....yes, and that is normally termed GDI. We've been talking GDP, whose official numbers use the expense method. What's your point?

I stated GDP because I meant GDP; although I would suppose that statement’s applicable to all creditable methods of calculating GDP or GDI.

/////////////////////

Posted 7:38 PM by Supposn:

Visbek, just to be clear, GDP accounted for by the income method or the expenditure method reflects the entire costs that contributed to the nation’s production of goods and service products. But costs that are not reflected within the prices of globally traded goods or service products will not be attributed to global trade.

To that extent a nation’s imports, exports and net balances of trade are somewhat understated.

....GDI also includes exports and imports. Neither method understates them.

If a statistic item is dependent upon the prices of globally traded products and the entire costs of goods and services that supported the production of the globally traded product are not reflected within the prices of any globally traded products, then it was not possible to attribute those production supporting goods and services to global trade.

If you can conceive as to how that it could ever be otherwise, please explain it to all of us.

//////////////////////////

Posted 7:38 PM by Supposn:

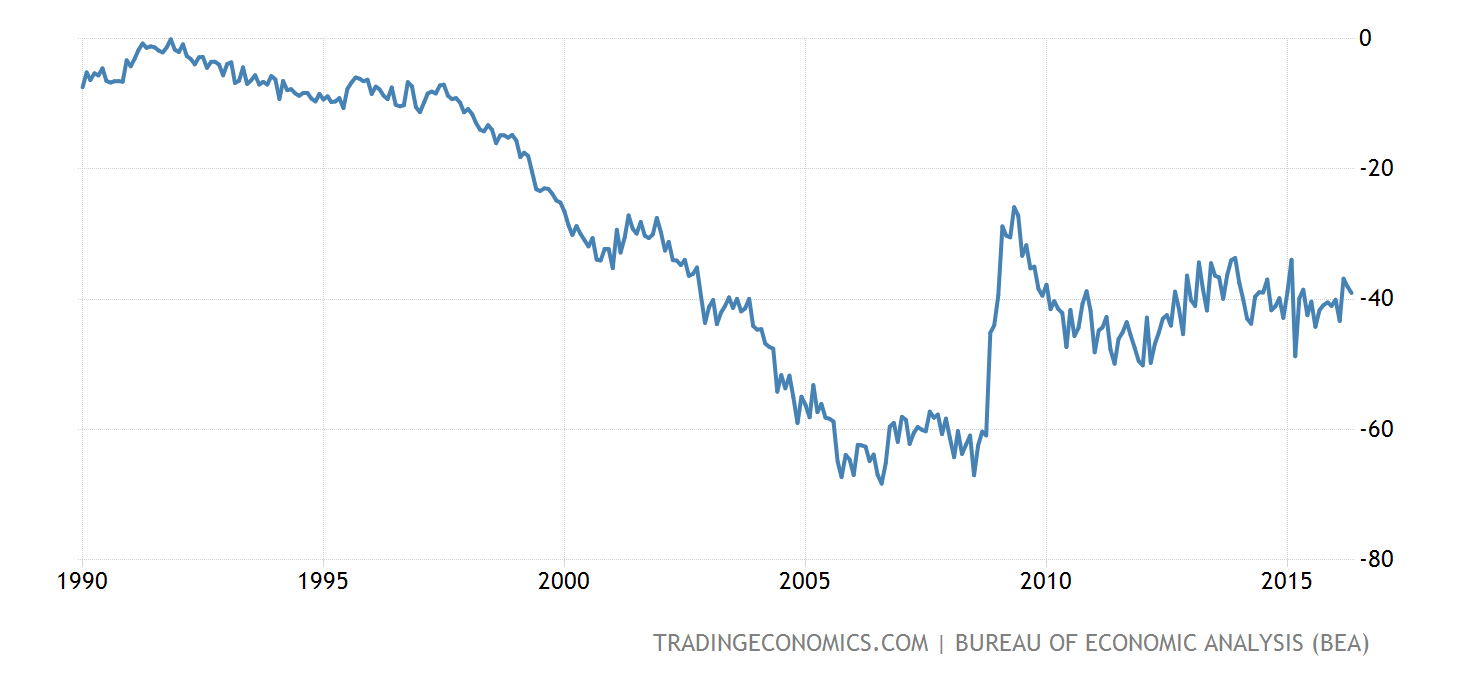

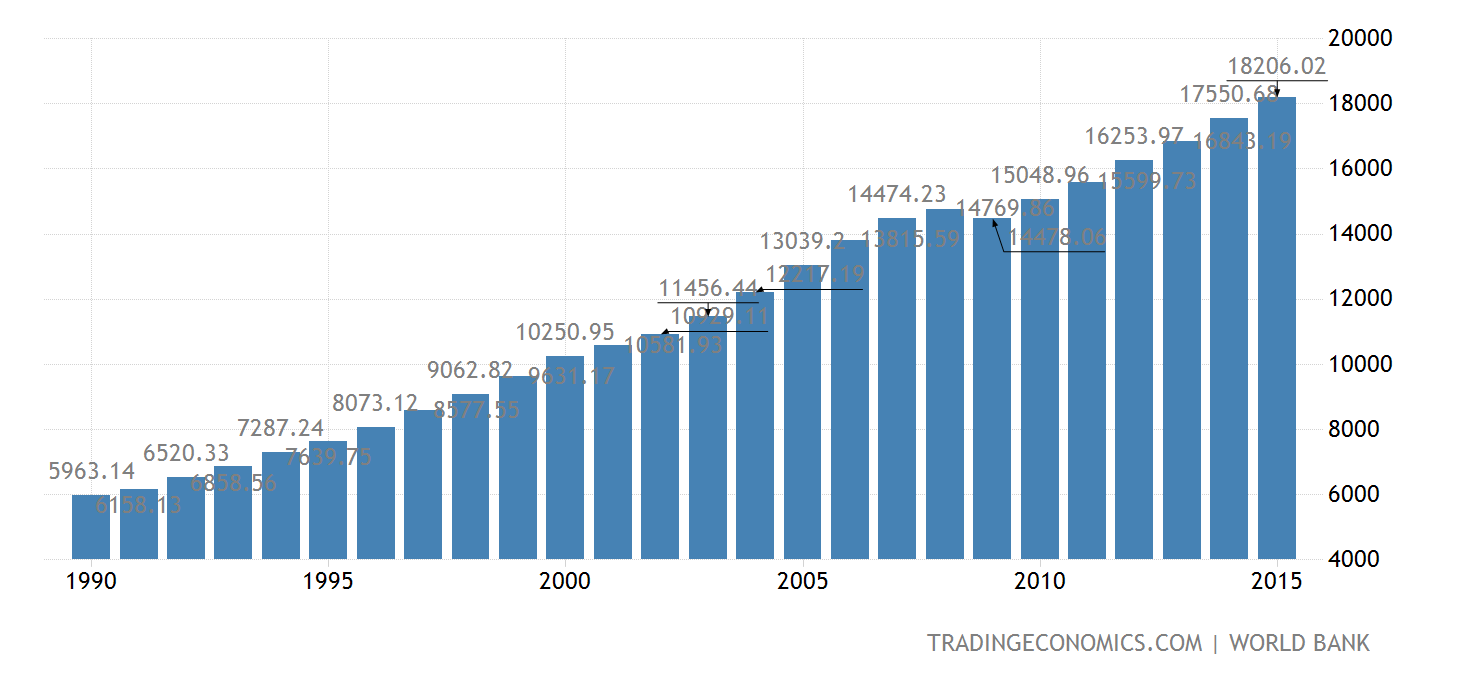

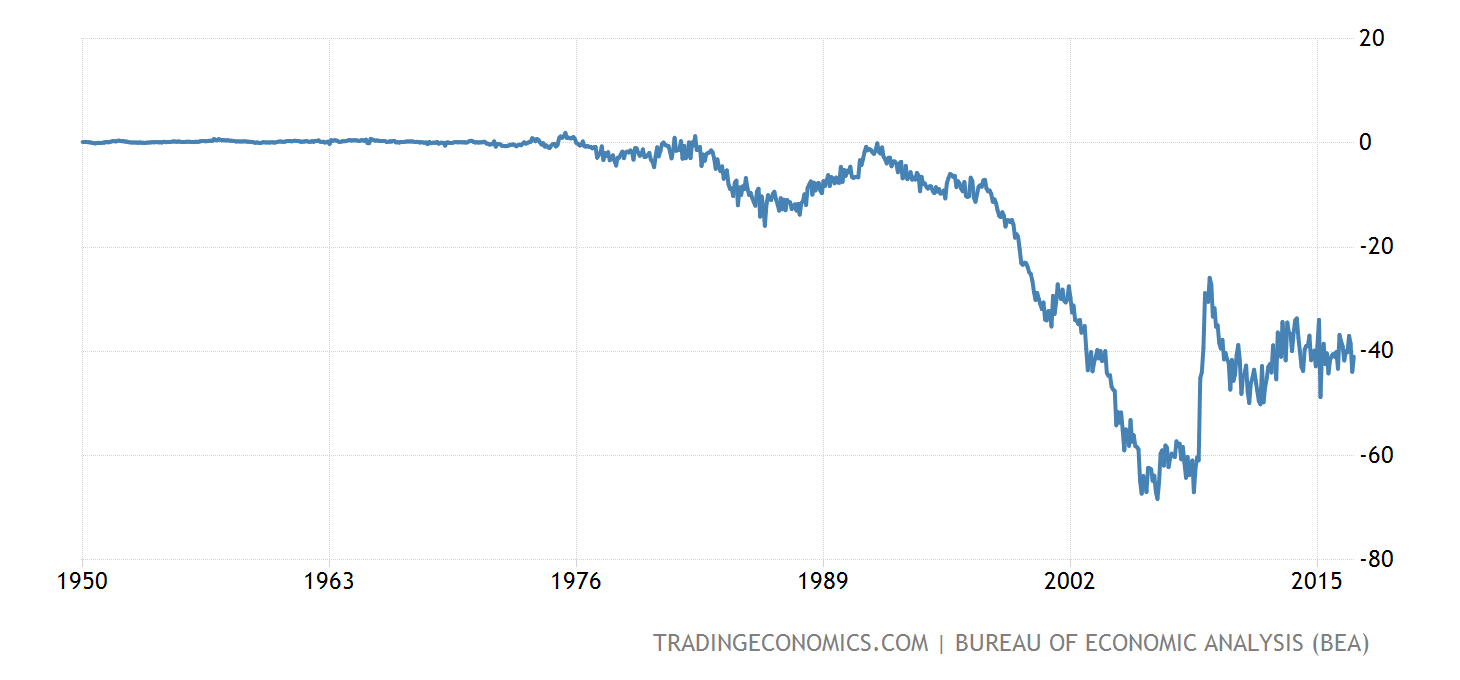

Regardless of a nation’s economic condition, due to a nation’s annual trade surplus, a nation’s GDP is greater than otherwise; (otherwise being if the nation had not experienced a trade surplus).

Similarly due to a nation’s annual trade deficit, a nation’s GDP is less than otherwise; (otherwise being if the nation had not experienced a trade deficit).

