- Joined

- Jun 3, 2009

- Messages

- 30,870

- Reaction score

- 4,246

- Gender

- Male

- Political Leaning

- Very Conservative

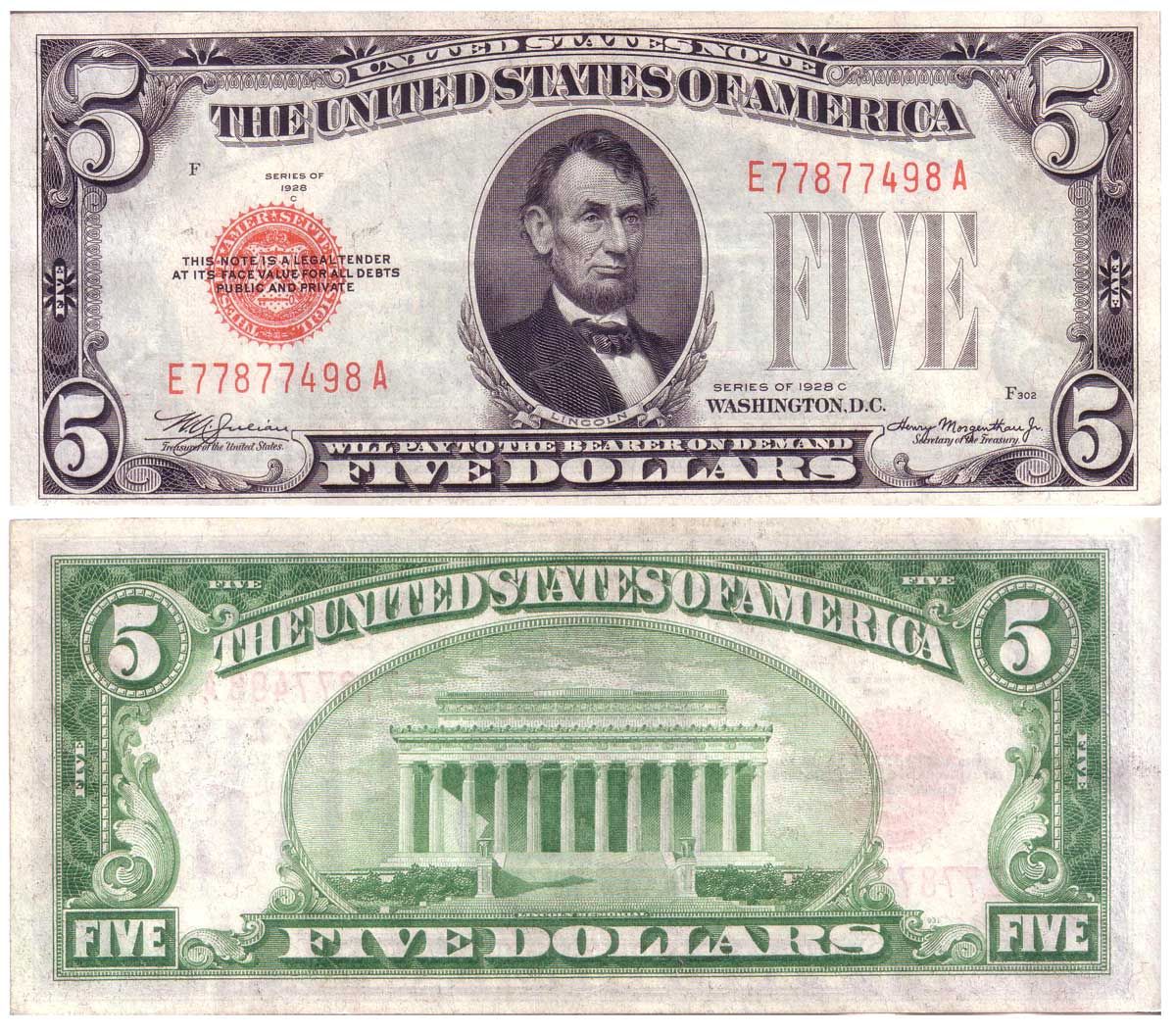

Almost all of our money is created by banks, tied to debt, and the banks get paid interest for this creation. All of the money that you use, it's all debt. It enriches the financial sector and leeahes from the real, productive part of the economy. You're being robbed every day and you don't even know it.

Banks shouldn't be making money. The government should, and it should benefit all of us, not just wealthy bankers. Oh you think it's inflationary? And the banks creating trillions of dollars isn't?

Last edited: