- Joined

- Sep 11, 2021

- Messages

- 18,826

- Reaction score

- 11,571

- Gender

- Undisclosed

- Political Leaning

- Very Liberal

The December 2022 inflation figures came out four days ago. For some reason there's no thread about this?

FRED!

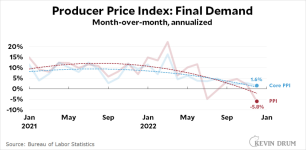

Some people who want to make inflation seem as bad as possible, like to compare current CPI to one year ago. But this has a lag of ONE YEAR in showing when inflation is really turning around.

If the trend of the last two months was to continue, then by Jun we would have year-on-year deflation of 0.8%

I'm assured that deflation is actually worse than inflation. Something about suppressing investment, or money hoarding. So is the latest month-on-month result a warning that we should stop increasing official interest rates? Or maybe even bring them back down?

FRED!

Some people who want to make inflation seem as bad as possible, like to compare current CPI to one year ago. But this has a lag of ONE YEAR in showing when inflation is really turning around.

If the trend of the last two months was to continue, then by Jun we would have year-on-year deflation of 0.8%

I'm assured that deflation is actually worse than inflation. Something about suppressing investment, or money hoarding. So is the latest month-on-month result a warning that we should stop increasing official interest rates? Or maybe even bring them back down?