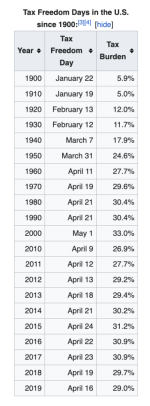

According to this page, the people in NYS have to work until May in order to pay their tax burden for the year. This does not include inflation, which is also a form of taxation.

In my view, this is an absolute travesty. You get only one life to live, and you have spend such a large portion of it working for the goddamn government?

You cannot call yourself "pro-labor" if you support the state confiscating such a large portion of the wealth produced by working people.

Of course, the political left wants taxes to be even higher than are now. Many of them would be happy with people working for the government 9, 10, or even 12 months of the year.

Leftists are fundamentally anti-labor.

In my view, this is an absolute travesty. You get only one life to live, and you have spend such a large portion of it working for the goddamn government?

You cannot call yourself "pro-labor" if you support the state confiscating such a large portion of the wealth produced by working people.

Of course, the political left wants taxes to be even higher than are now. Many of them would be happy with people working for the government 9, 10, or even 12 months of the year.

Leftists are fundamentally anti-labor.