- Joined

- Dec 20, 2009

- Messages

- 81,903

- Reaction score

- 45,028

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

New York Fed out with an interesting, updated set of numbers.

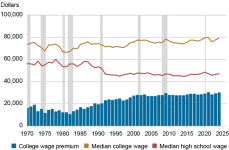

In a two-part blog series, we offer an economic perspective on the value of a college degree, updating our previous research and analysis. This first post examines the costs, benefits, and return for the typical college graduate. We estimate the return to college at 12.5 percent, a rate well above the threshold for a sound investment. Our second post looks beyond the typical graduate and finds a college degree might not be worth it for at least a quarter of college graduates....

We follow the methodology used in our previous studies, with one important exception. Rather than using standard regression methods to estimate lifetime earnings profiles for the average graduate, we utilize a quantile regression method to estimate earnings profiles and the rate of return for the median graduate. Because averages can be pulled up by particularly high wage earners, the median provides an estimate more in line with what the “typical” graduate could expect. Indeed, the rates of return we estimate here are generally a bit lower than our previous estimates based on averages. The chart below plots our estimates of the return to college for the median graduate since 1970.

....

...The typical college graduate earns a return that easily surpasses the benchmark for a sound investment. That said, there are a number of caveats to keep in mind with our back-of-the-envelope calculations. First, some of what we estimate as the benefit to college may not be a consequence of the knowledge and skills acquired while in school but rather could reflect innate abilities possessed by those who complete college. However, a number of studies that attempt to correct for this possibility find a similar return. In part, this is likely because in today’s labor market a college degree continues to serve as a gateway to professional occupations that offer better opportunities for wage growth over the life cycle. It is also important to keep in mind that our estimates apply to college graduates; those who start college but do not complete a degree incur at least some of the costs but enjoy far fewer benefits....