-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

No it's not "Tax cuts for the rich".

- Thread starter eman926

- Start date

- Joined

- Aug 10, 2013

- Messages

- 20,157

- Reaction score

- 21,479

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

- Joined

- Aug 10, 2013

- Messages

- 20,157

- Reaction score

- 21,479

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

/cdn.vox-cdn.com/uploads/chorus_asset/file/10149599/Screen_Shot_2018_02_03_at_1.58.16_PM.png)

Ryan deleted that tweet when he realized how stupid it sounded.

- Joined

- Jul 1, 2011

- Messages

- 91,888

- Reaction score

- 90,766

- Gender

- Male

- Political Leaning

- Independent

No it's not "Tax cuts for the rich".

sure it is.

- Joined

- Nov 18, 2016

- Messages

- 48,058

- Reaction score

- 25,297

- Gender

- Male

- Political Leaning

- Liberal

I find it amusing how cleverly the Koch bros found a way to to use the primitive ignorance, paranoias, misunderstandings, and prejudices of one of the most distressed and vulnerable demographics in our nation, ie, uneducated white males, to advance their shortsighted, plutocratic self-interests on their backs- and to have them do it with such zeal and passion. Amazing.

Last edited:

- Joined

- Jun 7, 2020

- Messages

- 879

- Reaction score

- 148

- Gender

- Male

- Political Leaning

- Very Conservative

And? If you pay the vast majority of taxes, you are going to get the vast majority of tax refunds. It doesn't mean that the other taxpayers won't get something. The GOP is also working on eliminating the payroll tax, which affects all workers.

- Joined

- Jun 7, 2020

- Messages

- 879

- Reaction score

- 148

- Gender

- Male

- Political Leaning

- Very Conservative

sure it is.

EVERY person who pays an income tax gets a refund. So stop distorting the message.

- Joined

- Aug 10, 2013

- Messages

- 20,157

- Reaction score

- 21,479

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

And? If you pay the vast majority of taxes, you are going to get the vast majority of tax refunds. It doesn't mean that the other taxpayers won't get something.

I'm sure the majority of taxpayers missing out on the "vats majority of tax refunds" appreciate the extra dollar fifty.

The GOP is also working on eliminating the payroll tax, which affects all workers.

Yes, we've heard about the plan to defund Social Security. The party hasn't moved as far from Dubya as they like to pretend.

- Joined

- Nov 18, 2016

- Messages

- 48,058

- Reaction score

- 25,297

- Gender

- Male

- Political Leaning

- Liberal

And? If you pay the vast majority of taxes, you are going to get the vast majority of tax refunds. It doesn't mean that the other taxpayers won't get something. The GOP is also working on eliminating the payroll tax, which affects all workers.

And that's why our deficits are going through the roof- in the middle of an economic boom. Why is that smart?

Next time there is a serious recession, we are going to have any ammo left to stimulate the economy. You use an economic boom to dig out from the deficit left over from digging out from the recession. The GOP has it ass-backwards: they don't want to stimulate an economy in distress (especially if there is a D in the whitehouse), and then they don't want to pay down the debt once we are out.

Doesn't make any sense at all. To any serious economist. Not smart at all.

- Joined

- Jul 1, 2011

- Messages

- 91,888

- Reaction score

- 90,766

- Gender

- Male

- Political Leaning

- Independent

EVERY person who pays an income tax gets a refund. So stop distorting the message.

i didn't. i told the truth. i think that the Russian word for "truth" is "правда."

- Joined

- Jun 7, 2020

- Messages

- 879

- Reaction score

- 148

- Gender

- Male

- Political Leaning

- Very Conservative

And that's why our deficits are going through the roof- in the middle of an economic boom. Why is that smart?

Next time there is a serious recession, we are going to have any ammo left to stimulate the economy. You use an economic boom to dig out from the deficit left over from digging out from the recession. The GOP has it ass-backwards: they don't want to stimulate an economy in distress (especially if there is a D in the whitehouse), and then they don't want to pay down the debt once we are out.

Doesn't make any sense at all. To any serious economist. Not smart at all.

We don't have a revenue problem, we have a SPENDING problem. FDR, Carter, and Obama raised taxes several times and deficits went up drastically. Calvin Coolidge lowered taxes and lowered spending and the national debt went down.

- Joined

- Mar 5, 2008

- Messages

- 112,953

- Reaction score

- 60,481

- Location

- Sarasota Fla

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

It's tax cuts for EVERY TAX PAYER. Quit it with your spin.

Few Americans think they'''re getting a Trump tax cut: NBC/WSJ poll

Yet the cuts for most taxpayers are so small that many didn’t notice.

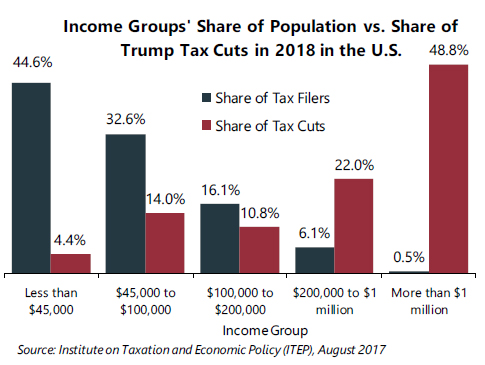

The lowest earning 60% of households stood to receive an average cut of less than $1,000, the analysis found. The top 1% of taxpayers could expect more than $51,000.

A tax cut that lets you go to McDonalds once a week really is not much of a tax cut.

And about 20 % got no tax cut, so you are factually wrong as well.

