- Joined

- Apr 22, 2019

- Messages

- 59,136

- Reaction score

- 30,179

- Gender

- Male

- Political Leaning

- Progressive

The following is a post to someone who said we need to cut spending, or the national debt will destroy the country, but it's such a crucial issue for the country, I'm posting a thread for it.

Sorry to put this bluntly, but I think that view is very wrong and ignorant. A question is whether you can hear my argument, or not.

Please read this slowly and consider the topic. Normally people with your views are 'locked in' and have a hard time, it seems. They're locked into the idea 'the only issue with the debt is spending too much'.

I understand why that is compelling. The debt IS a crisis for the country - an intended one by Republicans, but that's a longer topic, but it's about "starve the beast". That can make a person passionate about wanting to 'fix' the debt.

But I suspect you are blind to the actual problem and cause: undertaxing the wealthy. That's pushed on you more by using the idea of 'wasteful governemnt spending' with this and that example to keep you locked in on the spending.

Let me try a crude analogy. There is a business, which has enough sales to be very profitable. But the owner has a wife who spends wildly on her own enjoyment - mansions, yachts, jets - more than the company makes.

The owner preaches the value of 'fiscal conservatism', and decries the threat of the debt the business faces, and says the debt leave him no choice but to slash the number of stores, salaries, the marketing budget - any spending that actually strengthens the business. The cuts cause the business to do worse and worse, but he never looks at his wife's spending.

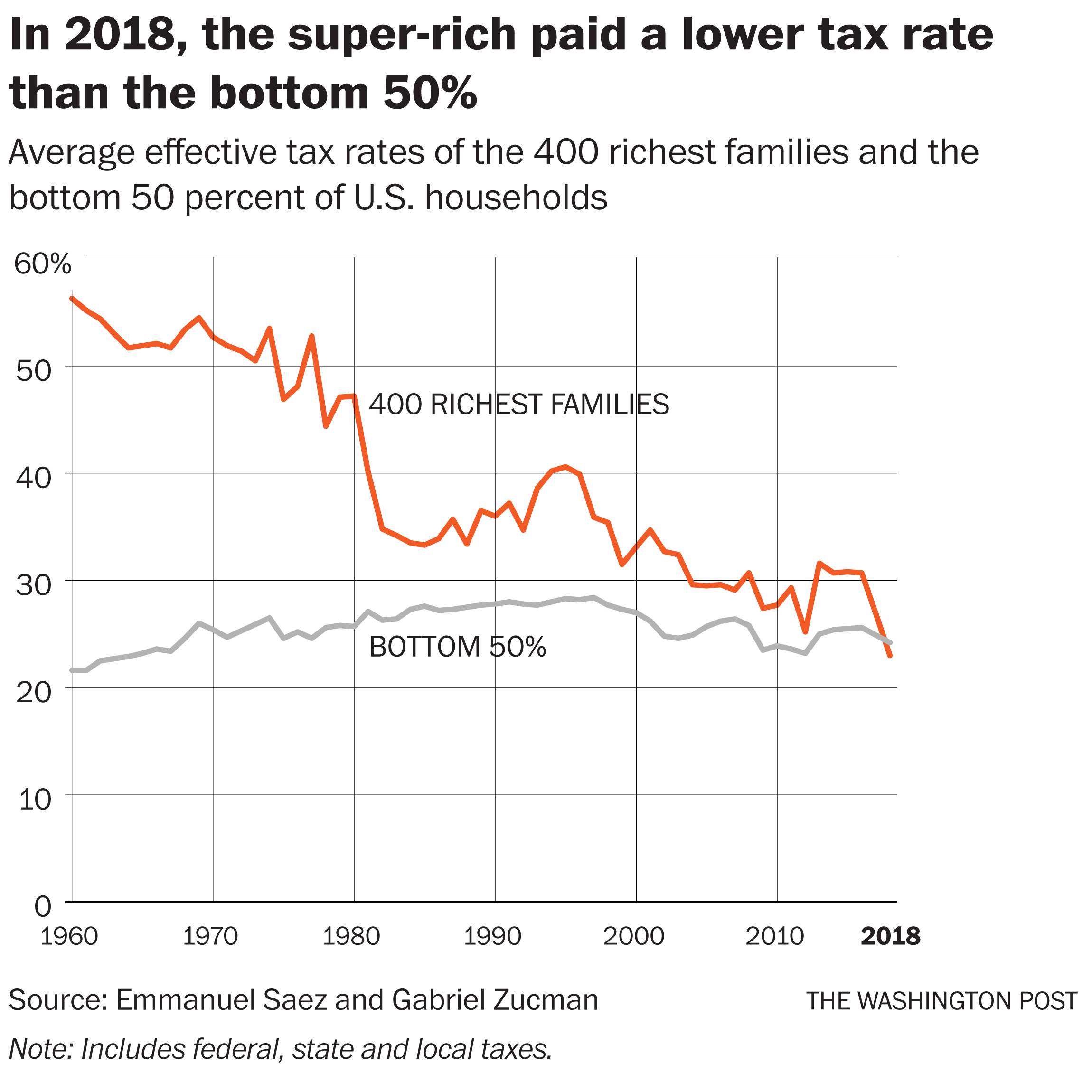

That's our situation. The US can have a very successful economy, but our politics have been corrupted to not tax the rich, over, and over, and over, and over. The tax cuts for the rich are the entire national debt.

But you are told not to ever look at the tax cuts for the rich - that the massive debt can only be solved by cutting spending - spending that goes for the benefit of the American people.

