- Joined

- Dec 4, 2013

- Messages

- 36,623

- Reaction score

- 35,642

- Gender

- Male

- Political Leaning

- Liberal

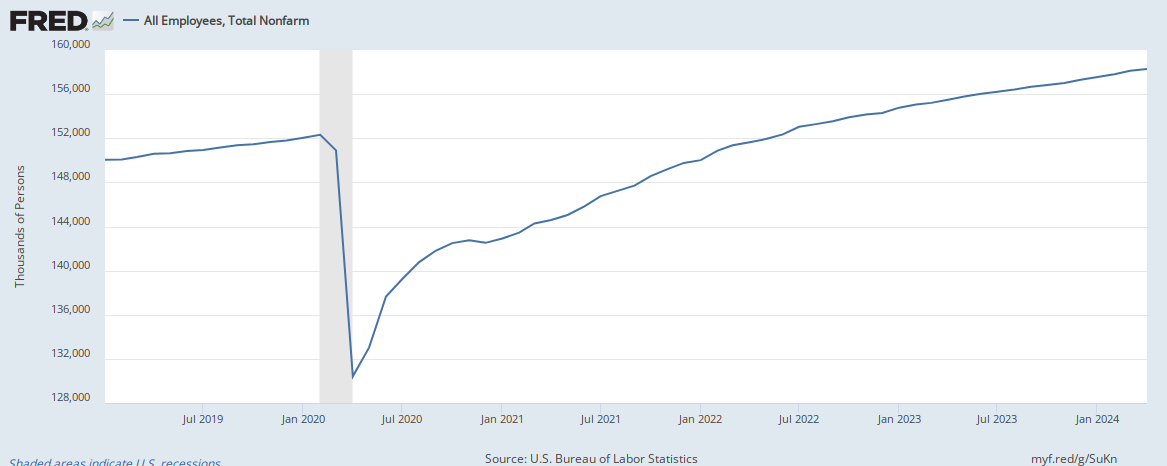

U.S. Job Growth Unexpectedly Soared in July

(I made this so you shouldn't hit a pay wall)The employment gains, which far surpassed expectations, show that the labor market is not slowing despite efforts by the Federal Reserve to cool the economy.

...

U.S. employers added 528,000 jobs in July, the Labor Department said on Friday, an unexpectedly strong gain that shows the labor market is withstanding the economic impact of higher interest rates, at least so far.

The impressive performance — which brings the total employment back to its level of February 2020, just before the pandemic lockdowns — provides new evidence that the United States has not entered a recession.

=========

I guess bringing employment back to pre-pandemic levels takes the wind out of the windbags complaining 'Biden hasn't brought back jobs to pre-pandemic numbers.' Yes, he has.

It also undercuts the argument that the economy is in a recession. In a recession, unemployment rises. What we had was two quarters of GDP decline (compared to last year) with brisk employment gains. Obviously, those GDP declines were from something other than consumer purchases. Maybe those GDP declines were due to government spending declines?

Last edited: