- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

From Buttonwood, here.

Excerpt:

We shouldn't worry about oil-prices rising? Why?

And should we nonetheless be thinking/proposing affordable options - like Federally subsidized installations of photo-voltaic or heat-pump alternative technologies?

____________________________

Excerpt:

IN THESE days of 24/7 news channels, attention spans have become shorter. So I ask readers to cast their minds all the way back to ancient history—January and February this year in those innocent days when Britain had yet to vote to leave the EU and the Republicans had yet to settle on Donald Trump as their nominee.

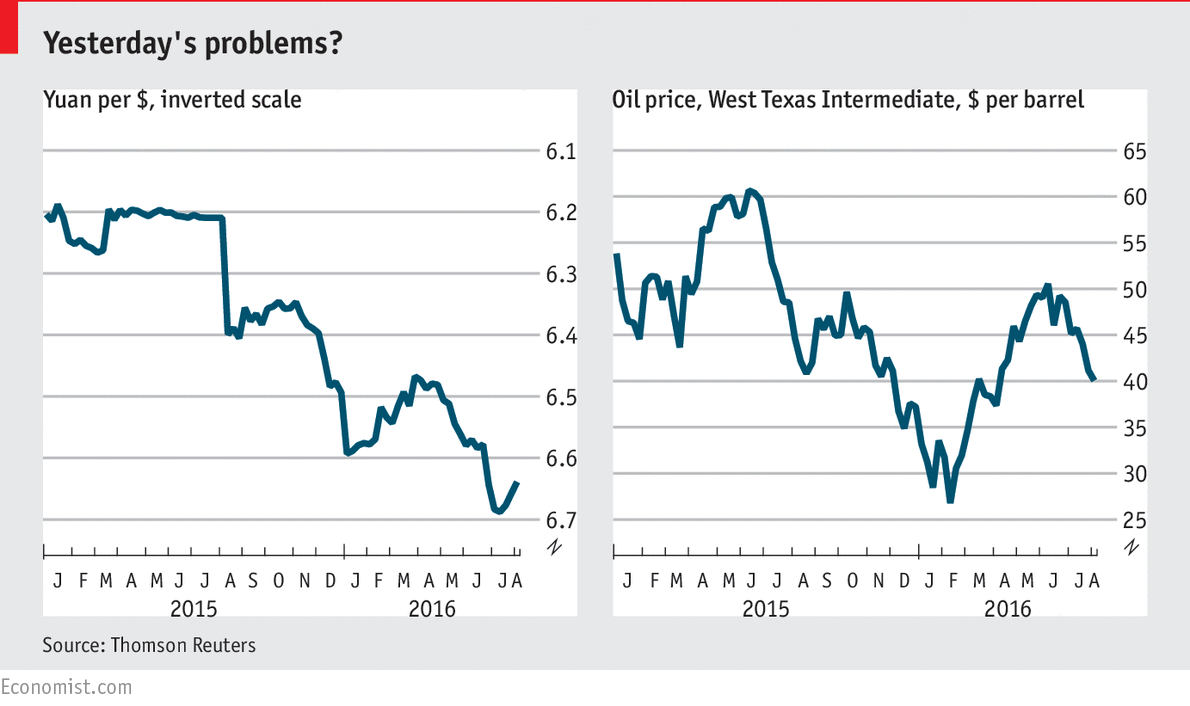

Back then, the markets began the year in wobbly mood, worrying about the fall in the oil price (as indicating weakness in global demand) and a weaker renminbi, on the grounds that lower Chinese prices might send a deflationary shiver round the world. As the year has worn on, investors have recovered their nerve, with the S&P 500 managing repeated intra-day record highs in recent weeks.

But as the chart shows, the renminbi is weaker than it was at the start of the year and oil is rapidly heading lower once more. On China, the good news is that the authorities have not allowed the currency to fall precipitately and the figures suggests the economy is slowing gently, rather than abruptly. Oil is more concerning. More supply is coming on to the market, with post-sanctions Iran stepping up production, the US adding drill rigs in each of the last five weeks and Libya hoping to boost exports by 900,000 barrels a day by the end of the year.

What explains this insouciance? ...

We shouldn't worry about oil-prices rising? Why?

And should we nonetheless be thinking/proposing affordable options - like Federally subsidized installations of photo-voltaic or heat-pump alternative technologies?

____________________________