A balanced and sensible update , imho , from Yaron Brook . BHZ Capital .

I am perhaps biased because I am involved in Commodities Trading and see a fantastic prices spurt before the year end . From his stated reasons I have been inclined to see hyper inflation in the ghastly short term move to a possible full scale depression

YB is not as negative . Perhaps I am too pessimistic . Huge correction but just painful inflation but not the hyper type !

I am even playing with coffee presently because of the wicked frosts in Brazil earlier in the week but that is more short term speculation than trading .

Kitco News

The U.S. is headed for bankruptcy and economic decline, and the best way to protect your wealth is with gold, said Yaron Brook, managing partner of BHZ Capital.

Brook is the best-selling author of several books, including “Free Market Revolution: How Ayn Rand's Ideas Can End Big Government”. He is the chairman of the board at the Ayn Rand Institute and is host of the Yaron Brook Show.

Speaking with Michelle Makori, editor-in-chief of Kitco News, on the sidelines of the Freedom Fest 2021 conference, Brook said the government is “destructive” and is responsible for the economic troubles the U.S. finds itself in.

“COVID has shown us that the American people are willing to behave like sheep when the government dictates what they should and shouldn’t do. Also, the government is willing to take on massive powers,” he said. “We’re seeing the government move systematically towards bankruptcy. Who’s going to pay this debt?”

This high level of debt is almost impossible to be paid off now, Brook added.

“We are approaching levels of debt we saw in World War Two, but in World War Two, right after the war, we ran surpluses, so we paid it all back. Nobody’s going to run a surplus today. Politically, it’s impossible,” he said.

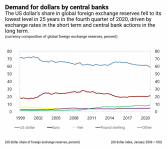

The more immediate consequence of high debt and government policies, including fiscal and monetary policies, is high inflation with no growth, or stagflation. However, the economy won’t reach hyperinflation territory, Brook said.

“[Hyperinflation] is quite unlikely because we know how to deal with inflation, we know how to stop it, it’s just very, very painful. I think what we’re really in for is a very long period of stagnation, maybe combined with inflation, maybe now. One thing we’re not going to see is significant economic growth,” he said.

Brook added, “I just don’t see good things happening in the U.S. economy. You’ve got massive malinvestment, you’ve got money flowing to the wrong things.”

The solution, according to Brook, is to reduce government intervention and abolish the Federal Reserve.

For the investor, assets to avoid in a stagflation scenario are risk assets like equities and long-term bonds. In fact, bonds will “get crushed”, he said.

“You want to be in something like gold, because gold actually maintains its value. It's on an investment as much as it is a store of value,” he said.