- Joined

- Feb 22, 2019

- Messages

- 44,458

- Reaction score

- 31,717

- Location

- The Bay

- Gender

- Male

- Political Leaning

- Progressive

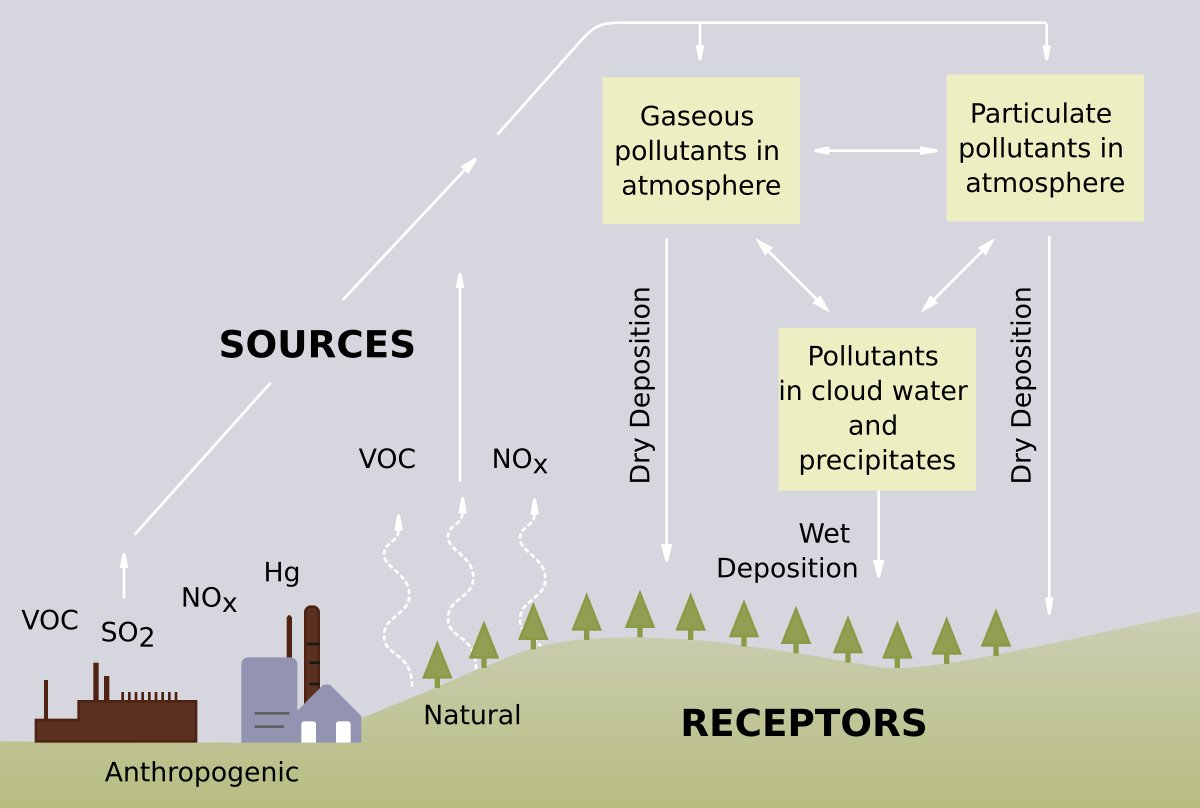

What is the fundamental factor that determines price in America? Supply and demand.Energy prices, petrol, rent and food: What’s driving the UK’s cost of living crisis?

Energy prices, petrol, rent and food: What’s driving the UK’s cost of living crisis?

A complex problem of supply and demand is rapidly driving up the cost of living in the UK.www.newstatesman.com

China's factory inflation hits 13-year high as materials costs soar

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GCFA7FBV6ZJXTIHADDJEEMNXDA.jpg)

China's factory inflation hits 13-year high as materials costs soar

China's factory gate inflation hit a 13-year high in August driven by roaring raw materials prices despite Beijing's attempts to cool them, putting more pressure on manufacturers in the world's second-largest economy.www.reuters.com

'Power outages in China may add to global inflation'

Coal, gas prices skyrocketed since government implemented new environmental standards for power generation, says analyst

'Power outages in China may add to global inflation' - Timeturk Haber

Coal, gas prices skyrocketed since government implemented new environmental standards for power generation, says analystwww.timeturk.com

What Is the Current US Inflation Rate?

BY

KIMBERLY AMADEO

Updated September 15, 2021

REVIEWED BY

MARGUERITA CHENG

The U.S. inflation rate as of August 2021 was 5.3% compared to a year earlier. That means consumer prices increased by 5.3% over a year. The inflation rate is an important economic indicator because it tells you how quickly prices are changing. It's measured by the Consumer Price Index (CPI), reported by the Bureau of Labor Statistics (BLS) each month. https://www.thebalance.com/current-u-s-inflation-rate-statistics-and-news-3306139

Okay, So, any of this related to covid?? Sorta, but not as of late. Faulty leadership is to blame. The UK is the 5th largest economy, China is number 2, and we know what the US standing is. So, given the global economic indicators, do we really want to keep borrowing and driving up the debt?? Thanks!!

Supply is messed up. Factories shut or producing less, transportation chains jumbled.

Demand is very high. People have restrained purchases for over a year, and during that year, relief checks have been sent to huge amounts to consumers.

Is there inflation now? Absolutely.

Is much of it transitory? I believe so.