- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

Defense spending today: U.S. Defense Spending Compared To Other Countries

Excerpt:

America would be better off with Much Lesser spending on "Defense" and more upon:

*Very low-cost Post-secondary education that prepares its people for the Brave New World of Services Industries that require high-level competence.

*National Healthcare for all at suitable prices assuring easy access to even the poorest Americans

Let's raise upper-income taxation by significantly larger amounts (above 70%). Whyzzat?

From here: America’s richest 400 families pay a lower tax rate than average taxpayer

Excerpt:

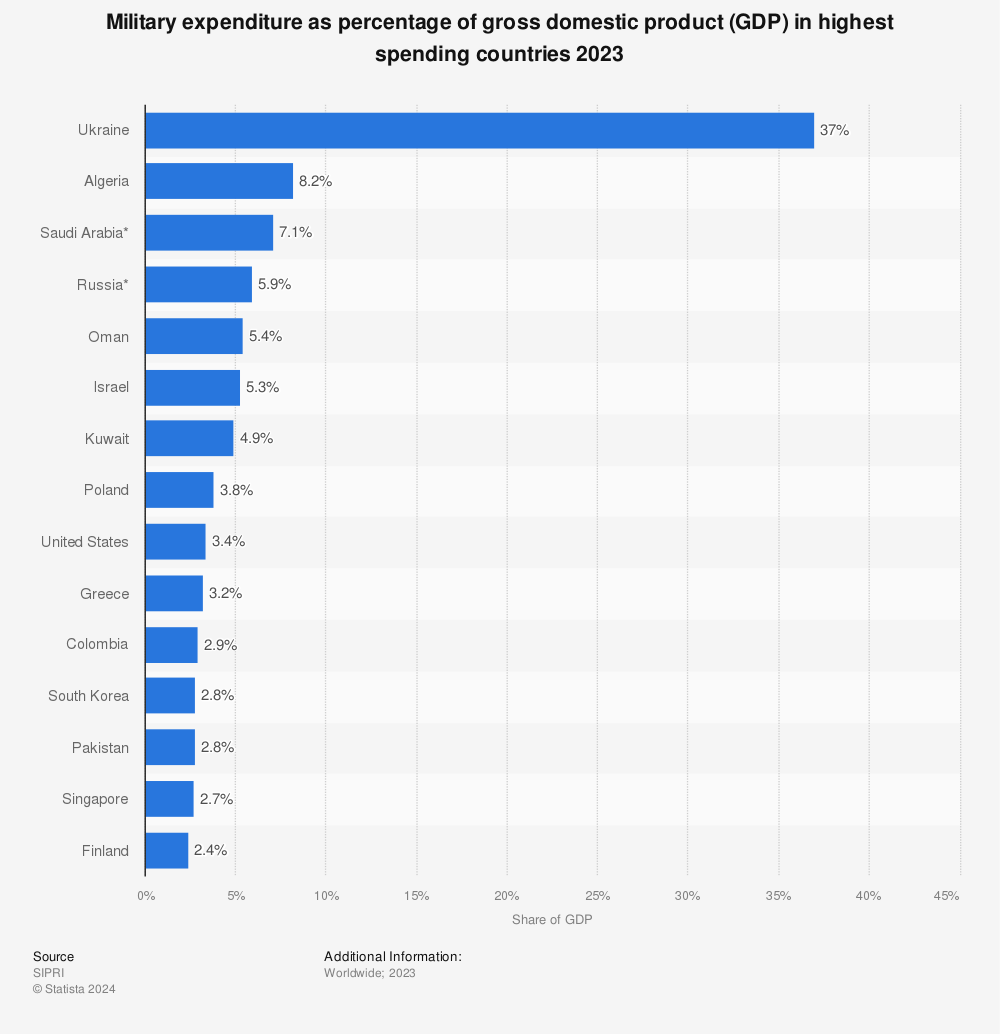

The United States spends more on national defense than China, India, Russia, United Kingdom, Saudi Arabia, Germany, France, Japan, South Korea, Italy, and Australia — combined. While the chart above illustrates last year’s defense spending in dollar terms, the United States has also historically devoted a larger share of its economy to defense than many of its key allies.

Defense spending accounts for more than 10 percent of all federal spending and nearly half of discretionary spending. Total discretionary spending — for both defense and nondefense purposes — is typically only about one-third of the annual federal budget. It is currently below its historical average as a share of GDP and is projected to decline further.

America would be better off with Much Lesser spending on "Defense" and more upon:

*Very low-cost Post-secondary education that prepares its people for the Brave New World of Services Industries that require high-level competence.

*National Healthcare for all at suitable prices assuring easy access to even the poorest Americans

Let's raise upper-income taxation by significantly larger amounts (above 70%). Whyzzat?

From here: America’s richest 400 families pay a lower tax rate than average taxpayer

The wealthiest Americans generate the bulk of their income from investments, which, if held longer than a year, are taxed at a lower rate than wages. The top federal income tax rate on wages is 37%, while the top rate on dividends and assets (like stocks and homes) sold for a gain is 20%.Sep 23, 2021