JP Hochbaum

DP Veteran

- Joined

- Feb 7, 2012

- Messages

- 4,456

- Reaction score

- 2,549

- Gender

- Male

- Political Leaning

- Independent

I think I am gonna like this csbrown guy, already hitting hard!

But by placing certain restrictions on "mega corporations", or maybe even busting them up with anti-trust laws or whatnot, we are guiding and shaping our transition into the next economy, whatever it may happen to look like. There are also steps we can take to reduce "lazy lower classes".

I believe that we actually have almost full control of our futures, our world economy can look however we chose it to look, pretty much just like a painter can make a painting look however he/she wants it to look, given enough skill and effort and hard work of course.

What was human nature up to the point that the Constitution was written? I mean the idea that certain rights weren't granted to you by anyone and therefore couldn't be taken away. The Constitution helped shape the evolution of human society. Not because it was True, but because it created an idea, a concept that enough people believed and still believe. The reality is that your belief in the idea of inalienable rights is meaningless in a culture that doesn't share your values. I don't think the Constitution is True, I think that it is the best practical framework for society to this point. So in that sense, I support it, and want it to be true.

So respectfully I will disagree, I think you can shape the human social evolution through the practical application and management of incentives. What I see now is an incentive system that, is harming the people that belong to the societies that should be promoting the health of the greatest number of people. I'm not advocating "socialism", or dragging the wealthy out into the streets so we can blame them for being wealthy. I'm just saying that I'm open to systems of incentives that make for a healthier society that more people benefit from, while at the same time remembering that we live in a world of competing societies.

I'm just curious, did I say that? I think the OP looks at the effect of a specific cause. Too much money is moving into the hands of too few people and the practical implications of the system that we now exist within. I'm not making a judgement of the people that are profiting from the system simply because they can. If I could I would, I'm not a hypocrite, however, I can make judgements of the individuals based on their actions. I'd like to think that I would advocate the same positions I advocate now, even if I had billions of dollars.

Let’s address your claim…..

If it hadn't gone to the top 1%, we would have massive inflation. The 1% can only trickle, not flood. Therefore, the 1% has saved us from complete disruption.

Let’s start with a few basics:

First, inflation is a value that is determined relative to other values before the results can be quantified.

Some of the values that must be known before you can determine the effect of inflation:

- Prices

- Wages

- Quantity of money

It also helps to know productive capacity and unemployment in some cases as well.

There are lots more things that effect inflation, but to keep it simple I’ll start with these.

Some kinds of inflation cause prices to rise and aggregate demand to fall, called cost-push inflation, other kinds of inflation cause prices to rise and cause aggregate demand to rise, called demand pull inflation.

Prices rising, generally speaking is a bad thing, but if prices rising are followed by increases in aggregate demand, then GDP rises it can, under specific circumstances, be a good thing. If demand pushes prices higher and there is labor and productive capacity available to meet that demand, then it is a good thing, because it puts people back to work and factories can utilize equipment that has(already) been purchased but is sitting idle. This is called demand-pull inflation.

View attachment 67151252

If you look at the chart above, you’ll note that from P to P1 indicates an increase in the price level accompanied by an increase in rGDP from Y to Y1.

This is possible because an increase in disposable income was made available somewhere in the economy. It can be falling taxes, it can be increased wages, it can be changes in import/ export levels, but the point is, this can be a good thing if the country has excessive unused productive capacity, both in labor and equipment.

In the case of a higher minimum wage, though prices may rise (as indicated on the chart) so will demand which in turn will cause increases in supply. This is possible in the current economy because unemployment is high (historically speaking), there is an excess of labor available and since we are still recovering from the great recession, there is also an excess of equipment that is unused and is able to meet the excess demand.

If you had a trucking company and 20% of your trucks were parked unused, you are paying for the trucks, but they aren’t producing. If demand rises and is followed by an increase in supply, then the need for transportation rises. As the owner of a company, you hire more people (decreasing unemployment) and put your idle trucks to use.

This is a win-win and what would happen in our current climate if minimum wage was increased.

In the case of cost-push inflation. This is triggered by higher prices in the economy. Perhaps there is an oil shortage, food prices soar, there is a huge recession triggered by a housing bubble that causes high rates of unemployment. This would cause prices to rise, but because, in this case, inflation has impacted the amount of extra money a family has after the bills are paid, people have less money to spend. This causes a decrease in aggregate demand. This puts people out of work and the cycle continues until things come back into equilibrium.

View attachment 67151253

Note the difference in this chart. Prices have risen, but unlike demand pull inflation, increasing prices have caused a decrease in aggregate demand resulting in reduced GDP.

The wealthy have been extracting wealth from the productive economy and moving to the top 1%. Now to fully understand what I’m talking about, I offer the following…..

View attachment 67151254

This chart represents what people think the income distribution is, what they think it should be and what it really is.

The top bar shows just how distorted people’s perceptions are and how messed up our economy is….

Shown another way…..

View attachment 67151255

This graph shows in more detail the disparity. The little guy in black at the end, he represents the 1%. The 1%b control 40% of all the wealth and earn 25% of all the income (including capital gains). They are 3.1 million people (out of 311 million). His line is so tall it has to be shown in 10 rows that’s 9 times higher than those in the 99%.

They have increased their share of the wealth since the early 70’s by almost 100% and their share of the income by almost 200%.

Think about that, they have extracted wealth from the 99% below them, with much of it coming from the bottom 2/3rds.

They aren't “preventing inflation”, they have caused selective deflation with the majority of the country feeling the effects.

Moving some of this money into the lower quintiles of the economy would indeed cause some inflation, but it would be productive inflation as it would put people back to work, it would increase salaries at all levels because as people are hired the labor pool shrinks, there is more competition on the parts of companies to hire the most qualified people.

Agreed.The problem isn't with just the amount of available money or credit but the ability to distribute it more evenly within society thru a sustainable growth pattern. There has been a shift in production to overseas and technology replacing jobs.

We can't keep increasing the population and immigration, while depleting the employment base.

We need a revamped economic model to balance the financial system with the emerging, labor replacing technologies and limited natural resources.

It's a multifaceted cultural situation, not merely an economic equation that can be solved.

You misinterpreted my meaning. I was trying to say the world is going to evolve no matter what but that people wanting to be wealthy is not going to change suddenly. Throughout history the level of greed has ebbed and flowed but it's never been eradicated.

I never accused you of anything. I made a statement that the problems we face can't be fixed by placing blame alone. Identify the problems, then approach them with rational solutions. The masses can try and make governments and corporations stop hoarding the wealth but it won't happen quickly or easily. We're not that far off in our opinions.

Government is not a household!

Why are you using words like extraction? Why not call it what it technically is? Earnings?

Do you really think the rural person in east-jesus should magically be earning as much as a New York broker?

The one thing that is not an assumption though is that when government forced citizens to do something against their will, it's a violation of their individual liberty.

If economics is largely as partisan as everything else, all finger pointing and based on such and such a premise, none of which is a hard science, then at the end of the day you better err on the side of non-interference because it's individuals expressing freedom. To take that away through law or tax or otherwise, is NOT an assumption, it's a clear negative for the person experiencing it.

Yes please, let's address this concept.

Do those at the top "earn" their wealth?

Looking at the definition of "earn" still leaves a lot of room for interpretation...

Earn: to receive as return for effort and especially for work done or services rendered.

The key work here is effort;

Effort: A vigorous or determined attempt.

So by definition, so far, a bank robber who carefully plans to break into a vault has earned the money he stole, because he has "done work" in a "vigorous and determined" way.

Now I'm not trying to be derisive, I'd just like to know what it means to "earn" something....

Perhaps you want to point out that bank robbery is theft, and no matter how hard you work, it can't be considered "earned".....Ok I'll go with that.....

When a CEO "earns" 380 times more than the average employee the the company he works for. Is he doing 380 times more work? Was it not possible to find someone who would accept 200 times the pay of the average worker to do the same job and be equally effective? What about 100 times the pay of the average worker? Would you say he "earned" his pay if the company was performing poorly? Would you say that a CEO earns his pay when he keeps costs low by hiring people a the lowest possible wage possible while paying as little benefit as possible? Do you think that a CEO and how much he makes has anything to do with the success of the employees that work for his company?

Now in the case of CEO's it would make perfect sense, if these salaries were tied to the performance of a particular company and the success not only of the products and services, but the employees, similar to the way that athletes make hundreds of millions of dollars to perform, much of their salaries tied to performance. But unlike an athlete who is let go faster than the average person can blink if they get hurt or fail to perform, we know of the stories where CEO's are given huge bonuses even when their companies fail. Were those bonuses earned?

What about someone who inherits their money, did they "earn" it? :think:

What about the hedge fund manager who literally manipulates a market in order to increase the profit on his clients portfolio's? Did he or his clients "earn" it? What if what he did was, technically not illegal? Does that make any difference? What if the profit came from the kind of people who are depending on their investments to get them through their retirement? Do you make a distinction between the hedge fund manager that legally manipulates a market to increase profit and the bank robber? (Jim Cramer Explains How The Stock Market Is Manipulated - YouTube)

What about naked shoring of a stock to the point that the companies shares are inflated to oblivion and the company goes out of business? Is the money earned, actually considered earned?

At my job if your in the right circles and you know the right people, there are certain positions you can get appointed to where the sales are guaranteed. Specifically with certain government contracts. Do those sales people "earn" their money?

What about putting together a huge marketing campaign to sell a product that is worth little to nothing and sell it for $20 (do you remember this? kinoki advertisement - YouTube). Did the investment group that backed this bogus product "earn" it's money?

What about a banks (most of them) that within the last 10 years or so, have decided to take the checks you write from largest to smallest. That way if you bounce a check, they can increase their fee revenue. Is that money earned? Did the bank provide a service or is it just maximizing profits?

What about holding deposit checks for 5 days (hoping that you'll spend the money before the bank credits your account), when on the other end, the bank knows down to the second that you wrote a check minutes or hours before a deposit to cover it went in? You want me to believe that they can't tell instantly if a check for deposit has funds to back it up? Are the fee's earned in this way, actually "earned"?

There are "instruments" that the ultra wealthy can use to make money, often without returning a service of equal value. Is this moral or ethical? Is money made with fore-knowledge that the product isn't worth what it returns in goods or service,

Now not that all these examples are absolutes, but I assert that much of the money that the lower, and middle class spend is extracted though systems that are designed to maximize profits without delivering an amount of a good or a service of comparable value considered, by your definition "earned"?

So when I say "extract" wealth, that's what I'm talking about. These are just a few of the millions of schemes that enormous wealth and resources can deploy to move money from the bottom of society to the top.

Am I alleging that all money at the top is made this way? Absolutely not, I'm certain that most very wealthy people that operate ethically, but it takes only one Bernie Madoff to defraud tens of thousands of people of hundreds of thousands if not millions of dollars each, and I think there are thousands if not tens of thousands of Bernie Madoff's running around and the money they extract makes a real difference in the lives of everyday people. While some of what's done is illegal, the money made by the Madoff's of the world has the power to make people turn the other way. I suspect that Madoff was only caught because his narcissism had reach tyrannical proportions.

The question of profit has, as a cultural ideal, been placed ahead of questions about ethics and morals.

No.....

I would settle for a system that made a reasonable effort to see that all products and services delivered made a reasonable attempt to return the value equal to the costs demanded of them.

I'd also settle for ethics and morals in business like we had 30+ years ago.

Just a few ideas from an incomplete list of things I'd like.

I'm really tired of this catch phrase about government "forcing" people against their will. There are cases where force is justified and others where it isn't and to make a blanket statement like that is totally meaningless and can't be judged without more information.

Preserve your freedom to the detriment of the entire country? I'm sorry sir, I'm more than willing to undermine your definition of freedom and liberty to save my country from fiscal collapse and to reduce suffering and increase opportunity of those around me.

Ok it was late, I was tired and grumpy and my comment was uncalled for. You have my sincere apology.

Let me see if I can explain....Again, I'm sorry for being a royal (insert chosen insult).....

I'm putting a response together and will have it to you shortly.....

Maybe if it hadn't gone to the top 1%, it would have gone to the 99%, who would have used that money to spend and save and avoid debt. And instead of inflation driven by too much money, we would have had increased production to match demand, which would have put more people to work, increased wages due to companies having to compete harder for employees, lowered the cost of production due to economy of scale and price competition, and the the guberment would have spent less on unemployment and welfare, which would have resulted in lower budget deficits. And if companies were producing and selling more stuff, then wouldn't they be more profitable?

I'm just saying that we are all just speculating here with the "what if's". Everyone has their own version of "what if", can't prove that any are right or wrong as they are all based upon assumptions.

Let’s address your claim…..

If it hadn't gone to the top 1%, we would have massive inflation. The 1% can only trickle, not flood. Therefore, the 1% has saved us from complete disruption.

Let’s start with a few basics:

First, inflation is a value that is determined relative to other values before the results can be quantified.

Some of the values that must be known before you can determine the effect of inflation:

- Prices

- Wages

- Quantity of money

It also helps to know productive capacity and unemployment in some cases as well.

There are lots more things that effect inflation, but to keep it simple I’ll start with these.

Some kinds of inflation cause prices to rise and aggregate demand to fall, called cost-push inflation, other kinds of inflation cause prices to rise and cause aggregate demand to rise, called demand pull inflation.

Prices rising, generally speaking is a bad thing, but if prices rising are followed by increases in aggregate demand, then GDP rises it can, under specific circumstances, be a good thing. If demand pushes prices higher and there is labor and productive capacity available to meet that demand, then it is a good thing, because it puts people back to work and factories can utilize equipment that has(already) been purchased but is sitting idle. This is called demand-pull inflation.

If you look at the chart above, you’ll note that from P to P1 indicates an increase in the price level accompanied by an increase in rGDP from Y to Y1.

This is possible because an increase in disposable income was made available somewhere in the economy. It can be falling taxes, it can be increased wages, it can be changes in import/ export levels, but the point is, this can be a good thing if the country has excessive unused productive capacity, both in labor and equipment.

In the case of a higher minimum wage, though prices may rise (as indicated on the chart) so will demand which in turn will cause increases in supply. This is possible in the current economy because unemployment is high (historically speaking), there is an excess of labor available and since we are still recovering from the great recession, there is also an excess of equipment that is unused and is able to meet the excess demand.

If you had a trucking company and 20% of your trucks were parked unused, you are paying for the trucks, but they aren’t producing. If demand rises and is followed by an increase in supply, then the need for transportation rises. As the owner of a company, you hire more people (decreasing unemployment) and put your idle trucks to use.

This is a win-win and what would happen in our current climate if minimum wage was increased.

In the case of cost-push inflation. This is triggered by higher prices in the economy. Perhaps there is an oil shortage, food prices soar, there is a huge recession triggered by a housing bubble that causes high rates of unemployment. This would cause prices to rise, but because, in this case, inflation has impacted the amount of extra money a family has after the bills are paid, people have less money to spend. This causes a decrease in aggregate demand. This puts people out of work and the cycle continues until things come back into equilibrium.

Note the difference in this chart. Prices have risen, but unlike demand pull inflation, increasing prices have caused a decrease in aggregate demand resulting in reduced GDP.

The wealthy have been extracting wealth from the productive economy and moving to the top 1%. Now to fully understand what I’m talking about, I offer the following…..

This chart represents what people think the income distribution is, what they think it should be and what it really is.

The top bar shows just how distorted people’s perceptions are and how messed up our economy is….

Shown another way…..

This graph shows in more detail the disparity. The little guy in black at the end, he represents the 1%. The 1%b control 40% of all the wealth and earn 25% of all the income (including capital gains). They are 3.1 million people (out of 311 million). His line is so tall it has to be shown in 10 rows that’s 9 times higher than those in the 99%.

They have increased their share of the wealth since the early 70’s by almost 100% and their share of the income by almost 200%.

Think about that, they have extracted wealth from the 99% below them, with much of it coming from the bottom 2/3rds.

They aren't “preventing inflation”, they have caused selective deflation with the majority of the country feeling the effects.

Moving some of this money into the lower quintiles of the economy would indeed cause some inflation, but it would be productive inflation as it would put people back to work, it would increase salaries at all levels because as people are hired the labor pool shrinks, there is more competition on the parts of companies to hire the most qualified people.

Very nice post. Thank you.

What I said was If it hadn't gone to the top 1%, we would have massive inflation.

You sir are a gentleman, and your welcome.

I had a reply all written, but let my try a more Socratic method.

Is all inflation under all circumstances bad?

If the minimum wage were increased to say $15 and hour what do you think would happen?

How would you define inflation?

Thoughts?

Agreed, now I'm curious why you shared that with me?

First thought: Anyone who buys an automobile with an eight-year loan is a moron and probably deserves to be parted from his money.

Second Thought: Anyone who pays 20% of his paycheck to borrow money for two weeks is also a moron. I'd scour trash bins for potato skins or boil Dandelions before I'd give money to a legalized loan shark.

Final Thought: Why do people feel the need to save others from their own stupidity?

Because you showed a graph pertaining to public debt. Public debt is a liability to the government, not a household.

So what was your point?

So stupid and ignorant people deserve to fleeced of their money? You can't see how that is a net negative for society as a whole?

Have a seat on the couch...Yes, there lie down.... Comfy?

That attitude reeks of someone who felt un-cared for as a child. No one cared about you, no one invested himself in you so why should you have to do it for anyone else? I mean, after all you made it without anyone else's help, right?

That's pretty narcissistic...

Assuming that our productivity keeps increasing, we can easily produce enough product for everyone in our country. While I am not recommending massive waves of immigration, the larger our population is, the more demand we have, thus the more jobs we create. How much and what an increasing population consumes is more or less dependent upon how much and what they produce, so population growth is largely a net wash.

When people aren't forced to suffer the consequences for their failure to perform their own due diligence they become mentally flabby. When we get away from the idea that personal responsibility and self-education are the best palliatives for ignorance, that's the net negative, and the real tragedy. Assuming they're not genuine simpletons, yeah, they deserve whatever consequences come their way.

What are you? A shrink with an eight-year auto loan? :lol: Actually, I grew up in traditional nuclear home raised by two loving parents who never abused me in any way. They invested a lot of time and money in my and my sister's endeavors, such as Arabian horses and 4-H for her and flying lessons and Explorer Scouts for me. But they taught us that no one owes us anything, and to the degree you surrender to a paternalistic government because you refuse to handle your own affairs you also surrender your freedom.

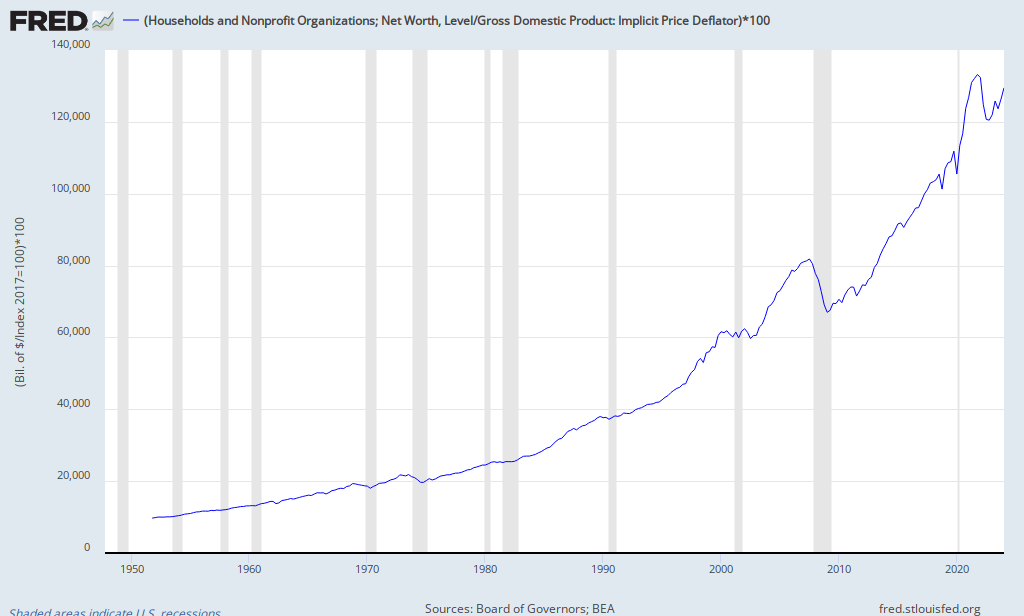

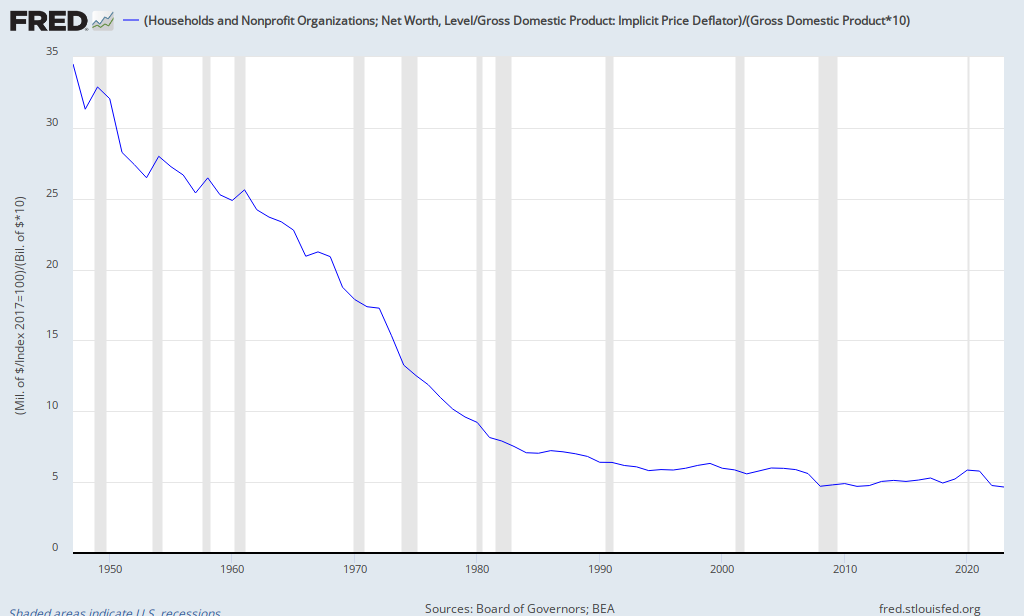

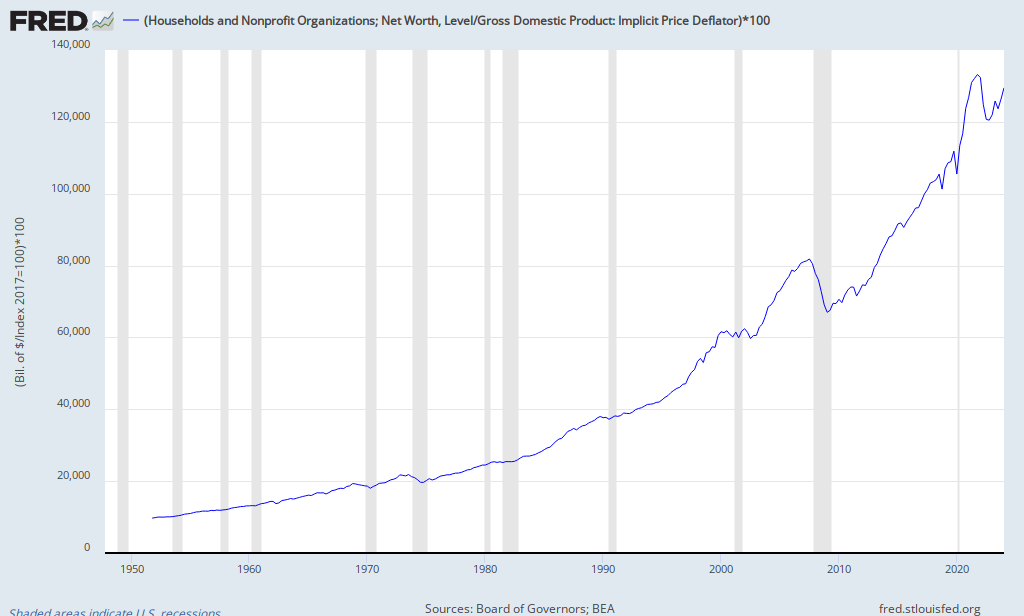

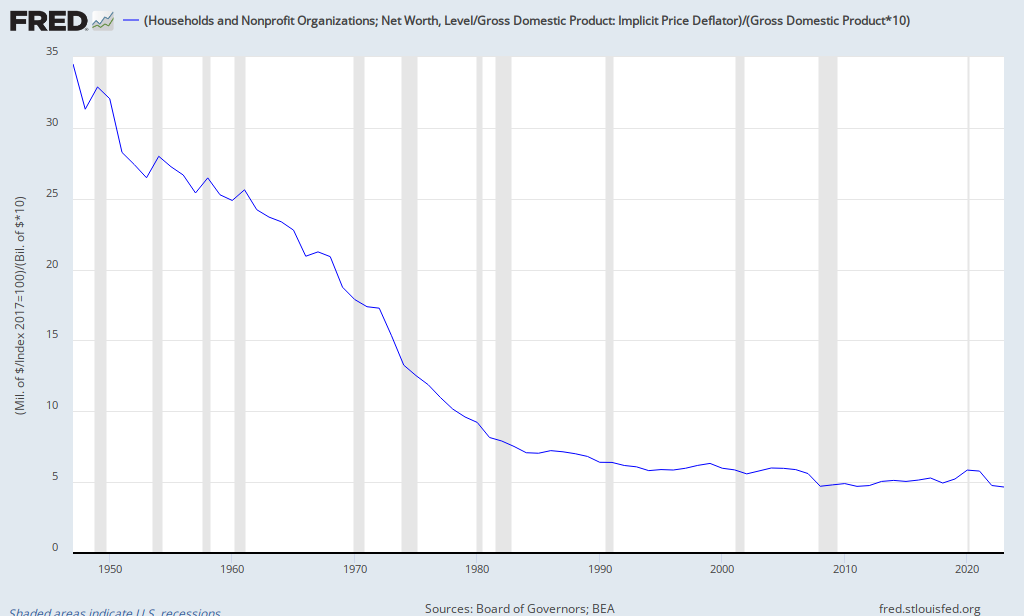

Liabilities are only a portion of the household balance sheet. Real net wealth (real assets - real liabilities) is near its pre-crisis high.

However, if measured in terms of aggregate output, something interesting happens.

Real net worth as a percentage of real GDP, has been declining since the 1950's. What do you make of it?

Is the second graph adjusted for inflation?

Is that total net wealth, or median net wealth?