- Joined

- Aug 10, 2013

- Messages

- 20,181

- Reaction score

- 21,525

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

Bloomberg had a good article over the weekend on a couple trends that are starting to intersect.

The first isn't new: independent physicians and practices have been disappearing for a long time as they willingly get absorbed into larger, hospital-led health systems (Hospital Acquisitions of Physician Practices Continue]). For the larger systems, those practices are an important source of patients and market share. For the formerly independent practices, giving up their autonomy can give them access to higher prices, more resources and capital, and some stability.

The other is the fallout from COVID: health care, which is usually about as recession-proof as an industry gets, was slammed last year (Health-Care Workers See Steep Job Losses From Coronavirus), particularly primary care practices (Primary-care practices fear they may not survive the pandemic). There's lots of expectation, or fear, that these pressures will accelerate the first trend, sending what remains of the nation's independent practices into the arms of well heeled buyers.

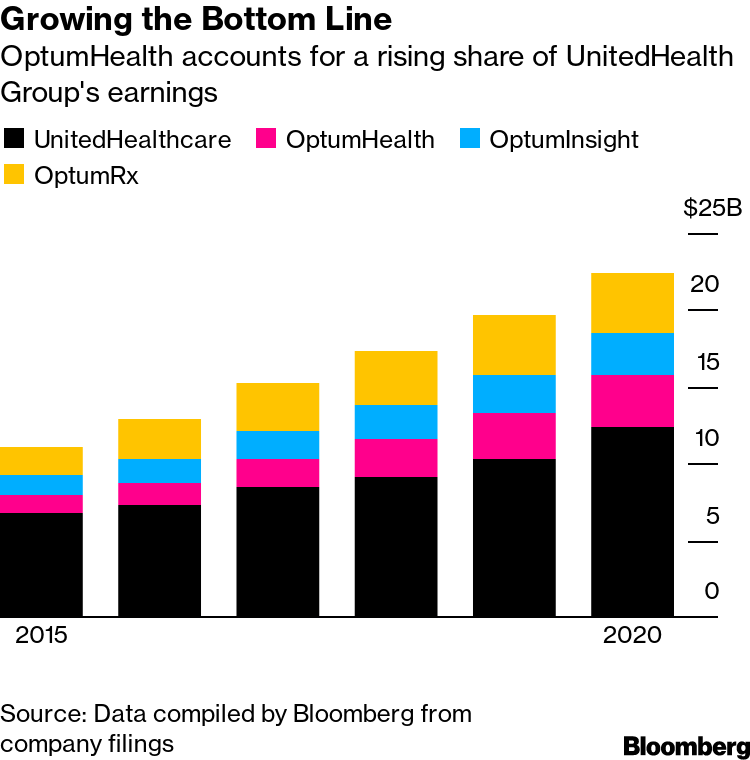

But big hospital-led health systems aren't the only potential buyers. UnitedHealth Group, which of course owns the nation's largest health insurer, has a health care delivery arm, OptumHealth. As a sign of things to come, it announced recently that it will acquire the largest independent physician group in Massachusetts. Those 700 docs are a drop in the bucket of the 10,000 that Optum intends to add nationwide this year. As the article notes, United already has more doctors than the largest health systems in the country--over 5% of American physicians, even before this year's plan to expand by 20%.

UnitedHealth Chases 10,000 More Doctors for Biggest U.S. Network

The first isn't new: independent physicians and practices have been disappearing for a long time as they willingly get absorbed into larger, hospital-led health systems (Hospital Acquisitions of Physician Practices Continue]). For the larger systems, those practices are an important source of patients and market share. For the formerly independent practices, giving up their autonomy can give them access to higher prices, more resources and capital, and some stability.

The other is the fallout from COVID: health care, which is usually about as recession-proof as an industry gets, was slammed last year (Health-Care Workers See Steep Job Losses From Coronavirus), particularly primary care practices (Primary-care practices fear they may not survive the pandemic). There's lots of expectation, or fear, that these pressures will accelerate the first trend, sending what remains of the nation's independent practices into the arms of well heeled buyers.

But big hospital-led health systems aren't the only potential buyers. UnitedHealth Group, which of course owns the nation's largest health insurer, has a health care delivery arm, OptumHealth. As a sign of things to come, it announced recently that it will acquire the largest independent physician group in Massachusetts. Those 700 docs are a drop in the bucket of the 10,000 that Optum intends to add nationwide this year. As the article notes, United already has more doctors than the largest health systems in the country--over 5% of American physicians, even before this year's plan to expand by 20%.

UnitedHealth Chases 10,000 More Doctors for Biggest U.S. Network

Atrius Health, the largest independent doctors’ group in Massachusetts, faced financial trouble heading into 2020. Covid-19 made it worse. . .Independent doctors were in decline before Covid, as high administrative costs and weak negotiating leverage favored tie-ups with big health systems. Then, the pandemic pushed up expenses for protective gear and dented revenue as patient visits dropped off. The combination could steer more practices into the arms of deep-pocketed suitors. Physician practices that need capital often find big hospital systems to be eager buyers, and Boston has plenty. Atrius, though, has agreed to be acquired by another health-care powerhouse: UnitedHealth Group Inc.’s OptumHealth unit.

The health-care conglomerate that owns the biggest U.S. medical insurer, UnitedHealthcare, has assembled one of the country’s largest collections of doctors -- more than 53,000, or about 5% of U.S. physicians. UnitedHealth wants to add at least 10,000 this year, and if regulators clear the proposed deal, Atrius’s 700 doctors and primary-care providers will be among them.

Across the industry, insurers are expanding their reach into care delivery. Cigna Corp. recently agreed to purchase telemedicine provider MDLive. Humana Corp. bought a South Florida physician network this week in its latest expansion of primary care. CVS Health Corp., which acquired insurer Aetna in 2018, is adding hundreds of HealthHUB clinics at retail stores.

Yet more than any of its rivals, UnitedHealth has bet on owning medical providers, including outpatient surgery centers, urgent care clinics and primary care practices that span 44 states. UnitedHealth says it’s essential to the company’s mission to create a “next generation health system” that offers better care at lower costs.