- Joined

- Sep 30, 2019

- Messages

- 18,839

- Reaction score

- 7,073

- Gender

- Male

- Political Leaning

- Independent

“If” never happens.You didn't answer. If they have a bad year, below a "fair profit" are you willing to subsidize them to give them a fair profit?

“If” never happens.You didn't answer. If they have a bad year, below a "fair profit" are you willing to subsidize them to give them a fair profit?

Bullshit, Excess profits should be confiscated. Salaries capped by law and bonuses abolished.Price Gouging Oil Companies Should Pay A Windfall Tax = Bring it on!

It's almost as if oil is traded on a global market...Russia supplies up to 3% of our oil, yet after the sanctions gas prices went up 25%. Seems legit.

Perhaps a consideration. But only after the government stops giving them tens of billions of dollars every year regardless of profit margins.

Really, so what is a fair profit?“If” never happens.

Why bother then it will be a wash anyway?

It's almost as if oil is traded on a global market...

But if you tax away "extra" profits, then how will they make up for bad years?"Why bother" barely scratches the surface of how I feel about corporations being able to write off one year's losses on the following years' taxes. It only makes sense for startups, who need to run losses for a few years, but even then it's pretty questionable. If they aren't obviously bound for failure (the IRS can't make this judgement but investors can) then they can simply borrow to cover losses, or issue more stock.

Compensating corporations that are already well established, for making losses does not make even economic sense. If they have no assets to sell, then they're bankrupt and have to go.

But if you tax away "extra" profits, then how will they make up for bad years?

Big oil is exploiting their customers daily by using the Invasion as an excuse.

If anyone offers anything for sale and people pay the price advertised, that is commerce.

When the value decreases, the price decreases.

This is pretty basic stuff.

OPEC and OPEC your basic stuff doesn’t apply to them.If anyone offers anything for sale and people pay the price advertised, that is commerce.

When the value decreases, the price decreases.

This is pretty basic stuff.

Do you understand that this is a tariff?Even before Vladimir Putin’s invasion of Ukraine shocked energy markets and sent oil prices to over $100 a barrel, Exxon was banking obscene profits. On February 1, the Texas-based fossil fuel giant announced profits of almost $9 billion for the fourth quarter of 2021—its biggest take in seven years,

Exxon didn’t have to party alone; Chevron, Shell, and BP were announcing surpluses of only slightly less startling proportions.

“Combined, the four companies raked in $24.4 billion in quarter four of 2021, bringing their total profits for last year to over $75.5 billion. Chevron, Shell, BP, and Exxon used these bloated profits to shower billions onto their shareholders—including their wealthy executives whose salaries are heavily padded with stocks,” reported the watchdog group Accountability.US.

“In 2021, the four companies bought back over $6.6 billion in stocks while hiking up their dividends. And the oil giants are planning for an ‘even better’ 2022 for shareholders, with plans already in place to buyback over $22 billion in stock thanks to high oil prices.”

In fact, 2022 could be dramatically better for Exxon and the other major oil companies.

Price-Gouging Oil Companies Need to Pay a Windfall Tax

Prices at the pump are shooting up as oil companies turn massive profits. A windfall-profits tax could go a long way toward providing relief for working families.www.thenation.com

Don't be naive.OPEC and OPEC your basic stuff doesn’t apply to them.

Saudi Arabia understands how to manipulate supply and demand, that is not naive that is being real.Don't be naive.

Do you understand that this is a tariff?

It's against our own companies so it's known as a reverse tariff. It has been done before under similar circumstances with disastrous results.

Crude Oil Windfall Profit Tax Act of 1980 - Wikipedia

en.wikipedia.org

Saudi Arabia understands how to manipulate supply and demand, that is not naive that is being real.

“OPEC’s Monopoly”After OPEC held the West "at the point of a pump" the US oil majors prospected and sometimes drilled in far more places around the world. OPEC's monopoly power is considerably reduced now: there are other sources who can increase their output to take advantage of (and drive down) any OPEC-fixed price. Trying to quadruple the price of crude oil as they did then, wouldn't work now.

US domestic fracking was a big part of this, of course, but it's not the only country.

Seen from OPEC's point of view, proving reserves elsewhere is almost as alarming as actually drilling them.

Even before Vladimir Putin’s invasion of Ukraine shocked energy markets and sent oil prices to over $100 a barrel, Exxon was banking obscene profits. On February 1, the Texas-based fossil fuel giant announced profits of almost $9 billion for the fourth quarter of 2021—its biggest take in seven years.

Exxon didn’t have to party alone; Chevron, Shell, and BP were announcing surpluses of only slightly less startling proportions.

“Combined, the four companies raked in $24.4 billion in quarter four of 2021, bringing their total profits for last year to over $75.5 billion. Chevron, Shell, BP, and Exxon used these bloated profits to shower billions onto their shareholders—including their wealthy executives whose salaries are heavily padded with stocks,” reported the watchdog group Accountability.US.

“In 2021, the four companies bought back over $6.6 billion in stocks while hiking up their dividends. And the oil giants are planning for an ‘even better’ 2022 for shareholders, with plans already in place to buyback over $22 billion in stock thanks to high oil prices.”

In fact, 2022 could be dramatically better for Exxon and the other major oil companies.

Price-Gouging Oil Companies Need to Pay a Windfall Tax

Prices at the pump are shooting up as oil companies turn massive profits. A windfall-profits tax could go a long way toward providing relief for working families.www.thenation.com

“OPEC’s Monopoly”

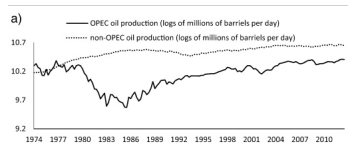

The non-OPEC members def do not want to upset OPEC.The math in this thing is over my head, but it does have a handy graph to illustrate my point.

View attachment 67379997

Note that non-OPEC production did not need to exceed OPEC production by much, to break their monopoly.

You say that like you understand that supply and demand do affect the Arabs. Why did you say that it didn't?Saudi Arabia understands how to manipulate supply and demand, that is not naive that is being real.

A reverse tariff. It taxes the profits of US companies and not those of foreign companies.A tax on profits is a tariff?

What you linked to was a tariff ON CRUDE OIL, and because it could be expected to increase imports (from the Middle East at that time) due to their lower extraction costs, it would be a bad idea now.

A tax on profits (ie corporate tax) does not have any of those effects. I doubt it would even lower fuel prices, it would just be a revenue source.

You say that like you understand that supply and demand do affect the Arabs. Why did you say that it didn't?

Oil has fallen to $100/barrel.It's almost as if oil is traded on a global market...

I understand that you are weaseling. First, you say that supply/demand does not apply to the Saudis. Next, you say that they can manipulate supply/demand. Which is it because it cannot be both?What part of “manipulate” do you not understand?