- Joined

- Jan 2, 2006

- Messages

- 28,174

- Reaction score

- 14,270

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

False. The Fed has existed for over 100 years, and there is no way to deny that their presence has led to a more stable and efficient long term economy.Ideally, yes, the economy is controlled from the bottom up, by individual agents. But the Fed's massive interventions interfere with that ideal.

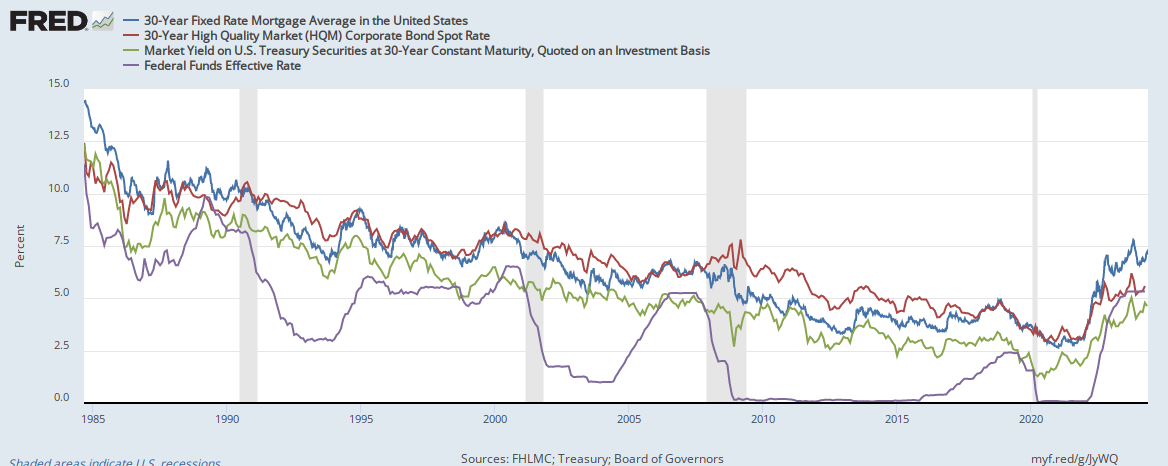

It's a matter of valuation. Stocks are worth more when interest rates are low... and just to preempt your rebuttal: interest rates in the developed world are naturally low due to an over-supply of capital throughout the developed world. For example:Now we have a stock market completely divorced from reality, since there is no safe alternative.

Even when the Fed increases the Fed Funds Rate, long term interest rates continue to move lower. From late 2015 until the middle of 2019, the Fed raised the FFR. And still, long term interest rates continued to fall.

False. We have inflation because the economy is running very hot. 6% inflation is a very good problem to have when it's accompanied by 12% GDP growth. The alternative would be 0% inflation and 2% GDP growth. **** that bullshit noise.And we have inflation, which was partially caused by unprecedented money creation.

Fed policy isn't driving inflation. The only people who believe that are motivated entirely by partisanship.And the Fed can't let interest rise to control inflation without crashing the stock market and real estate markets, and making the astronomical debt unpayable.

Never said they will be. However, government can help ensure market failure doesn't create a psychological blow to overall confidence. We've learned from the Great Depression. You continue to exhibit extreme ignorance with regards to this subject.Economies can't be all good all the time. The Fed has been trying to create a perpetual motion machine.