- Joined

- Apr 30, 2014

- Messages

- 4,810

- Reaction score

- 2,250

- Location

- is everything

- Gender

- Male

- Political Leaning

- Liberal

Re: MMT Has No Clothes

I accept yer pathetic surrender.

What was the top marginal rate in 1980? Trot that one out.

Worthless rhetoric. How can it overspend if it doesn't spend?

>>Until the government cuts out the waste, fraud, and abuse, I will place no trust in it.

I'm sure it will be able to get along just fine without yer faith and confidence. The US gubmint's credibility has been secured through tremendous amounts of work and incredible levels of sacrifice. Yer whining will not measurably diminish that.

>>Why are you perfectly fine with wasteful spending?

Why do you assume I am?

>>Oh, that's right, it's not "wasteful spending", it's, "MMT".

I'm not much of an MMTer.

>>gimme a break already.

I figure it's yer responsibility to outgrow yer simple-minded reactionary confusion.

Who told you that?

More of yer knowledge-based opining, eh? Federal poverty guidelines.

>>There are different poverty levels based on each tax payer's unique situations.

You mean the number of dependents?

>>I said that everyone over the poverty level should be paying some amount of federal income tax.

Yes, and thanks for repeating that.

>>With your examples I suspect that none of them are over the poverty level so therefore, in my scenario, they would pay zero federal income taxes

Examples? I provided one, a single person with no dependents earning fifteen grand. The poverty level for an individual last year was $11,770. So yer suspicion turns out to be unfounded. As I noted, $473 owed in FIT.

>>I'm just saying that it is ridiculous to say that someone who is already paying millions of dollars in federal income taxes should be paying their "fair share" while the person (47%) saying that is paying zero.

I didn't use the expression "fair share." And I don't much care who's "saying" what.

>>We need to collect more tax revenues (mostly from the rich)

I agree.

>>and spend less

What do you want to cut?

>>and EVERYONE over the poverty level needs to pay their fair share, not zero.

So you want to eliminate the exemption deductions for dependents?

>>billionaires who try writing off enough to pay zero taxes.

Like Frumpy the Clown.

And YOU advance the bizzare idea that they're the same thing.

>>"tax more" you say.

Well, some, yeah.

>>As if taxing me more directly helps. but it doesn't.

How can we fund gubmint spending if we don't collect taxes?

>>We currently have an extremely progressive federal income tax system.

Less than most comparable nations.

>>More progressive than in the past.

Not even close.

>>AND we currently are taxing at about our historical norm relative to GDP.

So I suppose it wouldn't hurt to squeeze a little more from the fat cats who are paying so much less than they used to.

>>The poor and middle class are paying the lowest federal tax in decades.

And I don't want more from them.

>>So we ARE ALREADY taxing to fund spending.

Yes, and we will continue to do so.

>>The issue is not taxing.. its SPENDING.

Completely unsupported rhetoric.

>>you are an MMT supporter.

Not really. The general arguments seem to make sense to me. I'm also a heliocentrist.

>>Since you advocate increase DEFICIT spending.

Not at this time. I was happy to see Obummer reduce the deficit from ten percent of GDP down to less than 2.5%. I figure we could benefit from another two hundred billion or so in spending (education, infrastructure, R & D), but I expect we could find enough additional revenue to cover it.

Yeah sure, why not?

>>You only seem to focus on increasing FEDERAL INCOME taxes on the rich.

Nah, I'll go after 'em on other taxes as well.

>>YOU are the one that's focused narrowly on income taxes

Incorrect.

>>the federal income tax is very progressive.

Nope, at least not as much I think it should be. ☺

So much dumb Sh$t in that post but I 've found through experience, once a liberal calls a tax cut a 'giveaway' you know the debate is over. LOL

I accept yer pathetic surrender.

Lol, you accuse someone else of making false assertions, then you trot out the ole "70% tax rate" chestnut in the same post.

