price, News, Quote & History - Yahoo Finance

Find the latest Moderna, Inc. (MRNA) stock quote, history, news and other vital information to help you with your stock trading and investing.

Novavax, Inc. (NVAX) Stock Price, News, Quote & History - Yahoo Finance

Find the latest Novavax, Inc. (NVAX) stock quote, history, news and other vital information to help you with your stock trading and investing.