CaughtInThe

DP Veteran

- Joined

- Aug 4, 2017

- Messages

- 144,992

- Reaction score

- 165,612

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

I guess they had to rush through more $$$$ for ICE so Trump could torture more brown people so they couldn't be bothered to actually read all of it or have their staffs read all of it (and summarize everything to them).

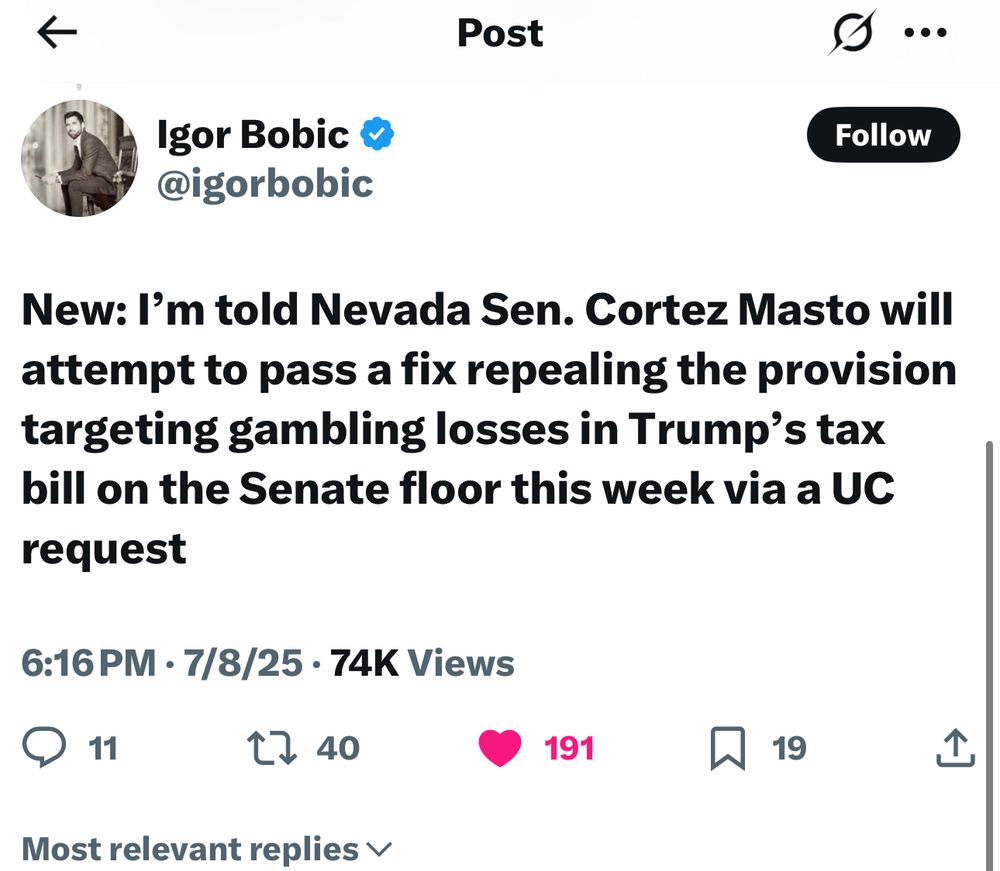

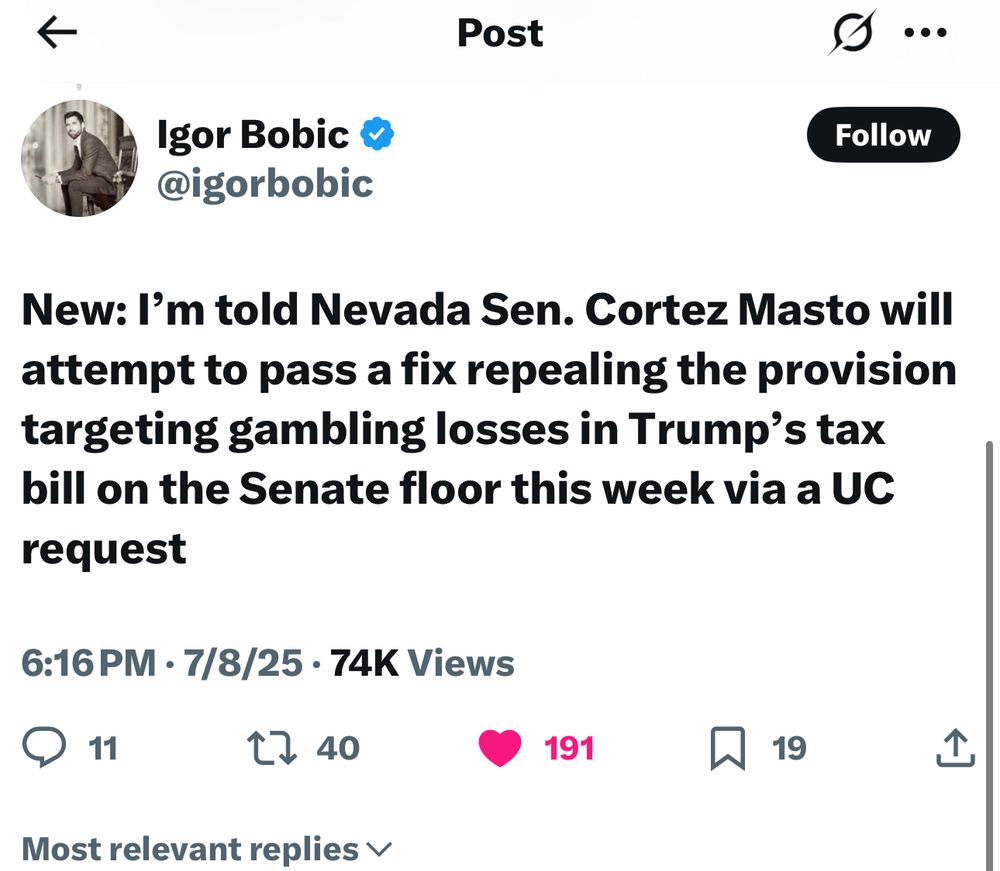

How BBB impacts gambling

Context: The new bill puts the amount gamblers can deduct from their winnings equal to 90% of their losses for a tax year. This rule would be permanent and start in 2026, said Garrett Watson, director of policy analysis at the Tax Foundation.- This means that a hypothetical gambler who won $100,000 but lost $100,000 would have to pay taxes on $10,000 of income.

- Pro poker player Phil Galfond said on X this amendment "would end professional gambling in the US and hurt casual gamblers."