- Joined

- Sep 3, 2014

- Messages

- 20,729

- Reaction score

- 24,115

- Location

- Pacific NW

- Gender

- Male

- Political Leaning

- Liberal

It wouldn't be that difficult if we had reasonably sane people in positions of power, that is.

(I've adapted the following from this article.)

Here are four painless things we could and should be doing:

1) Get wealthy Americans to pay the taxes they legally already owe. The net tax gap — taxes Americans are legally obliged to pay but don’t — is simply huge, on the order of $600 billion a year. There'll always be tax cheats, but restoring the IRS budget would let them crack down on wealthy tax cheats. (Of course, the GOP is doing the exact opposite, strangling the IRS of funds because Republicans don't like making people pay their legal share. Government tyranny!!!).

2) Crack down on Medicare Advantage overpayments. A Center for American Progress estimate found that Medicare is at risk of overpaying [Medicare Advantage] plans between $1.3 trillion and $2 trillion over the next decade. Elon Musk, where are you? Oh yeah, you're ending cancer research and stopping life-saving aid overseas. Great.

3) Get serious about corporate tax avoidance. Multinational firms use shady and dishonest strategies to make profits actually earned in the United States disappear and reappear in low-tax nations like Ireland. International cooperation, amending tax laws, and public shaming would help reduce the annual loss of tens of billions.

4) Let Donald Trump’s 2017 tax cut lapse. It wasn’t a response to any economic needs, and there’s not a shred of evidence that it did the economy any good. All it did was transfer a lot of money to corporations and the wealthy.

These provisions wouldn't be enough to balance the budget, but they would certainly slow the expansion of the debt to GDP ratio, and perhaps be enough to reverse it.

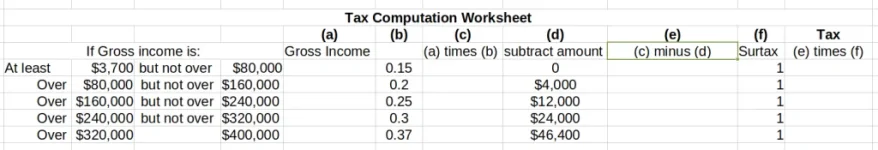

After all this, balancing the budget would only require the highest tax bracket to be raised by a few percentage points.

(I've adapted the following from this article.)

Here are four painless things we could and should be doing:

1) Get wealthy Americans to pay the taxes they legally already owe. The net tax gap — taxes Americans are legally obliged to pay but don’t — is simply huge, on the order of $600 billion a year. There'll always be tax cheats, but restoring the IRS budget would let them crack down on wealthy tax cheats. (Of course, the GOP is doing the exact opposite, strangling the IRS of funds because Republicans don't like making people pay their legal share. Government tyranny!!!).

2) Crack down on Medicare Advantage overpayments. A Center for American Progress estimate found that Medicare is at risk of overpaying [Medicare Advantage] plans between $1.3 trillion and $2 trillion over the next decade. Elon Musk, where are you? Oh yeah, you're ending cancer research and stopping life-saving aid overseas. Great.

3) Get serious about corporate tax avoidance. Multinational firms use shady and dishonest strategies to make profits actually earned in the United States disappear and reappear in low-tax nations like Ireland. International cooperation, amending tax laws, and public shaming would help reduce the annual loss of tens of billions.

4) Let Donald Trump’s 2017 tax cut lapse. It wasn’t a response to any economic needs, and there’s not a shred of evidence that it did the economy any good. All it did was transfer a lot of money to corporations and the wealthy.

These provisions wouldn't be enough to balance the budget, but they would certainly slow the expansion of the debt to GDP ratio, and perhaps be enough to reverse it.

After all this, balancing the budget would only require the highest tax bracket to be raised by a few percentage points.

Last edited: