drz-400

DP Veteran

- Joined

- Oct 12, 2009

- Messages

- 2,357

- Reaction score

- 551

- Location

- North Dakota

- Gender

- Male

- Political Leaning

- Conservative

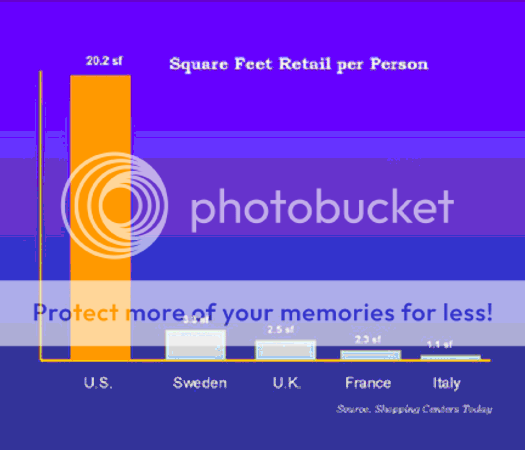

For those of you that still believe the real estate bubble's root cause was Frannie/Freddie, the community reinvestment act, predatory lending, subprime morgages, etc...

tulipomania

tulipomania