- Joined

- Jan 20, 2020

- Messages

- 28,456

- Reaction score

- 5,600

- Gender

- Male

- Political Leaning

- Progressive

Firstly, the 5K is pre-tax; net is substantially less. I assume your 1,500 is pre-tax, as well? And, you're not providing your own health insurance?

I'm not saying it can't be done at 1,500 a week gross, in some cases. But I don't think it's common across America.

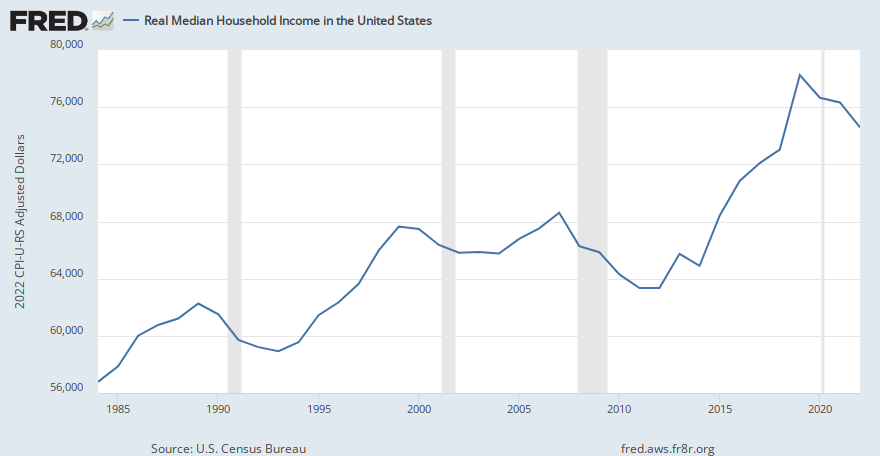

Real Median Household Income in the United States

View the inflation-adjusted value of the 50th percentile of the U.S. income distribution, as estimated by the Census Bureau.

fred.stlouisfed.org

You would be mistaken. The majority of households across the United States get by on that income, or less. It's more common than not.

The thought that one can't survive on less than $250,000 dollars per year in the United States defies reality...

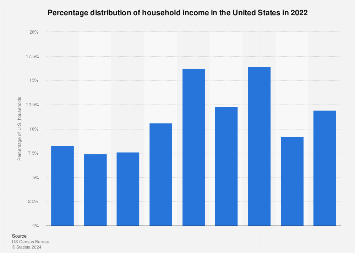

Distribution of household income U.S. 2023| Statista

In 2023, just over 50 percent of Americans had an annual household income that was less than 75,000 U.S.

For lack of a better method, I use national averages as a point of discussion.

Be sure to check the median against the average, as a general rule, in case outliers skew the data.

Yeah, that was a mispost. 208k is not enough to fund a 78k per year retirement.As to putting away 2K a week to "fund a full retirement in 2 years", I don't see how. Not on 208K.

It would take closer to 12 years of saving that from one's 5k per week payment to fund that, based on average market returns, using the 4% rule.

Sorry for my mistake, and thank you for correcting it. I probably meant twenty years.