I could write with numbers showing you the issue, but let's just look at the historical facts for examples. Reagan began this disaster, tripling our national debt, intentionally causing the debt. Bill Clinton increased taxes on the rich - without one Republican vote - and cut the deficit all eight years, until we had a budget surplus, the equivalent of reducing the wife's spending. It shows the issue clearly.

Oligarchy is a disaster. It reduces growth and total wealth, and greatly increases poverty; it gives the wealthy at the top bigger slices of a smaller pie. It's also incompatible with democracy, as Louis Brandeis noted over a century ago ("Society can have great concentration of wealth, of democracy, but not both.")

The view you have is very compelling, because it makes you fixate on the idea, a country can't spend too much, just as you can't buy a yacht you can't afford.

But the issue isn't the US spending too much or buying a yacht - rather the spending is not only things the American people deserve, but spending that is important for the national good, whether helping create wealth, like protecting the environment or investing in research and so on, or important for the good of the people, including humanitarian spending.

Cutting that spending causes a lot of harm to the country. But if we couldn't afford it, we'd need to make cuts. But that's where you get it wrong. "If" we couldn't afford it. We can.

You're ignoring the billionaires skyrocketing in wealth siphoned from the country, at all-time highs, like the wife with more yachts than ever. That is the only right solution to our debt.

Listen. Since Reagan, more than *$50 trillion* has been redistributed from the American people to the rich primarily by the tax cuts. The national debt has exploded to nearly $40 trillion. See the relation?

There is a propaganda industry that tries to bamboozle you to proudly be "patriotic" by being "against debt" with a tunnel vision only on cutting spending as the solution.

The success of that propaganda is causing our national oligarchy and debt crisis, as the people who fall for the propaganda demand the business cut the spending that allows it to function and profit.

What would it take to get these patriotic enemies of debt to overcome their brainwashing to always oppose taxes, and recognize the solution that doesn't ruin the country and bring more oligarchy?

This post tries to get you started. Are you able to break out of the brainwashing to never look at taxing the rich? This is a post competing with decades of massive propaganda and brainwashing. Did it get through?

Sorry to put this bluntly, but I think that view is very wrong and ignorant. A question is whether you can hear my argument, or not.

Please read this slowly and consider the topic. Normally people with your views are 'locked in' and have a hard time, it seems. They're locked into the idea 'the only issue with the debt is spending too much'.

I understand why that is compelling. The debt IS a crisis for the country - an intended one by Republicans, but that's a longer topic, but it's about "starve the beast". That can make a person passionate about wanting to 'fix' the debt.

But I suspect you are blind to the actual problem and cause: undertaxing the wealthy. That's pushed on you more by using the idea of 'wasteful governemnt spending' with this and that example to keep you locked in on the spending.

Let me try a crude analogy. There is a business, which has enough sales to be very profitable. But the owner has a wife who spends wildly on her own enjoyment - mansions, yachts, jets - more than the company makes.

The owner preaches the value of 'fiscal conservatism', and decries the threat of the debt the business faces, and says the debt leave him no choice but to slash the number of stores, salaries, the marketing budget - any spending that actually strengthens the business. The cuts cause the business to do worse and worse, but he never looks at his wife's spending.

That's our situation. The US can have a very successful economy, but our politics have been corrupted to not tax the rich, over, and over, and over, and over. The tax cuts for the rich are the entire national debt.

But you are told not to ever look at the tax cuts for the rich - that the massive debt can only be solved by cutting spending - spending that goes for the benefit of the American people.

I could write with numbers showing you the issue, but let's just look at the historical facts for examples. Reagan began this disaster, tripling our national debt, intentionally causing the debt. Bill Clinton increased taxes on the rich - without one Republican vote - and cut the deficit all eight years, until we had a budget surplus, the equivalent of reducing the wife's spending. It shows the issue clearly.

Oligarchy is a disaster. It reduces growth and total wealth, and greatly increases poverty; it gives the wealthy at the top bigger slices of a smaller pie. It's also incompatible with democracy, as Louis Brandeis noted over a century ago ("Society can have great concentration of wealth, of democracy, but not both.")

The view you have is very compelling, because it makes you fixate on the idea, a country can't spend too much, just as you can't buy a yacht you can't afford.

But the issue isn't the US spending too much or buying a yacht - rather the spending is not only things the American people deserve, but spending that is important for the national good, whether helping create wealth, like protecting the environment or investing in research and so on, or important for the good of the people, including humanitarian spending.

Cutting that spending causes a lot of harm to the country. But if we couldn't afford it, we'd need to make cuts. But that's where you get it wrong. "If" we couldn't afford it. We can.

You're ignoring the billionaires skyrocketing in wealth siphoned from the country, at all-time highs, like the wife with more yachts than ever. That is the only right solution to our debt.

Listen. Since Reagan, more than *$50 trillion* has been redistributed from the American people to the rich primarily by the tax cuts. The national debt has exploded to nearly $40 trillion. See the relation?

There is a propaganda industry that tries to bamboozle you to proudly be "patriotic" by being "against debt" with a tunnel vision only on cutting spending as the solution.

The success of that propaganda is causing our national oligarchy and debt crisis, as the people who fall for the propaganda demand the business cut the spending that allows it to function and profit.

What would it take to get these patriotic enemies of debt to overcome their brainwashing to always oppose taxes, and recognize the solution that doesn't ruin the country and bring more oligarchy?

This post tries to get you started. Are you able to break out of the brainwashing to never look at taxing the rich? This is a post competing with decades of massive propaganda and brainwashing. Did it get through?