- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

From the Economist*: Key-person risk is alive and kicking

Excerpt:

America, hell-bent since inception to Make a Quick Buck, does not have Europe's long-term vision/understanding that "time takes time". Everything, literally everything, is NOW orientated - whether its the latest thingamabob for the young or megabucks for the not-so-young.

What's the bother? The bother is the fact that any country axiomatically orientated towards the accumulation of Wealth cannot avoid Income Disparity - and the US is certainly no exception. Certainly, we cannot all have the same income. That silly notion found its timely death along with that of autocratic Communism. (China is "communist" in name only.)

But, on the other end, not all of us can make a quick megabuck, though such may indeed be our fondest dream. The problem derives from the fact that, "A quick megabuck is precisely what the American mentality is today!" Which means what?

These info-graphics rather than words -

As regards Wealth:

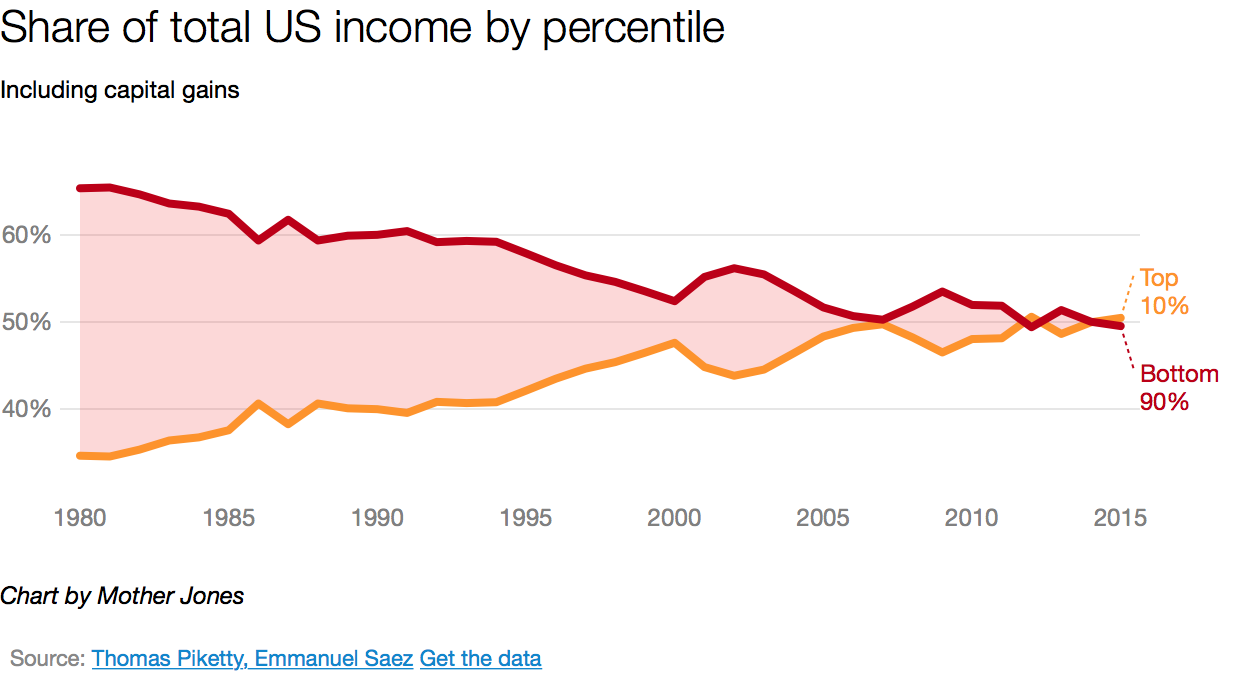

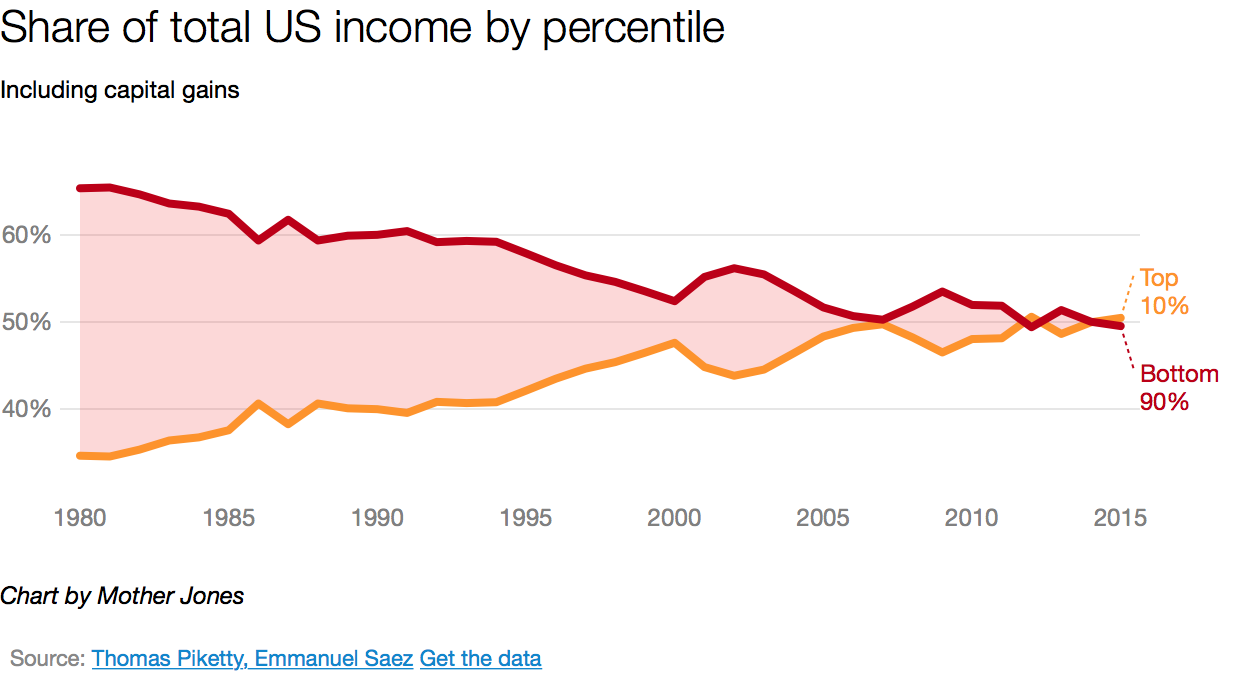

As regards Total US Income:

Does the above characterize the world you want to live in? Because the statistics behind these graphics are correct, and the consequence to our way of life as a country is awesome. Whyzzat?

Because in order for the above to happen, those at the top garner all and those at the bottom earn next-to-nothing. That situation can only lead to one consequence inevitably.

Civil disobedience. (And that's a kind-phrase for what could happen awesomely ...)

Excerpt:

It wasn’t meant to be this way. In the 1960s and 1970s the corporate king was heading for extinction, replaced by bland executives like those in the film “The Graduate”, who thought the key to life was “one word…plastics”. In 1967 John Kenneth Galbraith, an economist, published “The New Industrial State”, arguing that American industry was run by a faceless, benign technocracy. Modern finance theory emerged, seeing managers as functionaries who could be controlled using incentives.

In the 1980s the individual came roaring back. In “Wall Street”, a film released in 1987, a fictional tycoon bends firms to his will. By 2000 the imperial chief executive, typified by Jack Welch at General Electric and Sandy Weill at Citigroup, was in his pomp. Then came crises at WorldCom and Enron, and later at Lehman Brothers and Bear Stearns, showing the danger of firms run by charismatic bosses. Governance gurus urged boards to limit executive power.

As a matter of etiquette, contemporary bosses are expected to rein in their swagger and talk up their team. Some, like Satya Nadella at Microsoft, even project vulnerability, not invincibility. Yet despite this, key-person risk has risen. The tech boom means that lists of the largest firms are full of founder-led companies—six of the biggest 20 fall into this camp.

America, hell-bent since inception to Make a Quick Buck, does not have Europe's long-term vision/understanding that "time takes time". Everything, literally everything, is NOW orientated - whether its the latest thingamabob for the young or megabucks for the not-so-young.

What's the bother? The bother is the fact that any country axiomatically orientated towards the accumulation of Wealth cannot avoid Income Disparity - and the US is certainly no exception. Certainly, we cannot all have the same income. That silly notion found its timely death along with that of autocratic Communism. (China is "communist" in name only.)

But, on the other end, not all of us can make a quick megabuck, though such may indeed be our fondest dream. The problem derives from the fact that, "A quick megabuck is precisely what the American mentality is today!" Which means what?

These info-graphics rather than words -

As regards Wealth:

As regards Total US Income:

Does the above characterize the world you want to live in? Because the statistics behind these graphics are correct, and the consequence to our way of life as a country is awesome. Whyzzat?

Because in order for the above to happen, those at the top garner all and those at the bottom earn next-to-nothing. That situation can only lead to one consequence inevitably.

Civil disobedience. (And that's a kind-phrase for what could happen awesomely ...)