- Joined

- Dec 3, 2009

- Messages

- 52,009

- Reaction score

- 33,944

- Location

- The Golden State

- Gender

- Male

- Political Leaning

- Independent

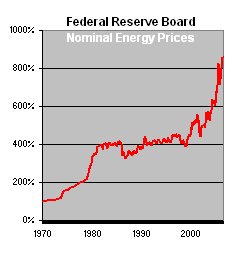

he's talking about (among other things) the speed that money shuttles around the economy. how fast does someone who get's paid 5$ spend that 5$ on a happy meal, and how fast does that restaraunt then pay it to an employee who then uses it to purchase a watermelon, and so on and so forth; the more the same money get's spent within a given time period (the equation goes) the higher the inflation. think of it as a helocopter (an apt analogy, hah); the more you shoot gas into the engine, the faster the rotor spins, and the higher the helocopter goes. the problem, of course, is that just as gas is not the only factor in how fast a helocopter goes up (air pressure, temperature, etc), that formula might not capture the full story of inflation

what's happening now is that the people looking out the windows are saying "hey, the helocopter is flying much higher much faster" and people like Goldenboy are saying "no no no, despite the fact that we're pouring on the gas; the rotor isn't spinning any faster", and the people looking out the window are saying "but we're still going higher", and the deflation hawks are saying "no, the rotor still isn't spinning faster".

so who are you going to believe; the perfect all-things-being-equal world of the formula? or your lying eyes?

I'll go with my lying eyes. I looked at the link to scientific looking formulas used in economics. They looked to me as if someone were trying to make economics out to be hard science, like physics or chemistry, when it is in fact more akin to meteorology.