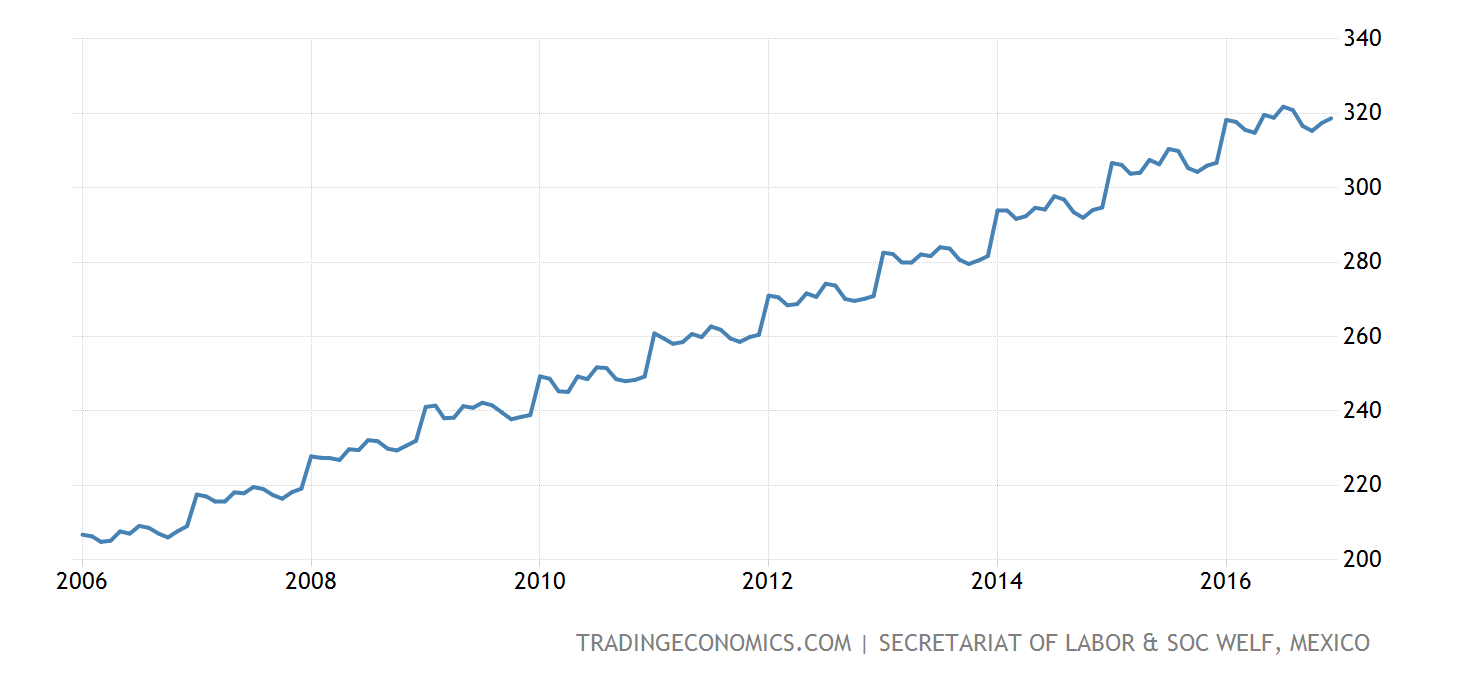

Trade deficit are always an immediate drag upon their nation’s GDP. Anything that’s a drag upon their nation’s GDP is also a drag upon their numbers of jobs and anything that’s a drag upon their nation’s numbers of jobs promotes unemployment and lesser wages’ purchasing powers.

....I assure you, I'm reading and comprehending what you're saying. It's pretty obvious that several people in this thread are trying to say that GDP will fall when trade deficits increase. And while Ex and Im are parts of GDP/GDI, the total does not correlate specifically to the trade balance (see posts above).

Visbek, you quoted me correctly. You simply misunderstand what you’re reading. I did not write that trade deficits will cause GDP to fall. I wrote, “Similarly due to a nation’s annual trade deficit, a nation’s GDP is less than otherwise; (otherwise being if the nation had not experienced a trade deficit)”.

I also stated “I’m unaware of anyone asserting that trade balances alone determine the rise or fall of the nation’s GDP, or that changes of a nation’s annual balance of trade and changes of their GDP retain some proportional relationships. If you have mistaken what others have written, that’s due to your own misunderstandings”.

If you should come across any post where I inadvertently wrote otherwise, please bring it to my attention. If I made an error, I want to correct it. Have you found any such instances inadvertent error?

Respectfully, Supposn