- Joined

- Oct 14, 2015

- Messages

- 64,170

- Reaction score

- 62,464

- Location

- Massachusetts

- Gender

- Male

- Political Leaning

- Other

/cdn.vox-cdn.com/uploads/chorus_asset/file/10149599/Screen_Shot_2018_02_03_at_1.58.16_PM.png)

Ryan deleted that tweet when he realized how stupid it sounded.

Why, with $78 you can buy nearly as many pounds of dry black beans!

- Joined

- Aug 10, 2013

- Messages

- 20,157

- Reaction score

- 21,479

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

Why, with $78 you can buy nearly as many pounds of dry black beans!

Hopefully she stocked up before the Trump bread lines and depression hit.

- Joined

- Oct 14, 2015

- Messages

- 64,170

- Reaction score

- 62,464

- Location

- Massachusetts

- Gender

- Male

- Political Leaning

- Other

It's tax cuts for EVERY TAX PAYER. Quit it with your spin.

No, it isn't, as has been demonstrated. And second you're assuming a silent "only". There is no "only."

Both Trump and Bush's tax cuts primarily benefited the upper crust, and of that upper crust benefited the richest the most. Trump's in particular were designed to screw blue staters, who tend to live in denser and hence more expensive states, primarily around those hated blue cities; replace stuff like the mortgage and state tax deduction with an expanded personal deduction, and you generally harm people living in higher tax states and pay higher mortgages.

Who is that, primarily? Well, blue states. Blue states typically have higher state taxes. Red states have lower ones, typicall. Red states only get away with that because they are net takers via the federal tax and spend power.

And who is more likely to have an expensive mortgage? Someone living near/in a blue city.

It did jack to stimulate the economy. It would be moronic to expect otherwise. Nobody invests in building more widgets unless they can sell them, and if they can sell them they do it with or without a tax cut.

Between their policies, this all cost over ONE TRILLION A YEAR in the "best economy ever." Thanks to Trump's malevolence and incompetence, he will be handing Biden a FOUR TRILLION DOLLAR DEFICIT in one year.

You will all promptly start caring about deficits again. And forget personal responsibility. Why pay for what you get? Borrow against your children and grandchildren so you the upper crust can have tax cuts.

- Joined

- Feb 2, 2013

- Messages

- 62,193

- Reaction score

- 20,679

- Location

- IL—16

- Gender

- Male

- Political Leaning

- Moderate

And? If you pay the vast majority of taxes, you are going to get the vast majority of tax refunds. It doesn't mean that the other taxpayers won't get something. The GOP is also working on eliminating the payroll tax, which affects all workers.

Who supports eliminating the payroll tax cut and Socialist Security?

- Joined

- Mar 5, 2008

- Messages

- 112,953

- Reaction score

- 60,481

- Location

- Sarasota Fla

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

We don't have a revenue problem, we have a SPENDING problem. FDR, Carter, and Obama raised taxes several times and deficits went up drastically. Calvin Coolidge lowered taxes and lowered spending and the national debt went down.

That is stupid. There are two factors in a deficit, income and outgo. Both are equally important to the equation.

Also, your ignorance of tax policy and how it affects deficits is painful. Here is a neat chart that will show you your painfully wrong interpretation: Data Lab - Federal Deficit Trends – U.S. Treasury | Data Lab. Notice how the deficit went down from 2011 to 2015, and ended lower under Obama than when he took office. When was the last time a republican president can say that? When was the last time a democratic president can say that? Hint: it was the democratic president right before Obama, Clinton. So deficits went down under democrat, up under republican, down under democrat, up under republican. And taxes went up under both those democrats, and down under both those republicans. Might be time to educate yourself.

- Joined

- Feb 2, 2013

- Messages

- 62,193

- Reaction score

- 20,679

- Location

- IL—16

- Gender

- Male

- Political Leaning

- Moderate

People who are against tax cuts are people who gain more from taxes than they pay in taxes. Prove me wrong.

Reds like the money they get from Blue cities.

- Joined

- Feb 2, 2013

- Messages

- 62,193

- Reaction score

- 20,679

- Location

- IL—16

- Gender

- Male

- Political Leaning

- Moderate

CC led us to a Great Depression.We don't have a revenue problem, we have a SPENDING problem. FDR, Carter, and Obama raised taxes several times and deficits went up drastically. Calvin Coolidge lowered taxes and lowered spending and the national debt went down.

- Joined

- Jun 18, 2018

- Messages

- 54,313

- Reaction score

- 50,885

- Gender

- Male

- Political Leaning

- Progressive

And? If you pay the vast majority of taxes, you are going to get the vast majority of tax refunds. It doesn't mean that the other taxpayers won't get something. The GOP is also working on eliminating the payroll tax, which affects all workers.

The rest of us get crumbs to look the other way.

Most people support Social Security, which is funded by payroll taxes.

- Joined

- Nov 18, 2016

- Messages

- 48,058

- Reaction score

- 25,297

- Gender

- Male

- Political Leaning

- Liberal

We don't have a revenue problem, we have a SPENDING problem. FDR, Carter, and Obama raised taxes several times and deficits went up drastically. Calvin Coolidge lowered taxes and lowered spending and the national debt went down.

Can’t have a modern developed economy that can’t even provide for safety nets to protect the most basic human rights and dignity of its own citizens. All other developed nations do it and they don’t have exploding deficits.

- Joined

- Aug 31, 2018

- Messages

- 56,008

- Reaction score

- 24,788

It's tax cuts for EVERY TAX PAYER. Quit it with your spin.

LOL, hook, line and sinker

- Joined

- Aug 8, 2019

- Messages

- 11,528

- Reaction score

- 3,032

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

The rest of us get crumbs to look the other way.

Most people support Social Security, which is funded by payroll taxes.

Vote for the dems and you will get more crumbs. Progressives need to jump ship to the Green Party.