Fair enough.

Given your financial position, I'm not sympathetic that you have spent $1000 over the last year.

I think there's a world of difference between your wife, who is married to someone who has made it clear that he is far from poor, and someone who is genuinely poor. I also think it's not realistic to compare someone on public welfare (with it's extremely low income thresholds) and a family with more than 100K in income.

The welfare recipient is facing a decision about money in a situation where every dollar counts. A couple with a 100k+ income is not in a similar situation.

A) the bolded is not true. Nearly $10K a year is either 2 Roth IRA's, or an annual contribution to college savings for each of their three children. Furthermore, $100k is a very different sum in (say) New York City or the areas surrounding Washington DC than it is in Decatur, Georgia.

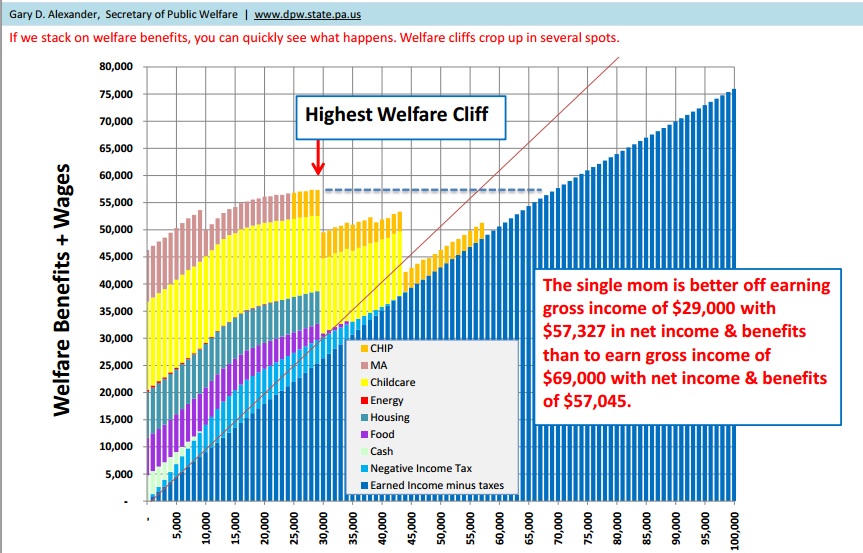

B) the underlined, however, is true. And that is why cliffs of this kind hurt them the most. Observe, for example, what happens to a man and a woman with children if they decide to get married so as to raise their children in the most stable environment, one best suited to allowing the kids to escape poverty:

For a recipient of aid, facing a decision about money, in a situation where every dollar counts (as you say) this is a powerful disincentive to take action that will benefit the children, themselves, and ultimately, society. It is a punitively high cost to impost on those who, when facing a decision about money, are in a situation where every dollar counts, for the crime of attempting to be responsible and improve their lot in live.

We already do this for single parents as well:

effectively trapping women with children into low-income, low-skill jobs and low-income, low-skill jobs. This means that they will never be able to accumulate significant resources to focus on their children, housing, you name it. This is one of the ways in which you create cyclical, multi-generational poverty and the loss of social mobility that so many of those on the left decry so loudly and understand so little.