What was the top marginal rate in 1980? Trot that one out.

The government doesn't "spend" money, it OVERSPENDS.

Worthless rhetoric. How can it overspend if it doesn't spend?

>>Until the government cuts out the waste, fraud, and abuse, I will place no trust in it.

I'm sure it will be able to get along just fine without yer faith and confidence. The US gubmint's credibility has been secured through tremendous amounts of work and incredible levels of sacrifice. Yer whining will not measurably diminish that.

>>Why are you perfectly fine with wasteful spending?

Why do you assume I am?

>>Oh, that's right, it's not "wasteful spending", it's, "MMT".

I'm not much of an MMTer.

>>gimme a break already.

I figure it's yer responsibility to outgrow yer simple-minded reactionary confusion.

Actually, MMT is unlimited deficit spending.

Who told you that?

I'm not going to look it up, but what is the poverty level?

More of yer knowledge-based opining, eh? Federal poverty guidelines.

>>There are different poverty levels based on each tax payer's unique situations.

You mean the number of dependents?

>>I said that everyone over the poverty level should be paying some amount of federal income tax.

Yes, and thanks for repeating that.

>>With your examples I suspect that none of them are over the poverty level so therefore, in my scenario, they would pay zero federal income taxes

Examples? I provided one, a single person with no dependents earning fifteen grand. The poverty level for an individual last year was $11,770. So yer suspicion turns out to be unfounded. As I noted, $473 owed in FIT.

>>I'm just saying that it is ridiculous to say that someone who is already paying millions of dollars in federal income taxes should be paying their "fair share" while the person (47%) saying that is paying zero.

I didn't use the expression "fair share." And I don't much care who's "saying" what.

>>We need to collect more tax revenues (mostly from the rich)

I agree.

>>and spend less

What do you want to cut?

>>and EVERYONE over the poverty level needs to pay their fair share, not zero.

So you want to eliminate the exemption deductions for dependents?

>>billionaires who try writing off enough to pay zero taxes.

Like Frumpy the Clown.

YOU and others here want to separate taxing from spending.

And YOU advance the bizzare idea that they're the same thing.

>>"tax more" you say.

Well, some, yeah.

>>As if taxing me more directly helps. but it doesn't.

How can we fund gubmint spending if we don't collect taxes?

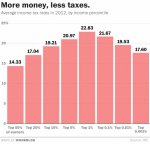

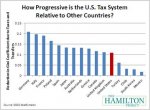

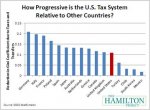

>>We currently have an extremely progressive federal income tax system.

Less than most comparable nations.

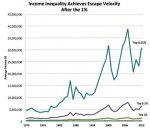

>>More progressive than in the past.

Not even close.

>>AND we currently are taxing at about our historical norm relative to GDP.

So I suppose it wouldn't hurt to squeeze a little more from the fat cats who are paying so much less than they used to.

>>The poor and middle class are paying the lowest federal tax in decades.

And I don't want more from them.

>>So we ARE ALREADY taxing to fund spending.

Yes, and we will continue to do so.

>>The issue is not taxing.. its SPENDING.

Completely unsupported rhetoric.

>>you are an MMT supporter.

Not really. The general arguments seem to make sense to me. I'm also a heliocentrist.

>>Since you advocate increase DEFICIT spending.

Not at this time. I was happy to see Obummer reduce the deficit from ten percent of GDP down to less than 2.5%. I figure we could benefit from another two hundred billion or so in spending (education, infrastructure, R & D), but I expect we could find enough additional revenue to cover it.

you state that we should take in ALL taxes into account.

Yeah sure, why not?

>>You only seem to focus on increasing FEDERAL INCOME taxes on the rich.

Nah, I'll go after 'em on other taxes as well.

>>YOU are the one that's focused narrowly on income taxes

Incorrect.

>>the federal income tax is very progressive.

Nope, at least not as much I think it should be. ☺

Last edited: