- Joined

- Jun 19, 2013

- Messages

- 15,192

- Reaction score

- 17,961

- Gender

- Male

- Political Leaning

- Independent

Mine is done by zip code, and while my risk is low others in the zip code are closer to the water.

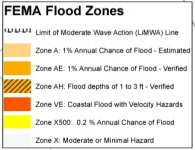

For the National Flood Insurance program rates are set on individual properties (not zip codes) and are based on property value*** and as a function of flood risk. Flood risk is evaluated based on flood data. The higher the risk zone the higher the insurance.

*** Technically - IIRC - it's insured value as I think you can take out insurance for less that the full value. Someone can check and correct me on that.

WW