- Joined

- Mar 22, 2021

- Messages

- 3,508

- Reaction score

- 1,635

- Gender

- Male

- Political Leaning

- Independent

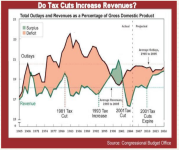

Have a source for that?federal reserve was worried that America was on track to pay off the 5.7 trillion dollar federal debt.

I mean I remember reading once that there was a worry when the budget was balanced under Clinton and Speaker Gingrich that there may not be any bonds to issue, and no one really knew what would happen.

Anyways, Clinton and Gingrich did mange to strike a deal that did in fact reduce the deficit, but the debt still grew every year under them.

No shrinkage fund was ever established, and we never retired any debt, we just rolled it over and added to it.