oldreliable67

DP Veteran

- Joined

- Oct 3, 2005

- Messages

- 4,641

- Reaction score

- 1,102

- Gender

- Male

- Political Leaning

- Undisclosed

Mention has been made in several threads about loan demand, typically couched in the form of 'bank's unwillingness to lend.' The Fed's Senior Loan Officer Survey for October provides the following:

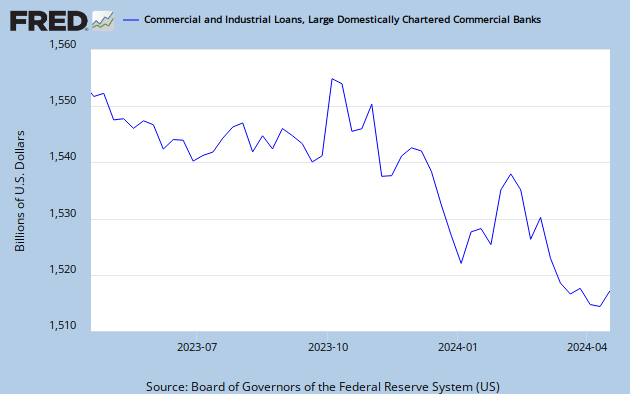

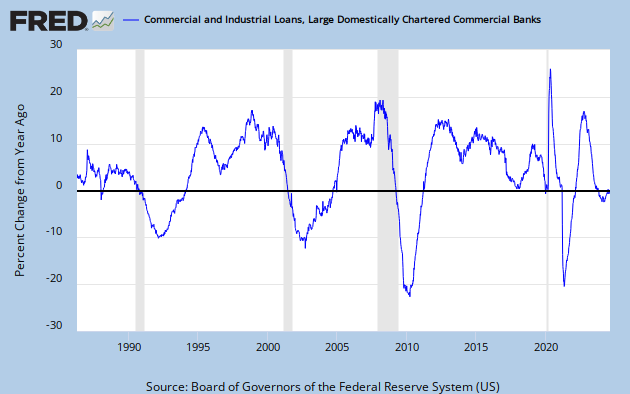

The 'somewhat eased standards' reported by survey participants is most likely reflected in the modest increases seen in recent weeks in C&I Loans by large commercial banks, noted here.

If banks have eased standards and at the same time, loan demand has picket up, what does that say about the recovery?

The October survey indicated that, on net, banks eased standards and terms over the previous three months on some categories of loans to households and businesses.2 Both large and other domestic banks reported having eased some standards and terms; large banks were primarily responsible for the easing reported in July.3 However, substantial fractions of banks reported in response to a set of special questions that standards for many categories of loans would not return to their longer-run averages for the foreseeable future.

Domestic survey respondents reported easing standards and most terms on C&I loans to firms of all sizes. As in the April and July surveys, banks mainly pointed to a more favorable or less uncertain economic outlook and increased competition from other banks or nonbank lenders as reasons for easing. Of the few banks that reported having tightened standards or terms, all reported a reduced tolerance for risk as being partly responsible for the tightening.

Changes in standards and terms on loans to households were somewhat more mixed. Banks again reported an increased willingness to make consumer installment loans, and a small net fraction of respondents reported easing standards for approving credit card applications. However, a few banks, on net, reported having tightened terms and reduced the size of credit lines on existing credit card accounts. Small net fractions of respondents--though not the largest respondents--also reported having tightened standards on prime and on nontraditional mortgage loans as well as standards for approving home equity lines of credit (HELOCs).

Demand declined, on net, for C&I loans, particularly for small firms; demand for C&I loans had been unchanged in the July survey.4 Large banks reported increased demand for commercial real estate (CRE) loans, but demand weakened at other banks. In addition, small net fractions of banks reported decreased demand for all types of residential mortgages and consumer loans, though the weakness was primarily at smaller institutions.

The 'somewhat eased standards' reported by survey participants is most likely reflected in the modest increases seen in recent weeks in C&I Loans by large commercial banks, noted here.

If banks have eased standards and at the same time, loan demand has picket up, what does that say about the recovery?