It's quite easy. I'll raise taxes, and appoint you, DA60, chief of communications for the White House, $80,000/ plus expenses. Why not? An open, transparent democracy requires liaison with the media, in order to inform the citizenry of what is going on. It's a required job, and tax money is going to pay for it. It's a pretty good bet you are going to spend all of that money domestically, and so generate more economic activity in the economy.

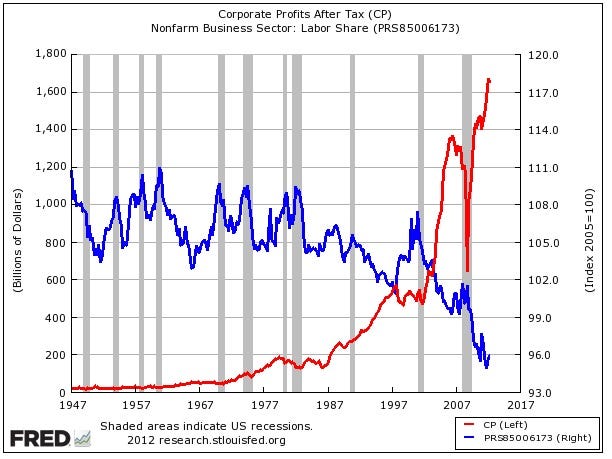

Greater capital in the public's hands allows for greater latitude in policy. The private sector will only spend when it is deemed in their own self interest, which may or may not coincide with the greater public interest. We are seeing a good case in point right now, as the private sector is sitting on billions in cash, as there is not enough money in the hands of workers, overall, to create enough demand. Makes sense from their point of view, but not from ours, because that money could be put to work building valuable infrastructure, retraining workers, and providing jobs- a real investment in society that is foregone due to laissez faire philosophy.